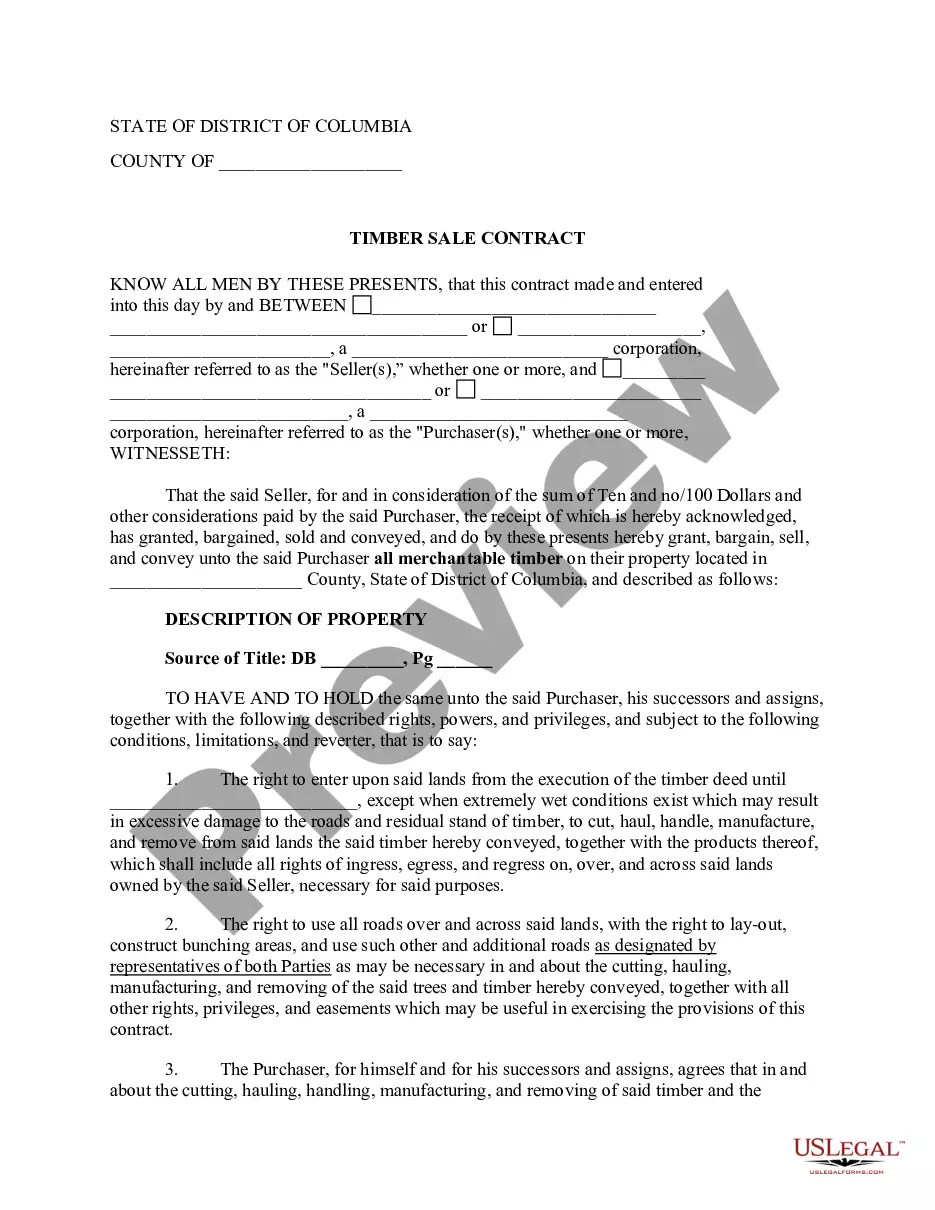

The Idaho Agreement for Donation of Land to City is a legal document that outlines the terms and conditions for the transfer of land from a private individual or entity to a city in the state of Idaho. This agreement is often entered into when a landowner wishes to donate a piece of property, whether it be for public purposes or for the benefit of the community. The Idaho Agreement for Donation of Land to City typically begins with the identification of the parties involved, namely the land donor (also known as the Granter) and the city (also known as the Grantee). The document may also include the official legal description of the land being donated, including details of its size, boundaries, and location. The agreement then sets forth the terms and conditions that both parties agree to abide by throughout the donation process. These terms may include: 1. Purpose of the Donation: The agreement may specify the intended purpose of the land donation. For example, it could be for the construction of a public park, a community center, a school, or any other public or municipal use. 2. Ownership and Transfer: The agreement will state that the donor is the lawful owner of the property and has the legal right to transfer ownership to the city. It will also outline the process and timeline for transferring the land rights to the city, including the necessary documentation and any required approvals. 3. Title and Liens: The donor typically warrants that the property is free and clear of any liens, mortgages, or other encumbrances, and that the title to the property will be transferred to the city free and clear of any claims or disputes. 4. Indemnification: The agreement may include provisions to protect both parties from any liabilities or claims that may arise from the donation. This could include indemnification clauses where the donor agrees to defend and hold harmless the city from any lawsuits or claims related to the property. 5. Remedies and Default: The agreement may outline the remedies available to the parties in case of default or breach of the terms set forth in the agreement. This could include termination of the agreement, damages, or specific performances. It's important to note that there may be different types or variations of the Idaho Agreement for Donation of Land to City, depending on the specific circumstances and requirements of the parties involved. For example, there could be agreements specifically tailored for the donation of land for conservation purposes, for the preservation of historical sites, or for the development of affordable housing projects. Each type of agreement would have its own specific terms and conditions that cater to the unique needs of the parties and the purpose of the land donation.

