A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

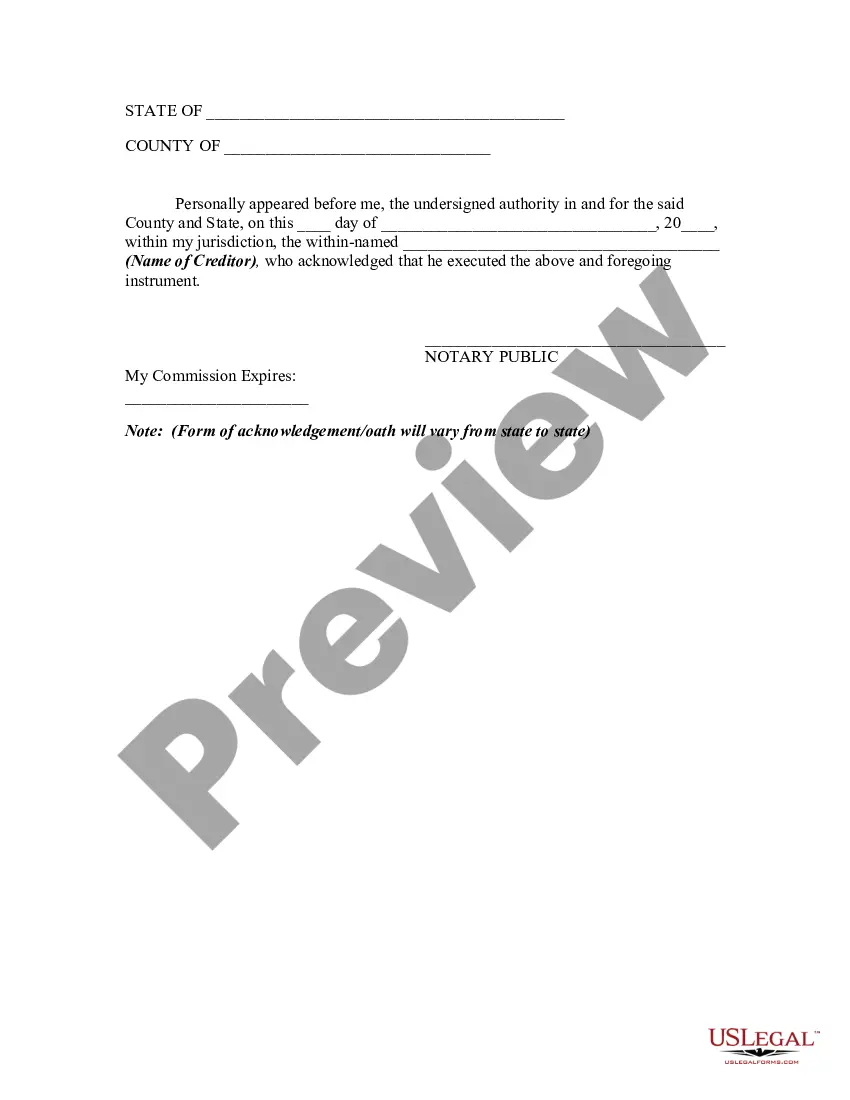

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Idaho Release of Claims Against an Estate By Creditor Introduction: The Idaho Release of Claims Against an Estate By Creditor is a legally binding document that serves to release a creditor's claims against the assets of a deceased person's estate. This detailed description will explain the purpose, requirements, and variations of the Idaho Release of Claims Against an Estate By Creditor. Keywords: Idaho, Release of Claims, Estate, Creditor I. What is the Idaho Release of Claims Against an Estate By Creditor? The Idaho Release of Claims Against an Estate By Creditor is a legal document that relieves a creditor from pursuing any further claims against the assets or property of a deceased person's estate. It ensures that the creditor waives their rights to assert any legal actions or seek payment from the estate of the deceased individual. II. Purpose and Importance: 1. Protecting the estate: The release of claims helps safeguard the estate from prolonged legal battles and potential depletion of assets arising from creditor claims. 2. Finalizing probate process: By obtaining a release from creditors, the estate executor can move forward with the distribution of assets and closure of the probate administration. 3. Facilitating creditor settlements: Creditors may prefer to settle claims outside the court system by signing a release, ensuring a faster resolution and potential payment. III. Requirements for the Idaho Release of Claims Against an Estate By Creditor: To ensure the validity of the release, certain elements must be present: 1. Identification of parties: The release should clearly identify both the creditor and the deceased person's estate. 2. Clear intent: The release must express the creditor's intent to release and discharge all claims, demands, and debts against the estate. 3. Voluntary agreement: The release should establish that the creditor is signing the document willingly and not under duress. 4. Consideration: Consideration, such as a settlement amount, may be mentioned to establish a binding agreement. 5. Signatures: The release must be signed by the creditor, and if applicable, their legal representative or attorney. IV. Variations of Idaho Release of Claims Against an Estate By Creditor: 1. General Release: This is a standard release that covers all claims the creditor may have against the estate. 2. Partial Release: In some cases, a creditor may release their claims only to a specified portion or assets of the estate. 3. Conditional Release: A creditor may agree to a conditional release, requiring the estate to fulfill certain obligations or conditions for the release to take effect. Conclusion: The Idaho Release of Claims Against an Estate By Creditor is a crucial legal document that ensures the smooth and efficient management of a deceased individual's estate. By signing the release, creditors relinquish their rights to pursue claims, allowing the estate to be settled and distributed in accordance with the decedent's wishes. Keywords: Idaho, Release of Claims, Estate, Creditor, Probate Administration, Settlements, Validity, General Release, Partial Release, Conditional Release.