Subject: Idaho Sample Letter to State Tax Commission Concerning Decedent's Estate: A Detailed Description Dear [Name], I hope this letter finds you well. I am writing to inquire about the necessary procedures and documentation required to address the tax implications of a decedent's estate in Idaho. As the personal representative or executor of the estate, I am seeking guidance from the Idaho State Tax Commission to ensure that all tax obligations are fulfilled in a timely and accurate manner. Idaho imposes an estate tax on certain qualifying estates. It is essential to determine whether the decedent's estate falls within the threshold for tax liability and comply with the associated regulations. To initiate the process, I would greatly appreciate your guidance on the following key matters related to Idaho State Tax Commission's requirements and procedures for a decedent's estate: 1. Determining Estate Tax Liability: — Please provide information on the current estate tax thresholds, rates, and any recent updates or amendments. — How does the Idaho State Tax Commission calculate the taxable estate value? — Are there any deductions or exemptions available that could potentially lower the tax liability? — Are surviving spouses exempt from the estate tax? 2. Required Documentation: — What documents should be submitted to the Idaho State Tax Commission to report and document the decedent's estate, such as the Last Will and Testament, Letters Testamentary, or Letters of Administration? — Are there specific forms or templates that must be completed for estate tax purposes? — Should I anticipate providing an inventory of the estate's assets and liabilities, including fair market values? 3. Timeline and Filing Procedures: — What is the deadline for filing the estate tax return to Idaho? — Is it possible to request an extension if additional time is needed? — Where should I submit the completed documents and tax payments? Are electronic filing options available? 4. Potential Audits or Inquiries: — What triggers an audit or review of an estate tax return? — How does the Idaho State Tax Commission communicate with the personal representative during the audit process? — Are there any red flags or common mistakes to avoid that may trigger an audit? Additionally, I would highly appreciate any additional information or resources that might facilitate the estate tax filing process or help me better understand the obligations imposed by the Idaho State Tax Commission in relation to a decedent's estate. Thank you for your attention to this matter. I look forward to receiving your guidance, forms, and any pertinent information regarding the aforementioned inquiries. Please feel free to contact me at [contact information] should you require any further details or clarification. Yours sincerely, [Your Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address]