Idaho Agreement for Donation of Land to City

Description

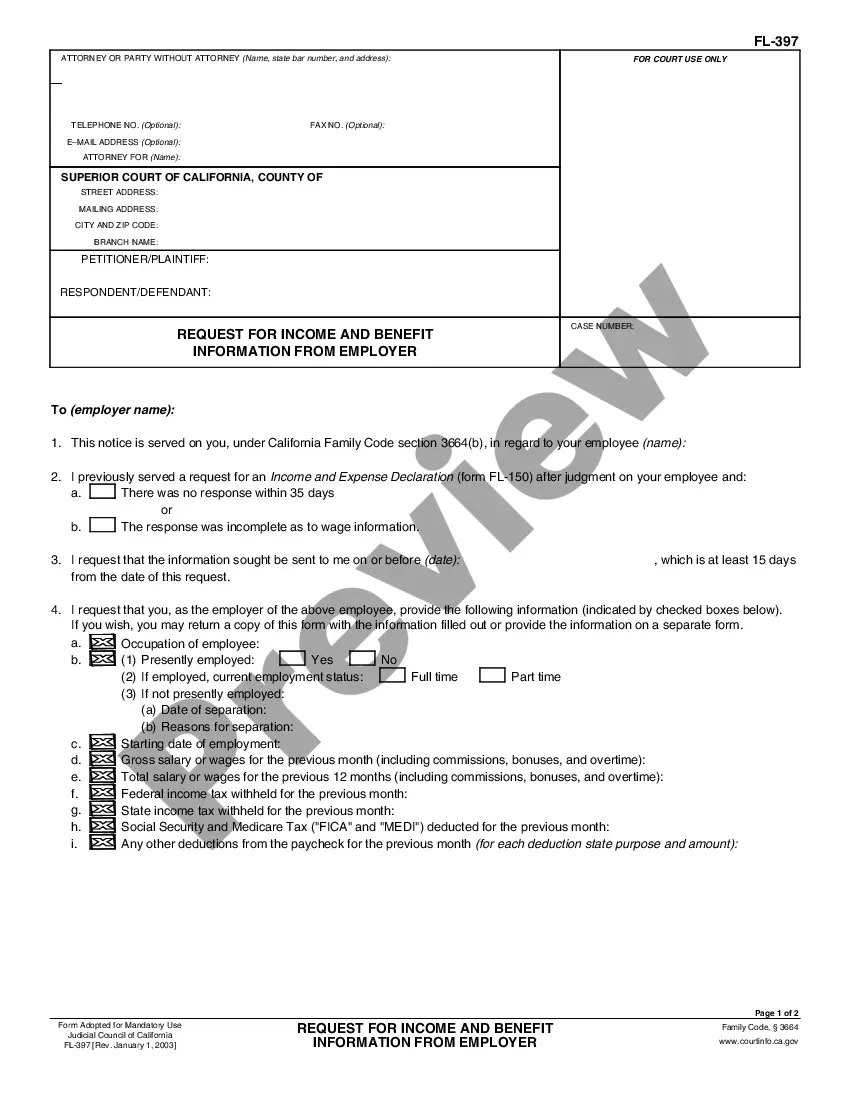

How to fill out Idaho Agreement For Donation Of Land To City?

US Legal Forms - among the largest collections of legal documents in the United States - offers a vast selection of legal document types that you can download or print. By utilizing the website, you will obtain numerous forms for business and personal uses, organized by categories, states, or keywords.

You can access the latest versions of forms like the Idaho Agreement for Donation of Land to City in moments.

If you have a subscription, Log In to download the Idaho Agreement for Donation of Land to City from the US Legal Forms repository. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Idaho Agreement for Donation of Land to City. Each template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another version, simply visit the My documents section and click on the form you need. Access the Idaho Agreement for Donation of Land to City with US Legal Forms, one of the most extensive collections of legal document types. Utilize a plethora of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to help you begin.

- Ensure you have selected the correct form for your area/region.

- Click the Preview button to review the form's content.

- Read the form description to ensure you have selected the appropriate form.

- If the form doesn’t meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your pricing plan and provide your information to create an account.

Form popularity

FAQ

The rebates automatically go to people who were full-year Idaho residents for 2020 and 2021 and who filed income tax returns for those years. This includes those who filed grocery-credit refund returns. The rebate amount is either $75 per taxpayer and each dependent or 12% of their 2020 taxes, whichever is greater.

Form 39-R is an Idaho Supplemental Schedule For Form 40, Resident Returns Only. It is simply a worksheet for posting your Form 40. View the IDAHO SUPPLEMENTAL SCHEDULE Form 39R. Form-39R is a supplemental form to Idaho's Form-40.

