Title: Comprehensive Guide to Idaho Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts Introduction: Identity theft is a grave concern in today's digital age, and even minors are not immune to this growing problem. In the state of Idaho, it is crucial for parents or guardians to promptly notify creditors about any fraudulent activities on their minor's accounts. This detailed guide will explain the process of writing an Idaho Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, ensuring the necessary steps are taken to protect your child's financial well-being. I. Idaho Letter to Creditors Explained: 1. Importance of notifying creditors: — Describes why immediate action is necessary to minimize the impact of identity theft on a minor's credit. 2. Overview of Idaho laws: — Provides an overview of the legal obligations in Idaho regarding identity theft for minors. 3. Purpose of the letter: — Clarifies the purpose of the letter: notifying creditors of fraudulently opened accounts on behalf of a minor. II. Required Information in an Idaho Letter to Creditors: 1. Full contact details: — Name, address, phone number, and email address of the victim's parent/guardian to establish communication. 2. Minor's information: — Full name, date of birth, and social security number of the affected minor. 3. Account details: — Details of the fraudulent account(s), including the account number(s), date(s) opened, and relevant financial institution(s) involved. 4. Nature of the identity theft: — Briefly explain how the identity theft was discovered, such as suspicious transactions, credit denial, or credit report assessment. III. Steps to Prevent Further Fraud: 1. Request for immediate action: — Clearly state the urgency of their response and request for freezing or closing the fraudulent accounts. 2. Supporting documentation: — Advise the creditors to provide instructions for submitting supporting documents, such as an identity theft affidavit or police report. 3. Identity verification: — Include a statement emphasizing the need for rigorous identity verification before making any financial decisions. 4. Monitoring services: — Suggest requesting the creditor to monitor the minor's credit file for any suspicious activities. IV. Closing the Idaho Letter to Creditors: 1. Expressing gratitude: — Thank the creditor for their cooperation and assistance in rectifying the situation. 2. Request for confirmation: — Ask for a written acknowledgement or confirmation of the actions taken to protect the minor's credit. Types of Idaho Letters to Creditors Notifying Them of Identity Theft of Minor for New Accounts: 1. Initial Letter: — Used to inform creditors of the identity theft and fraudulent accounts right after discovery. 2. Follow-up Letter: — Sent if the initial letter did not receive a timely response or if additional information/documentation is required. 3. Cease and Desist Letter: — Used to demand the immediate cessation of any attempts to collect debts resulting from the fraudulent accounts. Conclusion: By following the steps outlined in this Idaho Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, you can effectively communicate the fraudulent activities and urge creditors to take necessary actions to protect your child's financial interests. Prompt action and thorough documentation are vital to resolving identity theft issues and minimizing any potential long-term consequences.

