Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Idaho Land Deed of Trust

Description

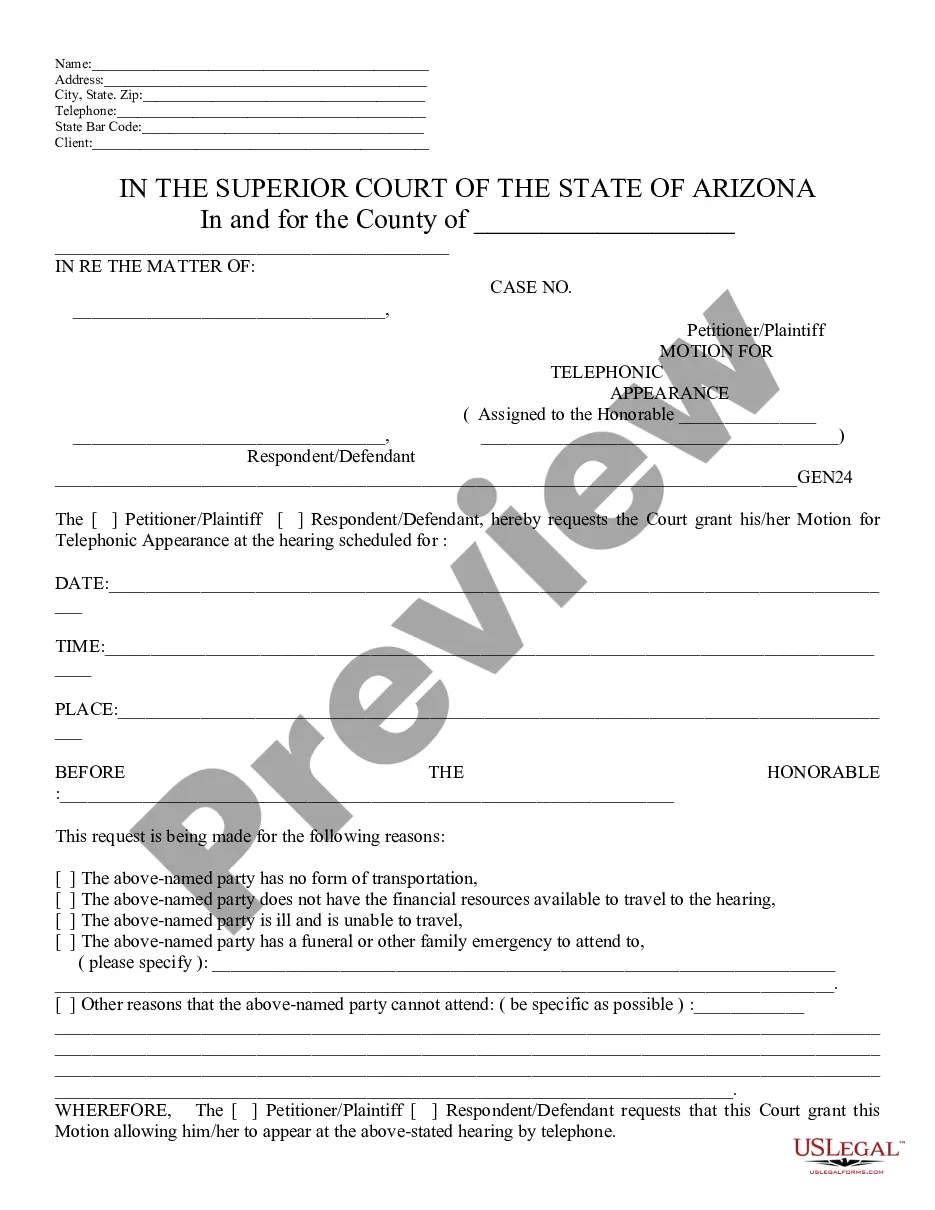

How to fill out Land Deed Of Trust?

US Legal Forms - one of the biggest libraries of lawful kinds in the United States - delivers a wide array of lawful file layouts you may acquire or produce. Using the website, you can get 1000s of kinds for enterprise and person uses, sorted by groups, claims, or keywords.You can get the newest versions of kinds much like the Idaho Land Deed of Trust within minutes.

If you already possess a membership, log in and acquire Idaho Land Deed of Trust from your US Legal Forms catalogue. The Obtain option will show up on every type you see. You have access to all earlier delivered electronically kinds within the My Forms tab of your respective bank account.

If you want to use US Legal Forms the first time, here are straightforward directions to obtain started out:

- Be sure to have picked out the proper type for your town/area. Click the Preview option to check the form`s content material. Read the type outline to actually have selected the right type.

- In case the type does not match your needs, use the Look for field at the top of the display to get the one that does.

- When you are satisfied with the shape, affirm your option by clicking on the Buy now option. Then, opt for the pricing prepare you want and provide your credentials to register for an bank account.

- Procedure the purchase. Make use of your bank card or PayPal bank account to complete the purchase.

- Pick the file format and acquire the shape on your gadget.

- Make alterations. Fill out, revise and produce and indicator the delivered electronically Idaho Land Deed of Trust.

Each and every template you put into your bank account does not have an expiration particular date which is the one you have permanently. So, if you wish to acquire or produce one more backup, just go to the My Forms segment and click on about the type you need.

Gain access to the Idaho Land Deed of Trust with US Legal Forms, one of the most comprehensive catalogue of lawful file layouts. Use 1000s of specialist and status-specific layouts that fulfill your company or person needs and needs.

Form popularity

FAQ

An Idaho deed of trust is a form used to record a mortgage interest in a given property. If it is properly recorded with the county recorder, it will prevent the property from being sold without first having the loan paid off.

The owner then lists the Trustee's address and provides the legal description of the real property. When this deed is recorded, the real property described in the deed has now been properly transferred or placed into the trust. From a legal view, the trust now ?owns? this real property.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The biggest difference between a title versus a deed is the physical component. A deed is an official written document declaring a person's legal ownership of a property, while a title refers to the concept of ownership rights.

The trust deed and rules set out the trustees' powers and the procedures trustees must follow. As a trustee, you must act in line with the terms of the trust deed and rules. The trust deed is a legal document that sets up and governs the scheme.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

An instrument that transfers legal title in real property to a trustee to hold as security for a loan made by a lender to a borrower. The borrower retains equitable title to the real property. A deed of trust typically involves three parties: The borrower (the trustor or grantor). The beneficiary (the lender).

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.