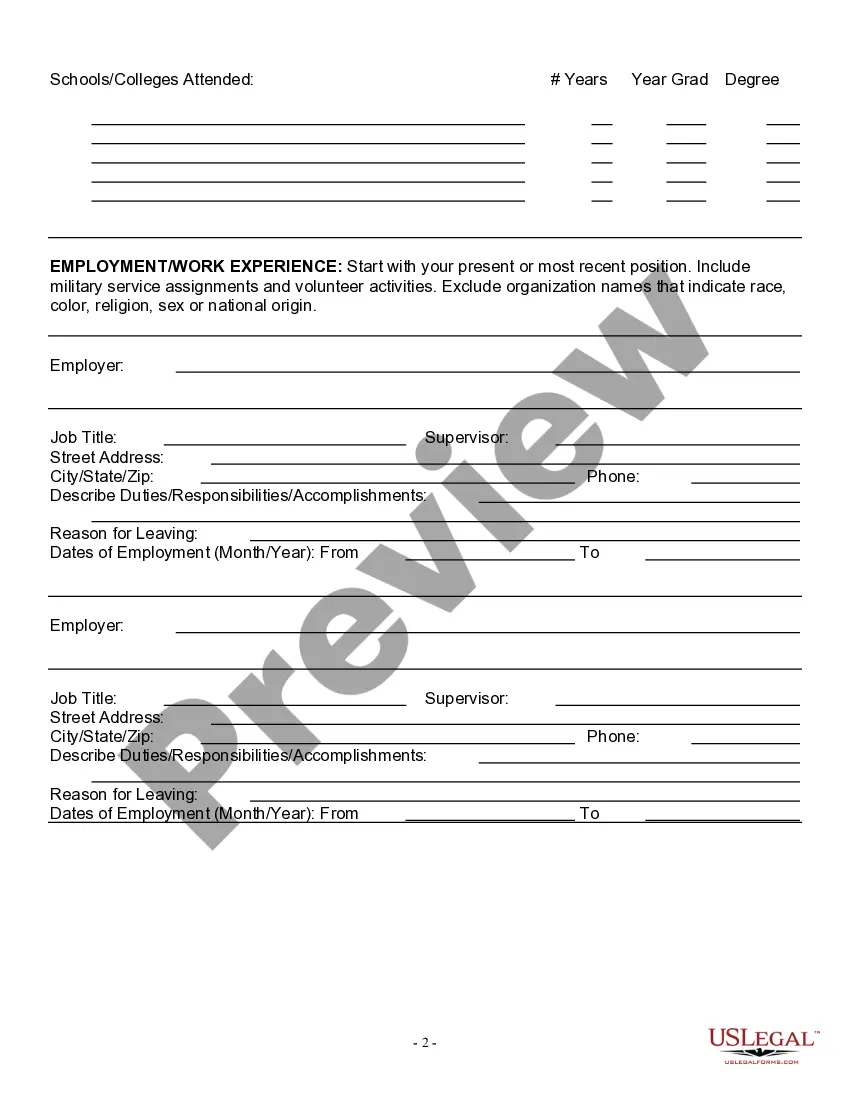

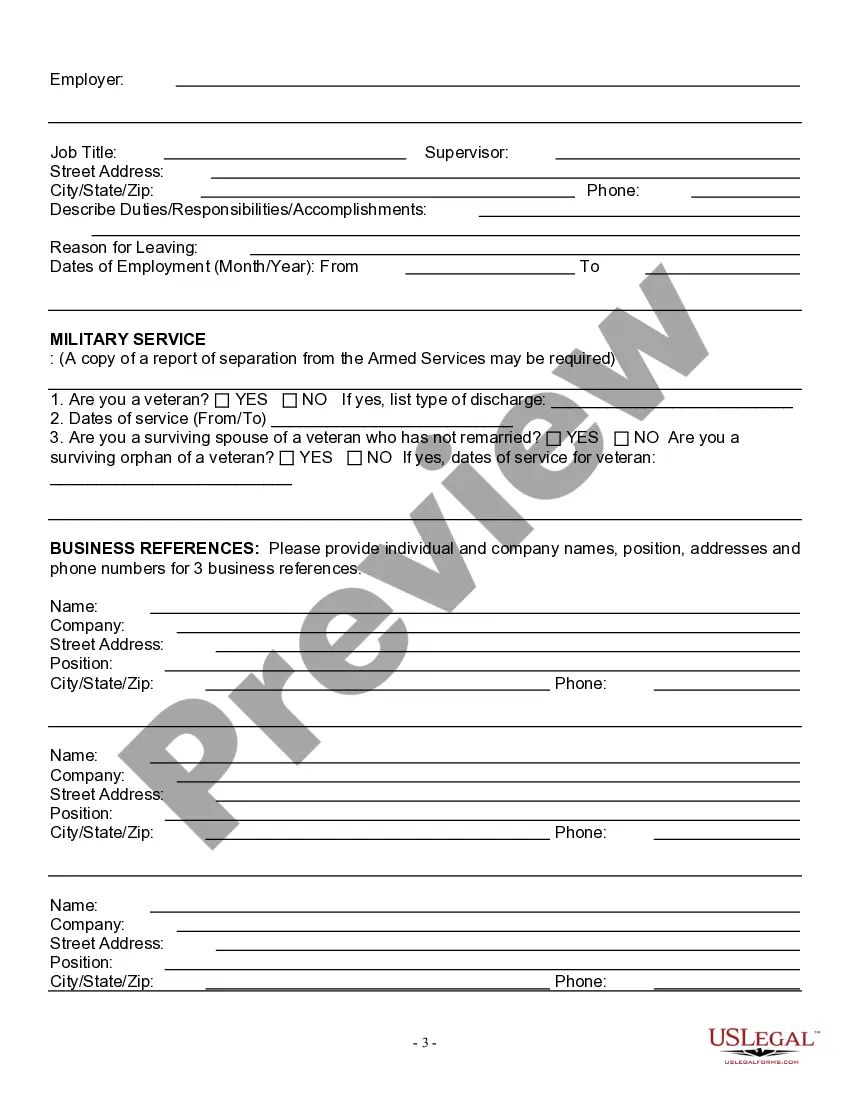

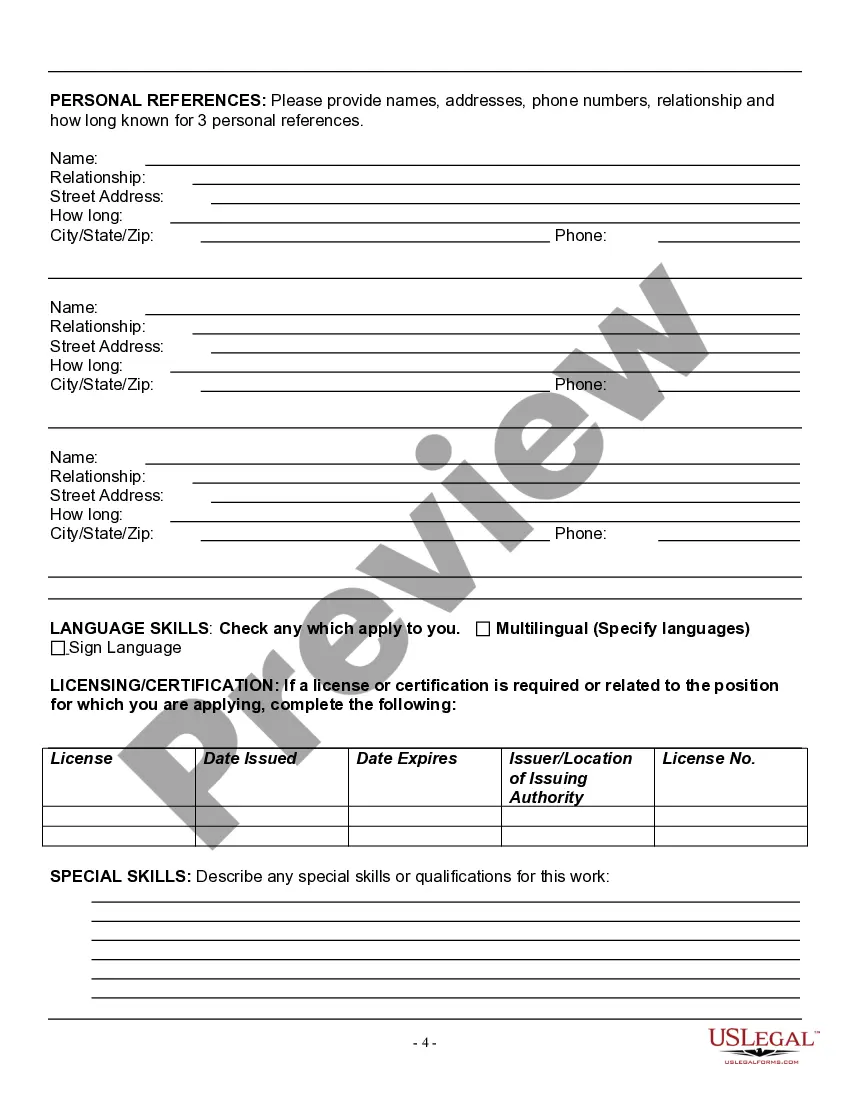

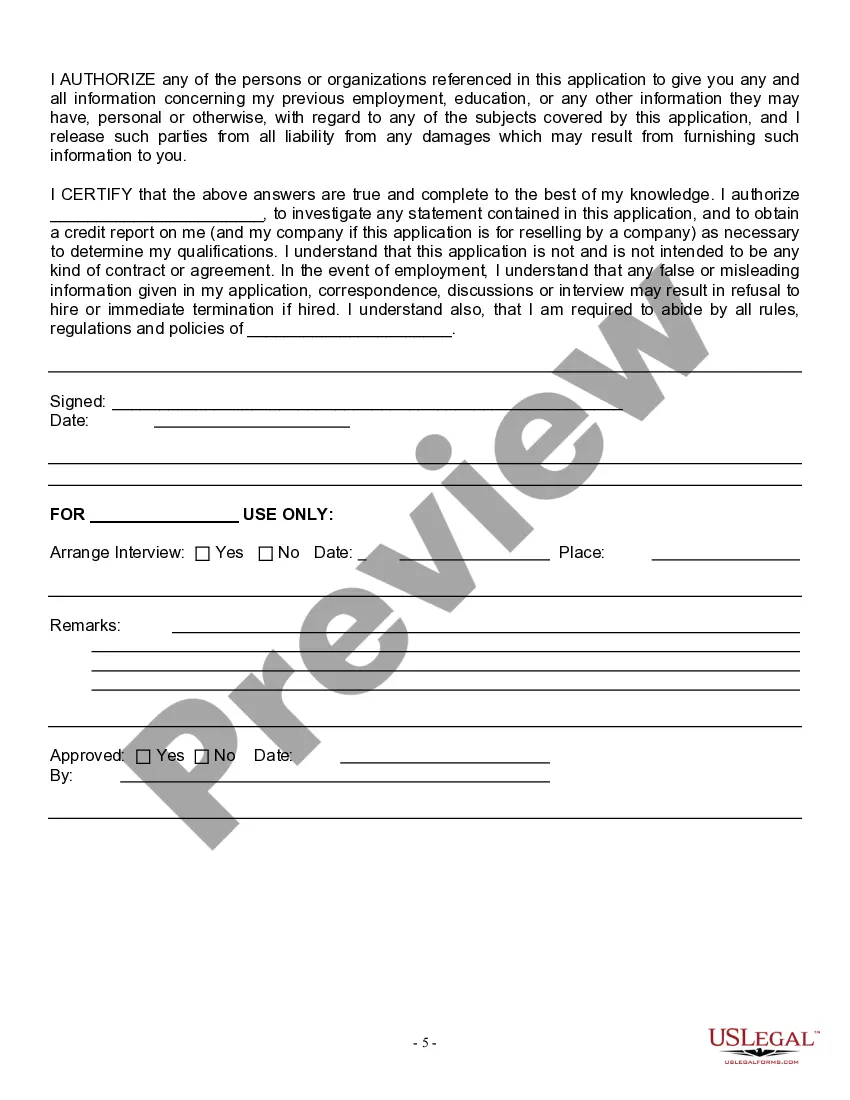

Idaho Employment Application for Event Vendor

Description

How to fill out Employment Application For Event Vendor?

Are you facing a scenario where you require documentation for either business or particular reasons almost every day.

There are numerous legal document templates available on the internet, but finding ones you can trust isn’t simple.

US Legal Forms provides a vast array of templates, such as the Idaho Employment Application for Event Vendor, which can be tailored to comply with both federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Idaho Employment Application for Event Vendor template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct state/region.

- Use the Preview button to review the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

