Idaho Restricted Endowment to Educational, Religious, or Charitable Institution

Description

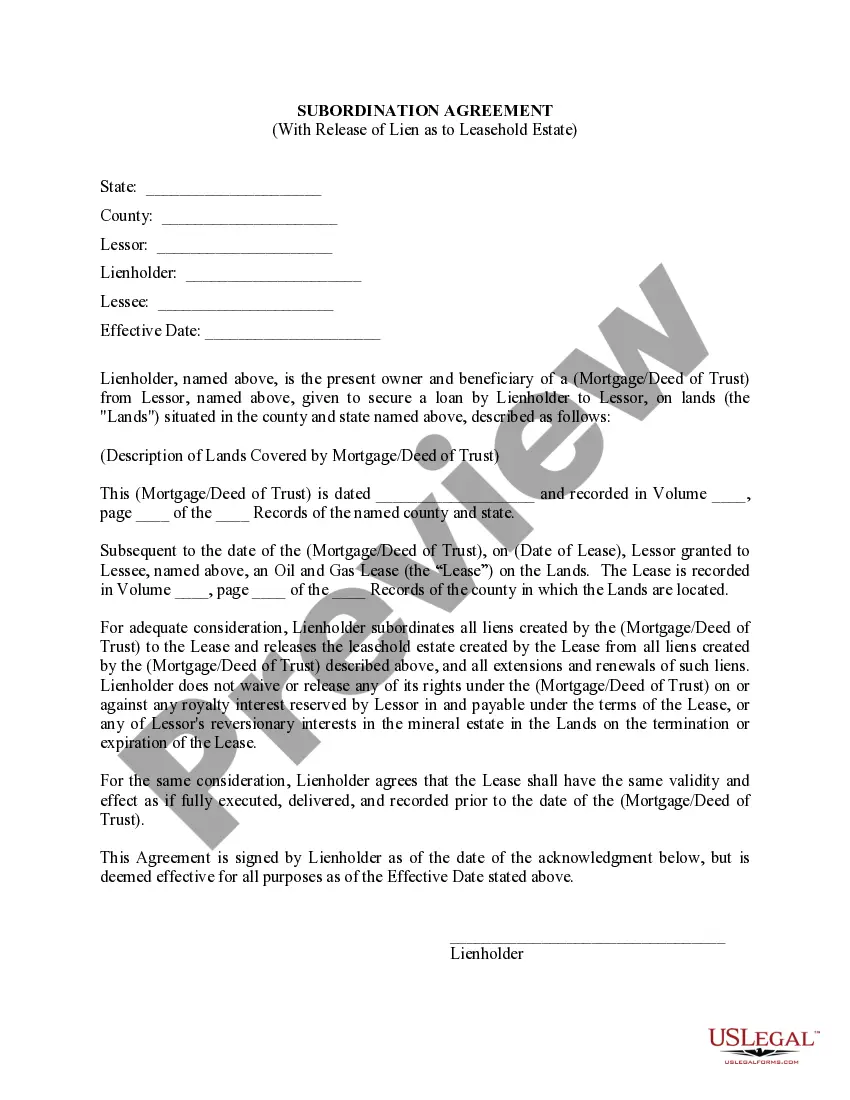

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

You might spend several hours online searching for the valid document template that meets the state and federal regulations you require.

US Legal Forms offers a wide range of legal forms that are evaluated by professionals.

You can easily download or print the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution from my service.

If available, utilize the Review button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of the acquired form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for your chosen county/city.

- Read the form description to confirm you have chosen the appropriate document.

Form popularity

FAQ

Individuals and corporations making donations to qualifying nonprofit organizations are eligible for the Idaho donation tax credit. This initiative supports contributors to the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution, helping to incentivize charitable giving. By participating, donors can enhance their financial impact while supporting vital educational and charitable activities in Idaho.

The trust lands in Idaho support a variety of endowments, primarily targeting public education, universities, and institutions with charitable missions. Notably, the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution plays a key role in providing financial support to these entities. The income derived from these lands enables the development and maintenance of essential services vital to the community.

Approximately 63% of land in Idaho is owned by the state or federal government. This significant ownership includes various types of land such as forests and grasslands, alongside the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution. Understanding this ownership structure is vital for those seeking to engage with state resources or benefit from endowment programs.

The Idaho Department of Lands oversees the management of the state's trust lands, including endowment lands. This agency is responsible for ensuring that the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution serves its purpose by maximizing income for supported institutions. Their management strategies often include timber lease agreements, grazing permits, and other revenue-generating activities.

A land endowment is a fund or resource created through land granted to an institution, organization, or public entity, often held to produce income over time. This concept is exemplified by the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution, where land generates revenue aimed at supporting educational and charitable goals. Such endowments ensure a steady income stream that can enhance program development and community services.

Idaho endowment land refers to tracts of land granted to the state of Idaho for the purpose of generating income to support specific public institutions. These lands are often managed within the framework of the Idaho Restricted Endowment to Educational, Religious, or Charitable Institution. The financial proceeds from leasing and selling resources on this land directly benefit these institutions, making them a crucial resource for education and charity in the state.

The Idaho education donation credit encourages taxpayers to support educational initiatives through their contributions. This credit can reduce your tax burden, making donations more impactful. Consider how donating to an Idaho Restricted Endowment to Educational, Religious, or Charitable Institution not only benefits the cause but also enhances your financial situation. Engage with credible platforms like uslegalforms to navigate these credits effectively.

The Idaho investment tax credit rewards taxpayers who invest in certain assets, promoting economic growth. Taxpayers can receive a credit based on the amount invested, which can lead to significant savings. By donating to an Idaho Restricted Endowment to Educational, Religious, or Charitable Institution, you may further optimize your tax situation. It’s essential to understand how these credits work together for your benefit.

In Idaho, the child tax credit provides financial relief to families with dependents who meet specific qualifications. This credit can help you manage the costs of raising children. Donations made to an Idaho Restricted Endowment to Educational, Religious, or Charitable Institution can also be beneficial when calculating your overall tax credits. Stay informed to optimize your financial support for your family.

The Idaho education tax credit supports taxpayers who donate to educational institutions. This credit can reduce your tax liability significantly, encouraging investment in local education. When you contribute to an Idaho Restricted Endowment to Educational, Religious, or Charitable Institution, you also increase your eligibility for such credits. Ensure you take advantage of this opportunity to make a difference.