Idaho Letter of Credit is a financial instrument that provides a guarantee of payment to a beneficiary from a bank or financial institution on behalf of the applicant or the buyer. It is commonly used in various industries, especially in international trade, where the parties involved are unfamiliar with each other or dealing across borders. A letter of credit serves as a contractual agreement between the applicant, the beneficiary, and the issuing bank. It is designed to mitigate risks and ensure secure transactions by offering a level of trust and assurance to all parties involved. In Idaho, there are different types of letters of credit that serve specific purposes and cater to different business needs. Some notable types of Idaho letters of credit are: 1. Revocable Letter of Credit: This type of letter of credit can be modified or canceled by the applicant or the issuing bank without prior notice to the beneficiary. It provides a lesser degree of security and is not commonly used due to the inherent risks for the beneficiary. 2. Irrevocable Letter of Credit: An irrevocable letter of credit provides a higher level of assurance for the beneficiary as it cannot be modified or canceled without the consent of all parties involved. It offers more security and reliability, making it the preferred choice in most business transactions. 3. Standby Letter of Credit: A standby letter of credit is often used as a form of financial guarantee, serving as a backup plan in case the applicant fails to fulfill their obligations. It ensures compensation to the beneficiary in situations such as non-payment or non-performance. 4. Commercial Letter of Credit: This type of letter of credit is primarily used in international trade to facilitate the payment between the buyer and the seller. It ensures that the seller will receive the agreed-upon amount if all the specified conditions outlined in the letter of credit are met. Each type of Idaho letter of credit has its unique characteristics and purposes, allowing businesses to choose the most suitable option based on their specific requirements and risk tolerance. In conclusion, an Idaho Letter of Credit is a vital financial tool that provides security and assurance in various business transactions. Understanding the different types of letters of credit available in Idaho allows businesses to make informed decisions and ensure smooth and secure trade operations.