Idaho Sample Letter to State Tax Commission concerning Decedent's Estate

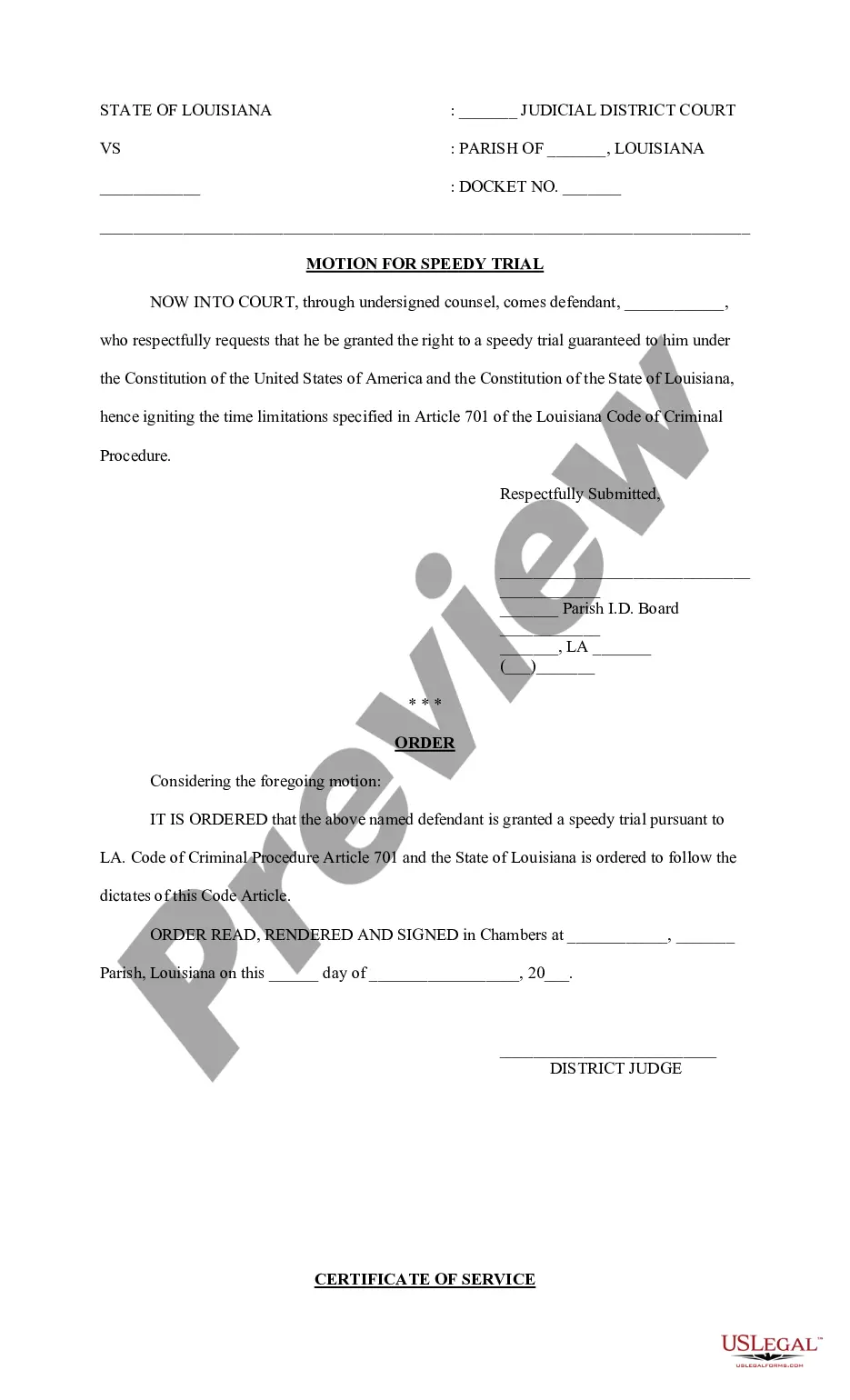

Description

How to fill out Idaho Sample Letter To State Tax Commission Concerning Decedent's Estate?

US Legal Forms - one of the greatest libraries of legal types in America - offers a wide range of legal file web templates you are able to acquire or print. While using website, you can find a large number of types for organization and specific uses, categorized by types, states, or keywords.You can find the newest variations of types just like the Idaho Sample Letter to State Tax Commission concerning Decedent's Estate within minutes.

If you currently have a registration, log in and acquire Idaho Sample Letter to State Tax Commission concerning Decedent's Estate in the US Legal Forms local library. The Download button will show up on each develop you see. You have accessibility to all formerly acquired types inside the My Forms tab of the account.

If you would like use US Legal Forms the first time, listed below are straightforward directions to help you began:

- Make sure you have picked the correct develop for the metropolis/county. Click the Preview button to analyze the form`s information. See the develop outline to actually have selected the appropriate develop.

- If the develop doesn`t suit your requirements, utilize the Lookup discipline on top of the screen to discover the one which does.

- Should you be happy with the form, verify your choice by visiting the Get now button. Then, opt for the rates program you want and give your accreditations to register for an account.

- Procedure the deal. Use your charge card or PayPal account to complete the deal.

- Choose the structure and acquire the form on your device.

- Make changes. Load, modify and print and signal the acquired Idaho Sample Letter to State Tax Commission concerning Decedent's Estate.

Every template you included in your account does not have an expiration particular date and it is your own property for a long time. So, if you would like acquire or print another backup, just check out the My Forms area and click in the develop you need.

Get access to the Idaho Sample Letter to State Tax Commission concerning Decedent's Estate with US Legal Forms, by far the most comprehensive local library of legal file web templates. Use a large number of skilled and express-certain web templates that fulfill your organization or specific requirements and requirements.

Form popularity

FAQ

Unlike a limited liability company or an S Corporation, a C Corporation is required to file a corporate tax return and pay taxes on any profits. When those profits are paid to shareholders as dividends, they will also be subject to taxation on the shareholders' personal tax returns.

Use Form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year on the form). You can also use Form 51 to make payments of Qualified Investment Exemption (QIE) recapture when you don't file your income tax return by the due date. Form 51 Voucher, Estimated Payment of Individual Income Tax idaho.gov ? forms_EFO00092 idaho.gov ? forms_EFO00092

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away. Deadlines for Completing a Probate in Idaho - Racine Olson racinelaw.net ? deadlines-for-completing-a-... racinelaw.net ? deadlines-for-completing-a-...

Form ID W-4 ? Employee's Withholding Allowance Certificate to estimate your Idaho withholding. Fill out Form ID W-4 with that information. Give both W-4 forms to your employer.

Use Form 41S to amend your Idaho income tax return. Make sure you check the Amended Return box and enter the reason for amending. If you amend your federal return, you also must file an amended Idaho income tax return.

Form 42 is used to show the total for the unitary group. A schedule must be attached detailing the Idaho apportionment factor computation for each corporation in the group. INSTRUCTIONS FOR FORM 42 zillionforms.com ? ... zillionforms.com ? ...

Part-Year Resident & Nonresident Income Tax Return.

There is No Idaho State Inheritance Tax Just as with the Federal taxation process, the estate would be required to pay any existing state taxes before any distributions are made to any heirs. As a result, the heirs themselves will owe no taxes. What Taxes Do You Have To Pay When You Inherit? - Racine Olson racinelaw.net ? what-taxes-do-you-have-to-... racinelaw.net ? what-taxes-do-you-have-to-...