Idaho Revocable Living Trust for Grandchildren is a legal document designed to protect and manage assets that grandparents want to leave for their grandchildren in the state of Idaho. This trust allows the grandparent (also known as the granter or settler) to retain control over their assets during their lifetime, while ensuring a smooth transfer of these assets to their grandchildren upon their death. A revocable living trust is a flexible estate planning tool that provides several benefits. Firstly, it allows the granter to maintain control over the assets placed in the trust, enabling them to manage and make changes to the trust provisions as needed. This means the trust can be modified or even revoked entirely if the granter's circumstances change. In terms of asset protection, a revocable living trust can help avoid probate, the legal process through which a person's will is validated in court. Probate can be time-consuming, expensive, and public, whereas assets held in a revocable trust can be distributed to beneficiaries without going through probate. This also ensures privacy for the granter and beneficiaries. There are a few different types of Idaho Revocable Living Trust for Grandchildren that can be established, depending on the specific needs and intentions of the granter: 1. General Revocable Living Trust: This is the standard type of trust that allows the granter to place their assets into the trust and retain control over them during their lifetime. It provides flexibility and ease in making changes or revoking the trust. 2. Education Trust: This type of trust is specifically designed to provide funds for the educational expenses of grandchildren. The trustee, appointed by the granter, is responsible for managing and distributing funds for educational purposes, ensuring the grandchildren's education is financially supported. 3. Health and Support Trust: The health and support trust is established to provide financial assistance to grandchildren for their health-related needs and general support. It can cover medical expenses, housing, living costs, and other essential needs. 4. Spendthrift Trust: A spendthrift trust is beneficial for grandparents who want to provide for their grandchildren but have concerns about their ability to handle money responsibly. This trust restricts the beneficiaries from accessing trust funds directly, instead appointing a trustee to manage and distribute funds on their behalf. When establishing an Idaho Revocable Living Trust for Grandchildren, it's crucial to consult with an attorney who specializes in estate planning to ensure the trust is properly drafted and complies with Idaho state laws. This helps to ensure the trust accurately reflects the granter's wishes and provides the intended benefits to the grandchildren while minimizing potential complications or challenges.

Idaho Revocable Living Trust for Grandchildren

Description

How to fill out Idaho Revocable Living Trust For Grandchildren?

Finding the correct legal document format can be quite a challenge. Naturally, there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service offers a vast collection of templates, such as the Idaho Revocable Living Trust for Grandchildren, which can be utilized for both business and personal purposes. All templates are verified by experts and comply with federal and state regulations.

If you are already a member, Log In to your account and click the Download button to obtain the Idaho Revocable Living Trust for Grandchildren. Use your account to search for the legal templates you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you need.

Select the file format and download the legal document format to your device. Complete, modify, print, and sign the finalized Idaho Revocable Living Trust for Grandchildren. US Legal Forms is the largest repository of legal templates where you can access various document formats. Utilize the service to download properly drafted paperwork that adheres to state regulations.

- First, ensure that you have selected the appropriate form for your area/county.