Idaho Letter of Credit

Description

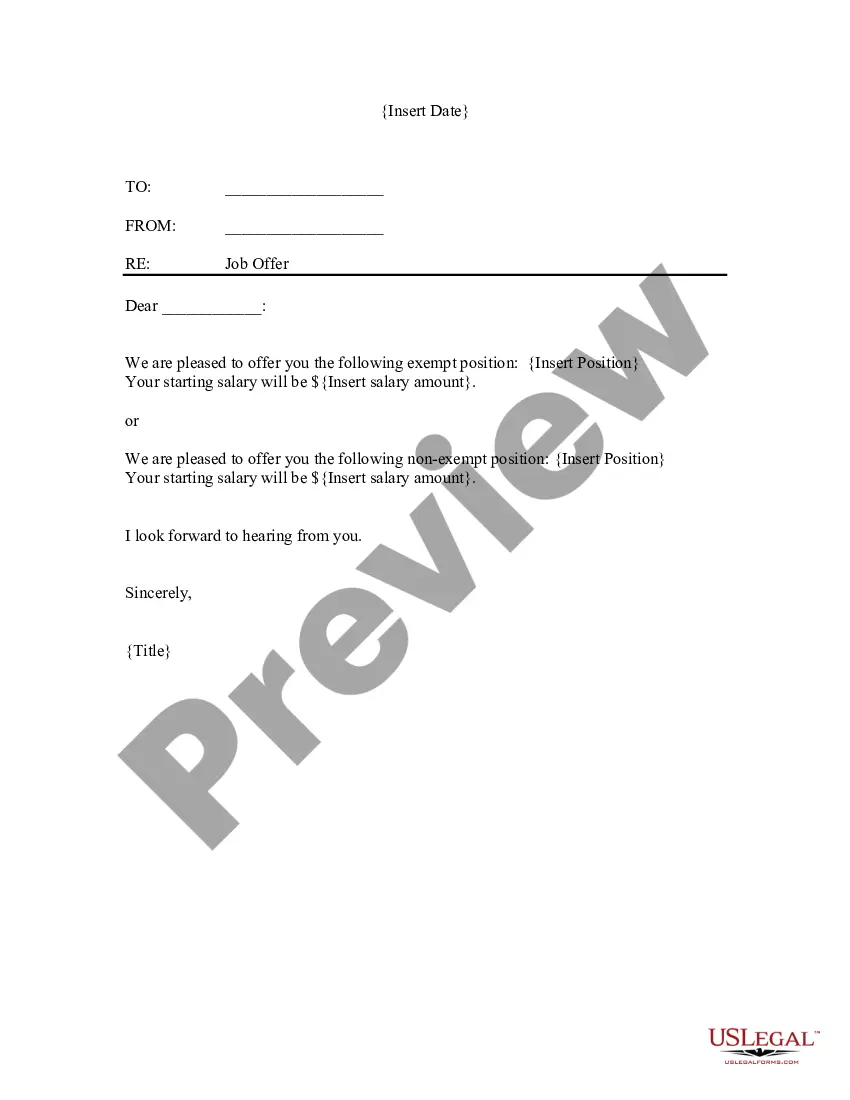

How to fill out Idaho Letter Of Credit?

Discovering the right legitimate document web template could be a battle. Naturally, there are plenty of templates available on the Internet, but how do you find the legitimate form you want? Take advantage of the US Legal Forms site. The assistance delivers a huge number of templates, like the Idaho Letter of Credit, which you can use for company and personal demands. Every one of the kinds are checked out by experts and meet up with federal and state specifications.

In case you are already listed, log in for your bank account and click the Acquire button to have the Idaho Letter of Credit. Make use of your bank account to look from the legitimate kinds you may have purchased in the past. Proceed to the My Forms tab of your respective bank account and acquire another version of the document you want.

In case you are a fresh end user of US Legal Forms, allow me to share simple instructions for you to follow:

- First, make certain you have chosen the appropriate form for your personal metropolis/state. It is possible to look through the form making use of the Review button and browse the form information to guarantee it is the right one for you.

- In the event the form fails to meet up with your expectations, make use of the Seach field to obtain the right form.

- Once you are certain that the form would work, click the Purchase now button to have the form.

- Choose the rates plan you desire and type in the required information. Make your bank account and pay money for your order making use of your PayPal bank account or charge card.

- Pick the submit file format and acquire the legitimate document web template for your gadget.

- Complete, edit and produce and sign the received Idaho Letter of Credit.

US Legal Forms is the greatest library of legitimate kinds where you can discover a variety of document templates. Take advantage of the service to acquire skillfully-produced documents that follow express specifications.

Form popularity

FAQ

Most letters of credit are governed by rules promulgated by the International Chamber of Commerce known as Uniform Customs and Practice for Documentary Credits.

A letter of credit is an instrument issued by a financial institution, usually a bank, which authorizes the bearer to demand payment from the institution. A letter of credit can be general, if it is not addressed to any specific person, or special, if it is addressed to a specific person or entity.

Uniform Commercial Code Article 5 governs letters of credit, which are typically issued by a bank or other financial institution to its business customers in order to facilitate trade.

The basic letter of credit procedure: Purchase and sales agreement. The buyer and the seller draw up a purchase and sales agreement. ... Buyer applies for letter of credit. ... Issue letter of credit. ... Advise letter of credit. ... Prepare shipment. ... Present documents. ... Payment. ... Document transfer.

UCC Article 5, Letters of Credit - Uniform Law Commission.

Key Takeaways. A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount. Letters of credit are often used within the international trade industry.

Using the sales agreement's terms and conditions, the importer's bank drafts the letter of credit; this letter is sent to the exporter's bank. The exporter's bank reviews the letter of credit and sends it to the exporter after approval. The exporter ships the goods as the letter of credit describes.

An import letter of credit is a legally binding document that minimizes financial risks to your business. It is a commercial L/C established for a buyer, the importer, to pay a specified sum of money to the overseas seller for the goods described in the L/C.