Idaho Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

How to fill out Idaho Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

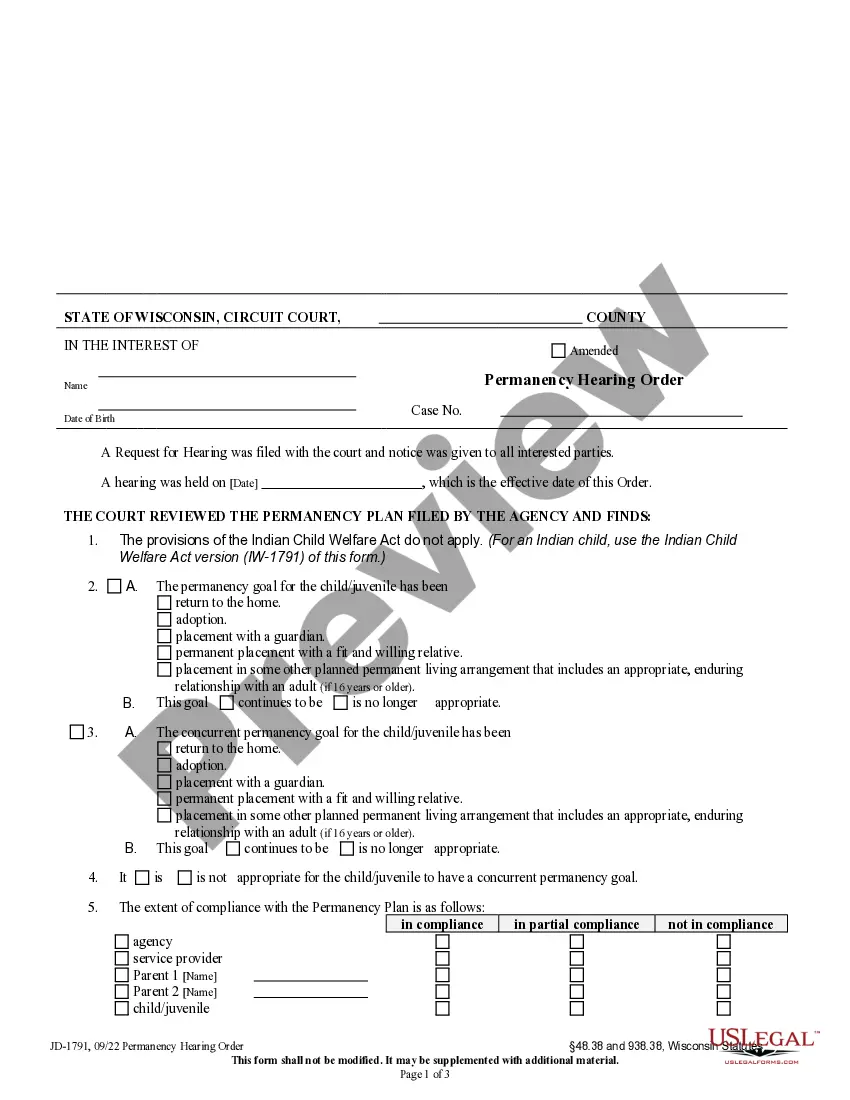

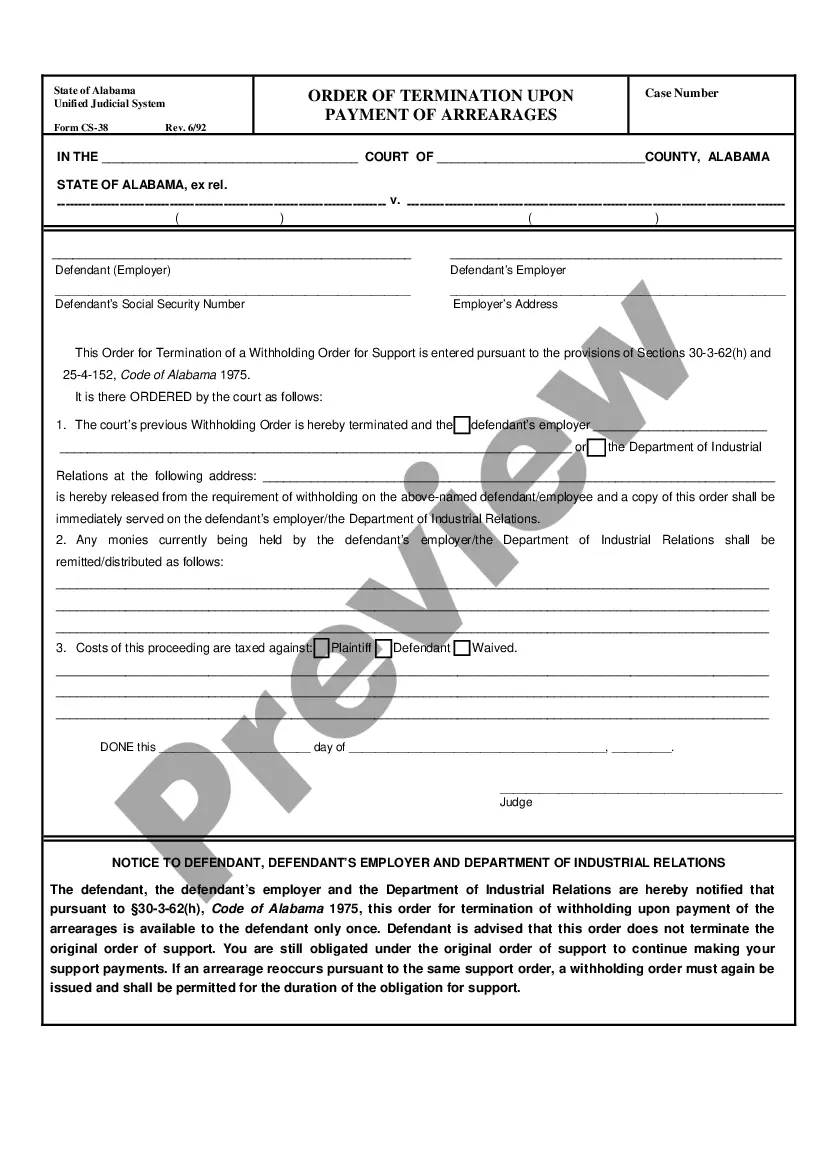

It is possible to spend several hours online trying to find the legal papers web template which fits the state and federal requirements you require. US Legal Forms offers a large number of legal forms that are evaluated by experts. You can actually download or print out the Idaho Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts from our assistance.

If you currently have a US Legal Forms bank account, you may log in and click the Down load key. Following that, you may comprehensive, edit, print out, or sign the Idaho Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts. Each and every legal papers web template you get is yours eternally. To acquire yet another version for any purchased type, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms web site the first time, keep to the basic recommendations listed below:

- First, ensure that you have chosen the right papers web template for the state/town of your liking. Browse the type explanation to ensure you have selected the right type. If offered, use the Preview key to look from the papers web template too.

- If you want to find yet another version of the type, use the Research industry to get the web template that meets your needs and requirements.

- Once you have discovered the web template you desire, simply click Acquire now to move forward.

- Select the pricing program you desire, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can utilize your charge card or PayPal bank account to cover the legal type.

- Select the file format of the papers and download it in your device.

- Make modifications in your papers if possible. It is possible to comprehensive, edit and sign and print out Idaho Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

Down load and print out a large number of papers templates while using US Legal Forms site, which provides the most important collection of legal forms. Use expert and status-certain templates to take on your company or specific needs.