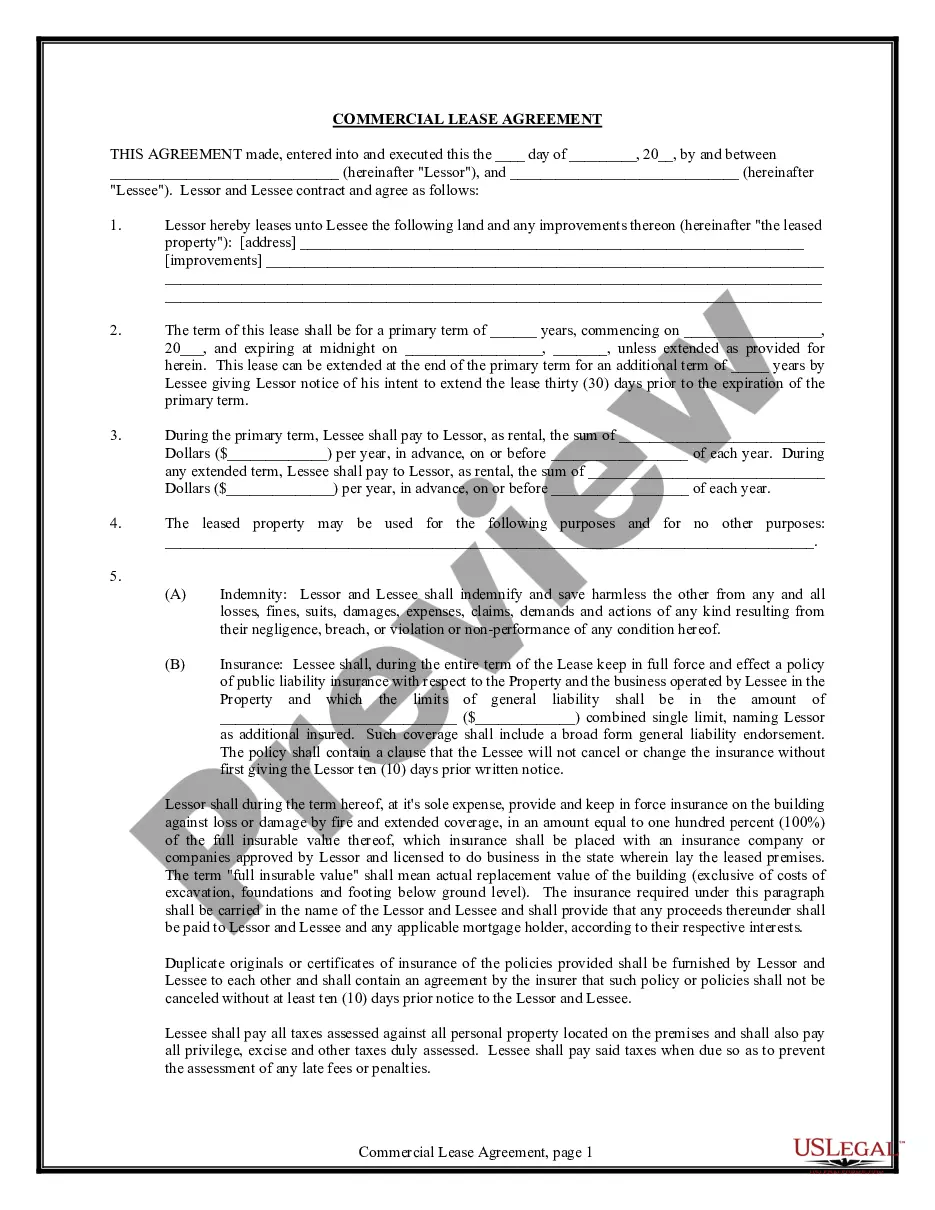

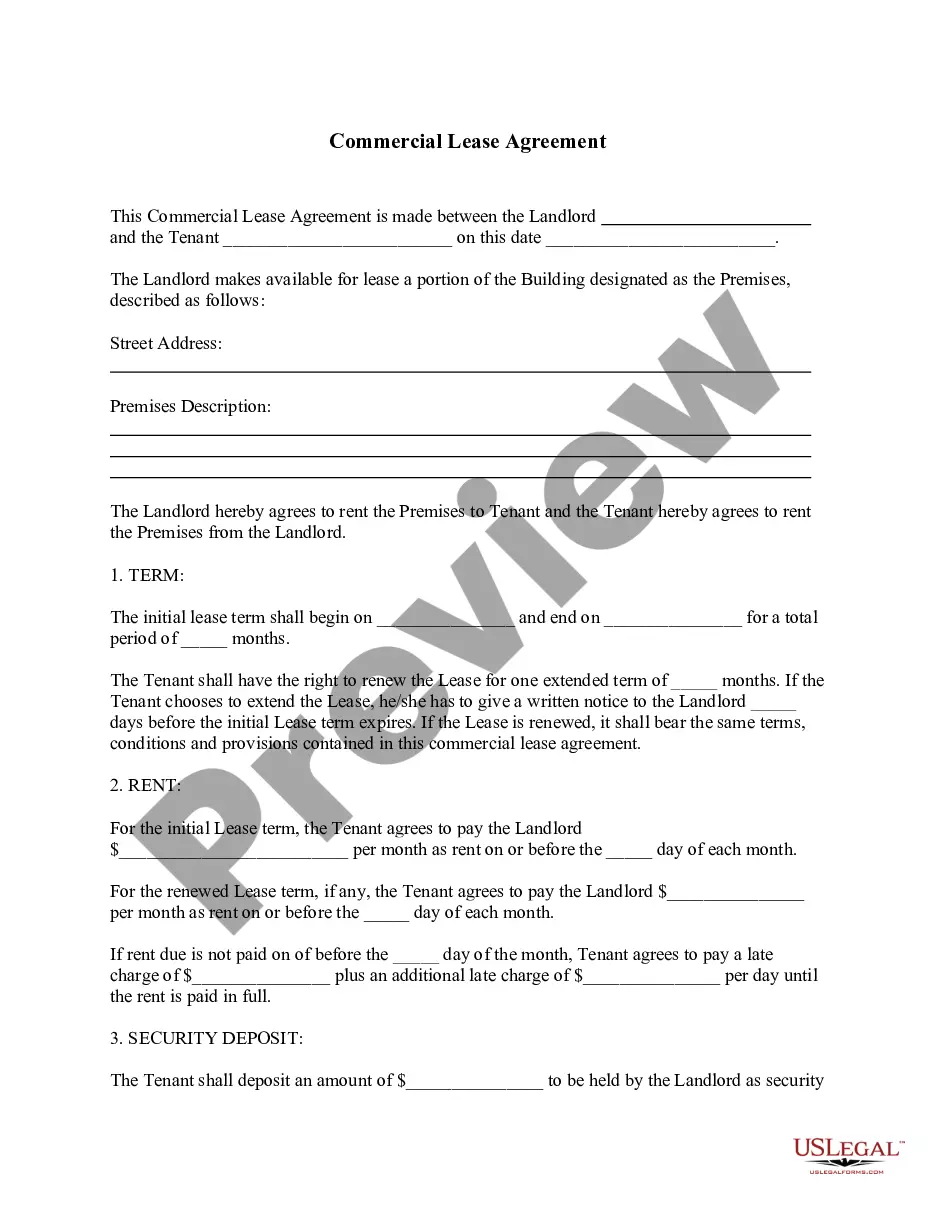

Idaho Office Space Lease Agreement

Description

How to fill out Office Space Lease Agreement?

If you desire to finalize, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms that is accessible online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Idaho Office Space Lease Agreement. Every legal document template you acquire is yours indefinitely. You have access to each form you downloaded in your account. Click on the My documents section and select a form to print or download again. Be proactive and download, and print the Idaho Office Space Lease Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Idaho Office Space Lease Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Get button to access the Idaho Office Space Lease Agreement.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for your appropriate jurisdiction.

- Step 2. Use the Examine option to review the form's details. Remember to check the description.

- Step 3. If you are not content with the form, take advantage of the Search bar at the top of the screen to find alternative types of the legal form template.

- Step 4. Once you have identified the form you need, click on the Purchase now button. Select the payment plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Here are some of the most important items to cover in your lease or rental agreement.Names of all tenants.Limits on occupancy.Term of the tenancy.Rent.Deposits and fees.Repairs and maintenance.Entry to rental property.Restrictions on tenant illegal activity.More items...?

10 THINGS EVERY RENTAL AGREEMENT SHOULD INCLUDE10 THINGS EVERY RENTAL AGREEMENT SHOULD INCLUDE. Category Advice.Tenant Information.Period of Tenancy.Limits on Numbers of Tenants.Rental Amount and Conditions.Other Amounts Due.Restrictions on Illegal or Unacceptable Activity on the Property.Access.More items...?

How to create a lease agreementCollect each party's information.Include specifics about your property.Consider all of the property's utilities and services.Know the terms of your lease.Set the monthly rent amount and due date.Calculate any additional fees.Determine a payment method.Consider your rights and obligations.More items...

A written lease agreement must contain:The names and addresses of both parties;The description of the property;The rental amount and reasonable escalation;The frequency of rental payments, i.e. monthly;The amount of the deposit;The lease period;The notice period for termination of contract;More items...

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. The introductory paragraph should also include the address of the property being leased, as well as the start and end dates of the lease.

Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Most leases and rental agreements include a clause in which the tenant agrees that the premises are in habitable (livable) condition and promises to alert the landlord to any defective or dangerous condition. Tenant's repair and maintenance responsibilities.

These are eight clauses that a landlord should include in a lease agreement in California:Security Deposits.Specific Payment Requirements.Late Rent Fees.Rent Increases.Notice of Entry.Rental Agreement Disclosures.Gas and Electricity Disclosure.Recreational Marijuana and Rentals.

File a copy of the signed lease agreement with the Office of the County Registrar (known as the County Recorder or Deed Registry in some states) in the county where the rental property resides. The office may charge a nominal filing fee for registration, which you must pay at the time of filing.