How to Become a Retail Vendor: a Simple Guide FundThroughWhat is a Retail Vendor?The Most Important Skills Of A Vendor.Familiarize Yourself With The Industry.Determine Your Business Goals.Make you sure You're Ready to Become a Retail Vendor.Connect with Purchasing Managers.Learn to use the Vendor Portal.More items...

To apply for a seller's permit, complete the Idaho Business Registration application. It's free. If you apply online, you'll get the permit in about 10 days. If you mail your application, it can take up to four weeks to get the permit.

A partnership must file Idaho Form 65 if either of the following are true: You're doing business in Idaho. You're a limited-liability company (LLC) treated as a partnership for federal income tax purposes and doing business in Idaho.

The EIN can be obtained by calling (800) 829-4933 or by visiting the IRS website at . If you are interested in attending a Business Basics class in your area, sign up today at .

The business must be operated by a full-time resident of the home, not an employee. The business must be a secondary use for the home; the primary use must remain that of a residence. The character of the home, interior and exterior, cannot be changed from that of a residence.

Temporary sales tax permits are a type of seller's permit and allow you, your company, or your organization to make infrequent retail sales in Idaho. These permits include a simple form to report sales and submit the sales taxes you collect from your customers.

The short answer to whether a business license is a requirement for online selling: yes. A business license is a requirement for online selling and it's a crucial part of establishing your business as legitimate and legal. But getting an online business license is not as simple as just applying for a document.

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

You must e-file if you file 11 or more individual federal returns per calendar year, and you must have an IRS-issued EFIN in order to e-file. (An EFIN designates you as an authorized e-file provider.) To apply for an EFIN, use the IRS' e-Services - Online Tools for Tax Professionals.

Electronic Filing Mandate Idaho does not currently mandate electronic filing for individual returns. Individual income tax returns can be e-filed or filed by mail to the address below.