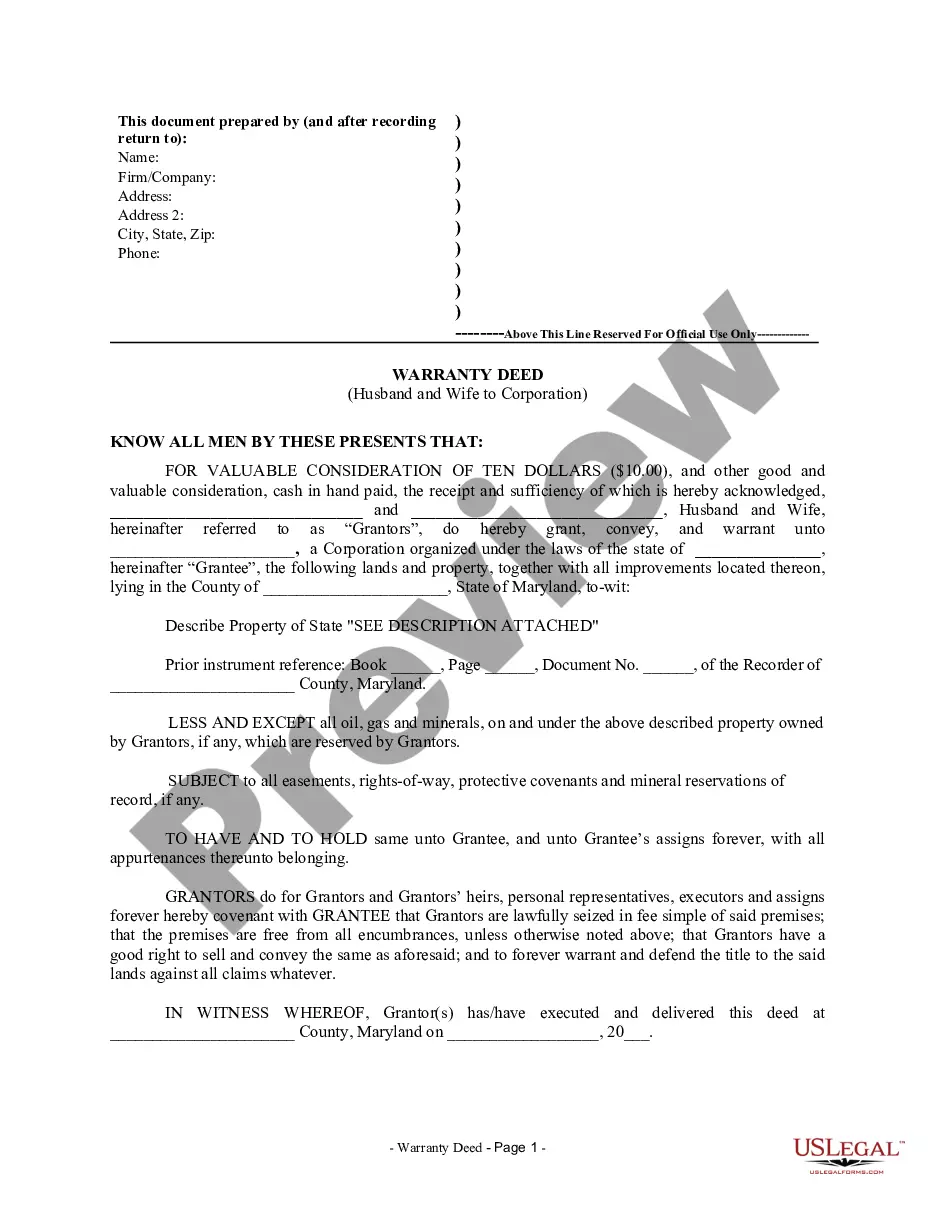

- You can preview the form by using the Preview button and review the form details to confirm that it is indeed the correct one for you.

- If the form does not meet your requirements, make use of the Search field to find the correct document.

- Once you are certain that the form is suitable, click on the Buy now button to acquire it.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

An Idaho Revocable Living Trust for Grandchildren is often considered the best option for ensuring your grandchildren's financial security. This type of trust allows you to manage your assets during your lifetime and designate how they will be distributed after your passing. Its revocable nature gives you the flexibility to make changes to the trust as your situation or the needs of your grandchildren evolve. By establishing this trust, you can provide for your grandchildren's education, healthcare, and other essential needs in a structured way.

In many cases, an Idaho Revocable Living Trust for Grandchildren offers benefits that a will does not. Trusts typically avoid the probate process, which can be time-consuming and costly, providing faster access to your assets for your beneficiaries. Additionally, a trust offers enhanced privacy, as its details do not become part of public record, unlike a will. This can be particularly beneficial for families looking to protect their financial legacy.

Yes, you can absolutely set up an Idaho Revocable Living Trust for Grandchildren. This type of trust allows you to designate your grandchildren as beneficiaries, ensuring that your assets will be managed and distributed according to your wishes. By establishing this trust, you provide financial support while retaining control over the assets during your lifetime. This can be a thoughtful way to secure your grandchildren's future.

It is generally not a good idea to put certain assets into a revocable trust. This includes assets that benefit from specific tax treatments, like retirement accounts. Furthermore, consider leaving personal property, like vehicles or artworks, outside of the trust for easier management. Using an Idaho Revocable Living Trust for Grandchildren allows you to strike a balance between protection and accessibility.

One downside of a revocable trust is that it does not provide asset protection. Since you can change or revoke the trust at any time, creditors may still access those assets. Additionally, a revocable trust may not offer tax benefits during your lifetime, which is something to consider. Weigh these factors carefully when setting up your Idaho Revocable Living Trust for Grandchildren.

To fill out a revocable living trust, start by determining the specific assets you'll include. Create a list of your grandchildren and other beneficiaries to ensure they're accounted for. Employ a user-friendly service like US Legal Forms to access templates that guide you through the necessary clauses and provisions for an Idaho Revocable Living Trust for Grandchildren. Completing this step with care can help protect your family's future.

Certain assets are typically not advisable to place in a revocable trust. For instance, retirement accounts, health savings accounts, and life insurance policies are often better kept outside of a trust. This allows for a more efficient transfer of those assets upon your passing. Always consider consulting a legal expert to guide you on organizing your Idaho Revocable Living Trust for Grandchildren appropriately.

Yes, you can write your own trust in Idaho. However, it is crucial to understand the legal requirements to ensure it's valid. Utilizing resources like US Legal Forms can simplify this process by providing templates that comply with Idaho laws. This ensures you create an Idaho Revocable Living Trust for Grandchildren that meets your specific needs.

Filling out a revocable living trust involves several steps. First, gather information about your assets and beneficiaries, including your grandchildren. Then, use a legal template or platform like US Legal Forms to ensure you include necessary legal language. Finally, review the document, sign it, and make sure your assets are properly funded into the trust.

Yes, a living trust can help avoid probate in Idaho, protecting your grandchildren's inheritance from lengthy court processes. When you place assets into an Idaho revocable living trust, they are not subject to probate upon your death. This can lead to a smoother transition and quicker distribution of assets. Utilizing platforms like uslegalforms can assist you in setting up your trust for optimal effectiveness.

Interesting Questions

More info

Shed for.