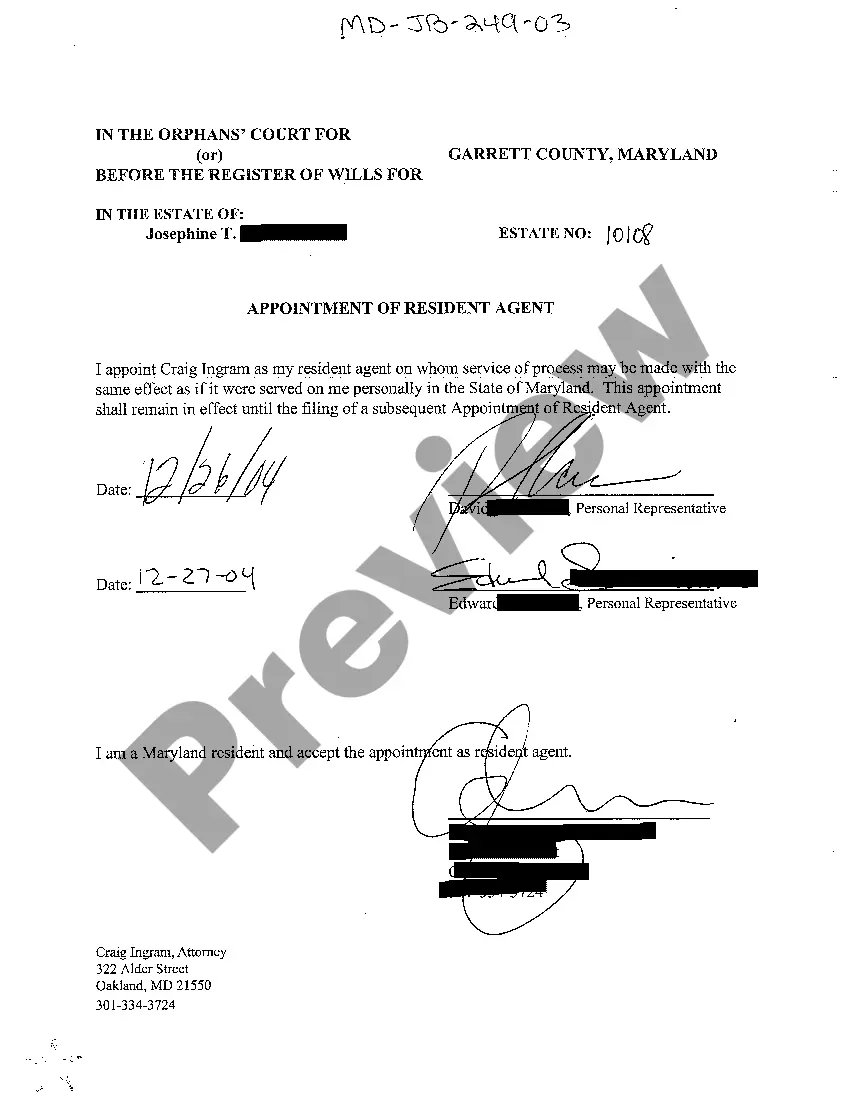

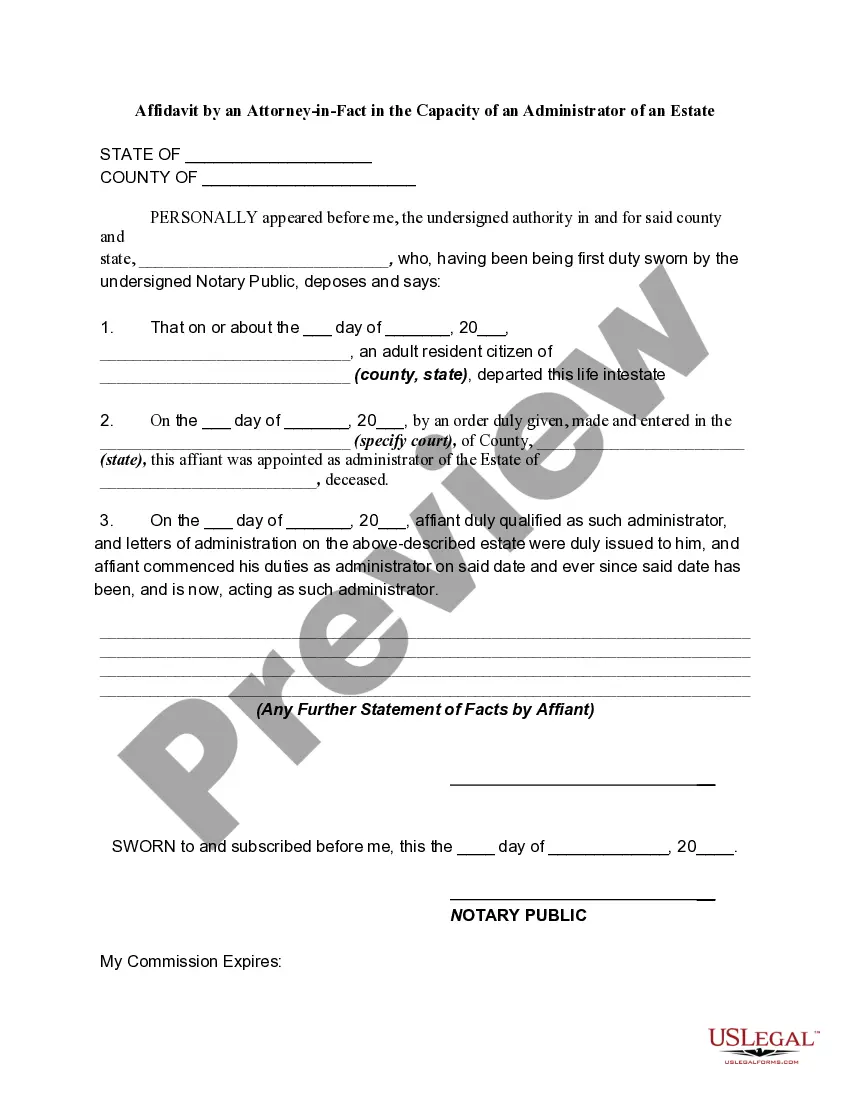

The Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate is a legal document that allows an attorney-in-fact to act on behalf of an estate's administrator in the state of Idaho. This affidavit is commonly used when an administrator of an estate appoints an attorney-in-fact to handle certain tasks or make decisions in their stead. The purpose of the Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate is to grant legal authority to the attorney-in-fact to perform specific duties on behalf of the administrator. These duties may include managing financial affairs, selling or transferring property, filing tax returns, paying debts, and distributing assets to beneficiaries. The Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate must be signed and notarized by both the administrator and the attorney-in-fact. It is crucial to provide accurate and detailed information in the affidavit, including the names and contact information of the parties involved, the powers granted to the attorney-in-fact, and the duration of the authority given. It is important to note that there may be different types or variations of the Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate, depending on the specific circumstances of the estate administration. These variations may include: 1. Limited Power of Attorney: This type of affidavit grants the attorney-in-fact a limited scope of authority, allowing them to perform specific tasks or make decisions within certain boundaries defined in the document. This option may be suitable if the administrator only requires assistance with specific aspects of estate administration. 2. General Power of Attorney: This type of affidavit grants the attorney-in-fact broad and comprehensive authority to act on behalf of the administrator in almost all matters related to the estate administration. This option may be useful when the administrator wants to delegate a wide range of powers and responsibilities to the attorney-in-fact. 3. Durable Power of Attorney: This type of affidavit remains in effect even if the administrator becomes incapacitated or mentally incompetent. It ensures that the attorney-in-fact can continue to act on behalf of the administrator, providing consistency in estate administration even in challenging circumstances. When preparing an Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate, it is recommended to seek legal advice to ensure compliance with state laws and to tailor the document to the specific needs and requirements of the estate administration.

The Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate is a legal document that allows an attorney-in-fact to act on behalf of an estate's administrator in the state of Idaho. This affidavit is commonly used when an administrator of an estate appoints an attorney-in-fact to handle certain tasks or make decisions in their stead. The purpose of the Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate is to grant legal authority to the attorney-in-fact to perform specific duties on behalf of the administrator. These duties may include managing financial affairs, selling or transferring property, filing tax returns, paying debts, and distributing assets to beneficiaries. The Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate must be signed and notarized by both the administrator and the attorney-in-fact. It is crucial to provide accurate and detailed information in the affidavit, including the names and contact information of the parties involved, the powers granted to the attorney-in-fact, and the duration of the authority given. It is important to note that there may be different types or variations of the Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate, depending on the specific circumstances of the estate administration. These variations may include: 1. Limited Power of Attorney: This type of affidavit grants the attorney-in-fact a limited scope of authority, allowing them to perform specific tasks or make decisions within certain boundaries defined in the document. This option may be suitable if the administrator only requires assistance with specific aspects of estate administration. 2. General Power of Attorney: This type of affidavit grants the attorney-in-fact broad and comprehensive authority to act on behalf of the administrator in almost all matters related to the estate administration. This option may be useful when the administrator wants to delegate a wide range of powers and responsibilities to the attorney-in-fact. 3. Durable Power of Attorney: This type of affidavit remains in effect even if the administrator becomes incapacitated or mentally incompetent. It ensures that the attorney-in-fact can continue to act on behalf of the administrator, providing consistency in estate administration even in challenging circumstances. When preparing an Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate, it is recommended to seek legal advice to ensure compliance with state laws and to tailor the document to the specific needs and requirements of the estate administration.