The rebates automatically go to people who were full-year Idaho residents for 2020 and 2021 and who filed income tax returns for those years. This includes those who filed grocery-credit refund returns. The rebate amount is either $75 per taxpayer and each dependent or 12% of their 2020 taxes, whichever is greater.

Permanent Building Fund (PBF) tax A unitary group of corporations must pay $10 for each corporation required to file in Idaho, whether the corporations file individually or the unitary group includes them in a group return. S corporations must pay $10 for each shareholder it pays the Idaho income tax for.

A qualified educational entity includes the following: A nonprofit corporation, fund, foundation, research park, trust, or association organized and operated exclusively for the benefit of Idaho colleges and universities.

Residents 65 or older get $120. All full-year Idaho residents qualify for a grocery credit refund. Qualifying dependents include those born or adopted by the end of 2021, as well as resident dependents who died in 2021.

However, if you've owned the property for longer than one calendar year, you are now responsible for long-term capital gains tax. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates: Zero percent, 15 percent, or 20 percent.

Idaho has a graduated individual income tax, with rates ranging from 1.00 percent to 6.00 percent. Idaho also has a 6.00 percent corporate income tax rate. Idaho has a 6.00 percent state sales tax rate, a 3.00 percent max local sales tax rate, and an average combined state and local sales tax rate of 6.02 percent.

BOISE, Idaho (KMVT/KSVT) Senate Republicans passed a bill that aims to keep Idaho senior citizens in their homes by allowing more people to qualify for a property tax reduction. Senate Bill 1241 increases the maximum home value for a homeowner to qualify for Idaho's circuit breaker program from 125% to 200%.

Unlike the default pass-through tax situation, when an LLC elects to be taxed as a corporation, the company itself must file a separate tax return. The State of Idaho, like almost every other state, taxes corporation income. In Idaho, corporation income generally is taxed at a flat 7.4% rate plus an additional $10.

Interesting Questions

More info

Aching Media Training Media Relations Community Engagement Media Services Media Resources.