Idaho Bill of Sale of Mobile Home with or without Existing Lien

Description

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

Locating the appropriate authorized document template can be challenging.

Certainly, there is a range of templates available online, but how do you identify the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Idaho Bill of Sale for Mobile Home with or without Existing Lien, suitable for both business and personal use.

You can preview the form using the Review button and read the form description to confirm it is the right one for you.

- All the forms are reviewed by professionals and comply with federal and state requirements.

- If you are already registered, sign in to your account and click the Download button to access the Idaho Bill of Sale for Mobile Home with or without Existing Lien.

- Leverage your account to search for the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

To sell a car privately in Idaho, you will need the car title, an Idaho Bill of Sale of Mobile Home with or without Existing Lien, and a valid form of identification. Also, ensure that you communicate any liens associated with the vehicle to the buyer. Using platforms like US Legal Forms can help you generate necessary documents effortlessly.

If you need to write a bill of sale without a title, start by including all relevant details such as the buyer's and seller's information, a description of the mobile home, and any existing lien details. It's important to note that selling a mobile home without a title can complicate the process, so consulting resources like US Legal Forms can provide guidance on what to include.

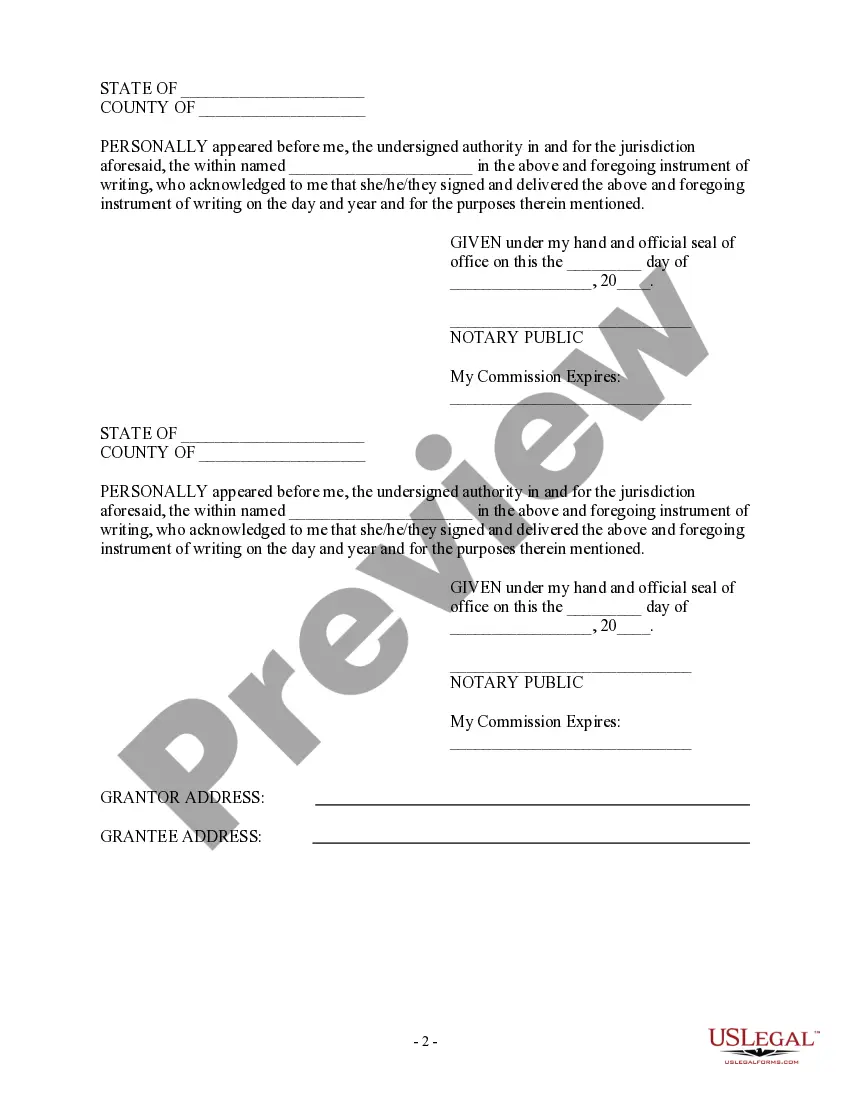

In Idaho, notarization of a bill of sale is not strictly required. However, having the document notarized can add an extra layer of security and verification for both the buyer and seller. Including notarization might be beneficial, especially in transactions involving an Idaho Bill of Sale of Mobile Home with or without Existing Lien.

A handwritten bill of sale should clearly state the buyer's and seller's names, contact information, and date of the transaction. It must describe the mobile home adequately and outline any terms agreed upon between the parties involved. Including specifics about any existing lien on the mobile home can help prevent future complications, and using US Legal Forms can simplify this process.

In Idaho, you can initiate certain title transfers online, depending on your situation. However, it's essential to have the Idaho Bill of Sale of Mobile Home with or without Existing Lien ready, as you may need to upload this document during the online process. Always check the Idaho DMV website for specific guidelines and any required fees related to online title transfers. For a smoother experience, you may consider using platforms like uslegalforms to help prepare the necessary documents.

To transfer a mobile home title in Idaho, you need to complete the appropriate title transfer forms provided by your local Department of Motor Vehicles (DMV). Along with the completed forms, you must present the Idaho Bill of Sale of Mobile Home with or without Existing Lien, which acts as proof of the transaction. Make sure both the buyer and seller sign the bill of sale to validate the transfer. After gathering all necessary documents, submit them to your local DMV office to finalize the title transfer.

Filling out a bill of sale in Idaho involves several key steps to ensure all necessary information is included. First, provide the date of the transaction, details of the seller, and buyer information. Next, specify a thorough description of the mobile home, including its make, model, and identification number. For added clarity, refer to a sample Idaho Bill of Sale of Mobile Home with or without Existing Lien available on legal resources like US Legal Forms to guide you.

A bill of sale acts as a receipt confirming the transfer of ownership for the mobile home. In contrast, the title is an official document issued by the state that proves ownership of the mobile home. While the bill of sale details the transaction, the title provides legal recognition of ownership. Having both is essential for a complete transfer when dealing with an Idaho Bill of Sale of Mobile Home with or without Existing Lien.

Yes, a bill of sale is typically required to transfer a mobile home title in Idaho. This document serves as proof of the transaction between the seller and buyer, and it must include specific details, such as the mobile home's identification number. Without a bill of sale, the title transfer may face complications. Thus, having an Idaho Bill of Sale of Mobile Home with or without Existing Lien can significantly simplify this process.

To transfer a mobile home title in Idaho, you must complete the required paperwork, including a signed bill of sale. This document should outline the details of the transfer between the seller and buyer. After filling out the necessary forms, submit them to the Idaho Department of Transportation for processing. Using the Idaho Bill of Sale of Mobile Home with or without Existing Lien makes this process clearer and more straightforward.