Idaho Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act

Description

How to fill out Designation Of Successor Custodian By Donor Pursuant To The Uniform Transfers To Minors Act?

Have you been inside a situation where you need papers for sometimes organization or personal reasons almost every time? There are tons of authorized papers themes available on the Internet, but discovering kinds you can depend on is not straightforward. US Legal Forms delivers thousands of develop themes, such as the Idaho Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act, that are composed in order to meet federal and state specifications.

In case you are already knowledgeable about US Legal Forms website and possess an account, basically log in. Afterward, you can download the Idaho Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act web template.

If you do not come with an accounts and need to begin using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is for your appropriate city/county.

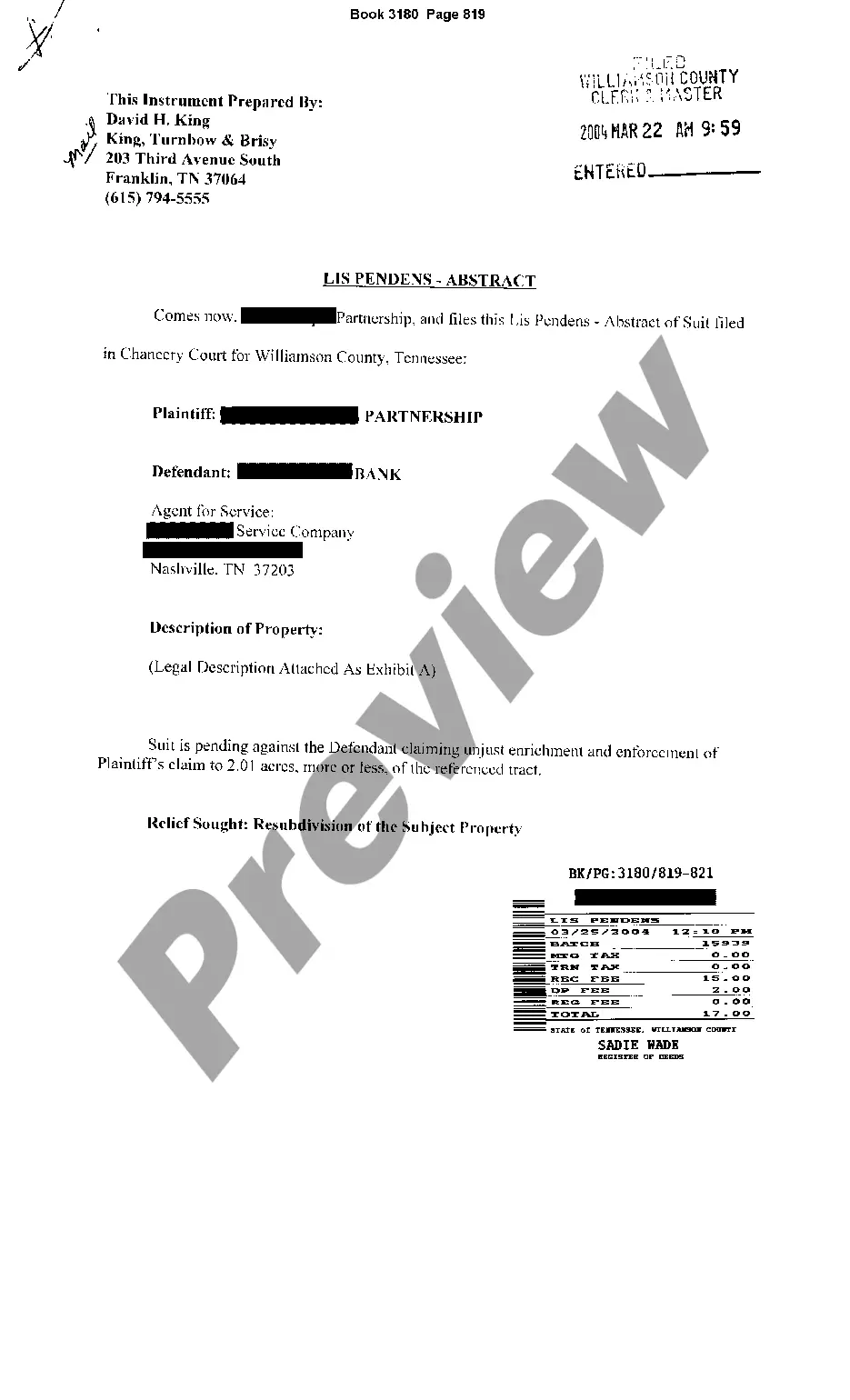

- Make use of the Preview switch to examine the form.

- Browse the outline to ensure that you have chosen the appropriate develop.

- If the develop is not what you`re trying to find, use the Research area to discover the develop that suits you and specifications.

- If you get the appropriate develop, click Acquire now.

- Choose the prices strategy you want, fill in the necessary information to create your bank account, and pay for an order making use of your PayPal or credit card.

- Choose a practical document format and download your version.

Get each of the papers themes you possess bought in the My Forms menu. You can obtain a additional version of Idaho Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act any time, if possible. Just click the required develop to download or produce the papers web template.

Use US Legal Forms, by far the most comprehensive assortment of authorized kinds, to conserve efforts and steer clear of mistakes. The assistance delivers appropriately made authorized papers themes that you can use for an array of reasons. Generate an account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

The UTMA account is properly titled as a fiduciary account (e.g., ?UTMA? indicating a fiduciary relationship). Deposit insurance coverage passes through John, the custodian, to Julia, the actual owner of the funds. The funds are insured as Julia's single account for up to $250,000.

(2) "Abandoned" means the failure of the parent to maintain a normal parental relationship with his child including, but not limited to, reasonable support or regular personal contact. Section 16-1602 ? Idaho State Legislature idaho.gov ? idstat ? title16 ? sect16-1602 idaho.gov ? idstat ? title16 ? sect16-1602

The beneficiary designation under UTMA/UGMA must include the name and identifying information for the custodian, the child's name and relationship to the insured, and the name of the state act. Generally, only one custodian and one minor may be named in each designation. Beneficiary Designations Reference Guidelines myfasttermquotes.com ? uploads ? 2019/01 ? sam... myfasttermquotes.com ? uploads ? 2019/01 ? sam...

One way to provide for a minor child with your life insurance benefit is to place it in a trust managed by a custodian of your choice. It might also be possible to designate your death benefit for uses that benefit your minor child.

Generally, when UTMA or UGMA accounts (UTMA/UGMA Accounts) are established, the beneficiary (a minor) becomes the owner of the property at the time of the gift; however, the custodian manages and invests the property on the beneficiary's behalf until the beneficiary reaches the age of majority, at which point the ...

The term Uniform Transfers to Minors Act (UTMA) refers to a law that allows a minor to receive gifts without the aid of a guardian or trustee. Gifts can include money, patents, royalties, real estate, and fine art. Uniform Transfers to Minors Act (UTMA): What It Is and How It Works investopedia.com ? terms ? utma investopedia.com ? terms ? utma

The minor owns the account. The custodian establishes and maintains control until the minor reaches the age of majority specified by the specific state's UTMA law.

Age of Majority and Trust Termination StateUGMAUTMAHawaii1821Idaho1821Illinois2121Indiana182149 more rows Age of Majority and Trust Termination - FinAid.org finaid.org ? savings ? ageofmajority finaid.org ? savings ? ageofmajority