Idaho Contract with Employee to Work in a Foreign Country

Description

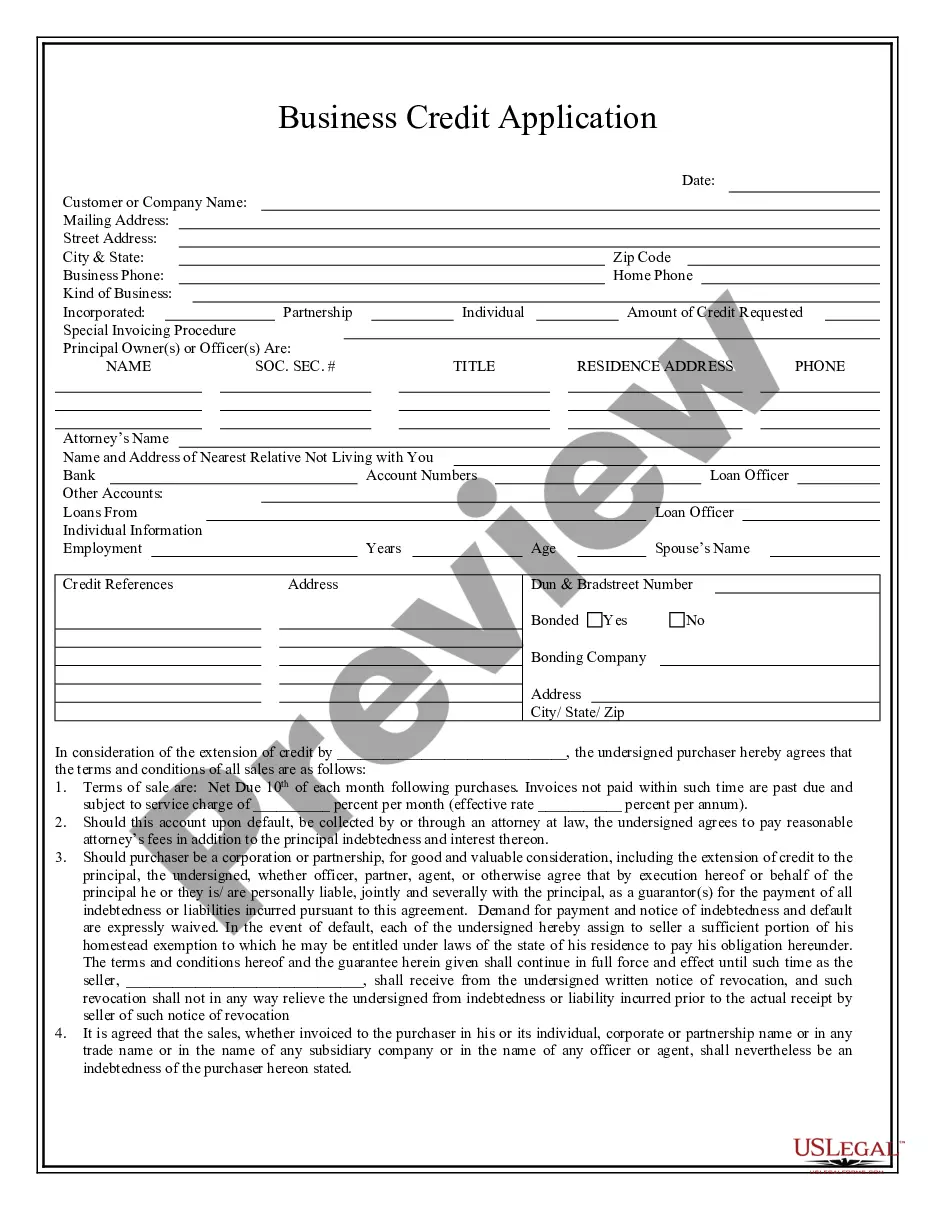

How to fill out Contract With Employee To Work In A Foreign Country?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest forms, such as the Idaho Contract with Employee to Work in a Foreign Country.

If you already have an account, Log In and download the Idaho Contract with Employee to Work in a Foreign Country from your US Legal Forms library. The Obtain button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your Visa, Mastercard, or PayPal account to finish the transaction.

Choose the format and download the form to your device.

- If you want to use US Legal Forms for the first time, here are some simple steps to get started.

- Make sure you have selected the appropriate form for your city/state.

- Click the Preview button to examine the form's content.

- Check the form description to confirm you have chosen the correct document.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

Idaho provides several tax breaks for seniors, including a property tax benefit and a deduction for retirement income. These incentives can significantly affect financial planning during retirement. If you are considering employment options like an Idaho Contract with Employee to Work in a Foreign Country, understanding available tax breaks can help maximize your savings.

Idaho taxes residents on their income, regardless of where it is earned. If you work out of state or even in a foreign country, you will still need to report that income on your Idaho tax return. Understanding the implications of your income while operating under an Idaho Contract with Employee to Work in a Foreign Country is vital for tax compliance.

Yes, Idaho does tax pensions that originate from other states. Regardless of where your pension is from, it remains subject to Idaho's tax laws. Thus, if you receive a pension while working overseas under an Idaho Contract with Employee to Work in a Foreign Country, be sure to account for taxes.

In Idaho, pension income is subject to state income tax. The state tax rate can depend on your total income level. Knowing how an Idaho Contract with Employee to Work in a Foreign Country interacts with your pension can help you plan for taxes effectively.

Several states offer favorable tax conditions for retirees, including Florida and Nevada. However, it's essential to consider your retirement plans, lifestyle needs, and how an Idaho Contract with Employee to Work in a Foreign Country may impact your tax situation. Evaluating these details will help you make the best decision for your financial future.

Idaho Form 910 is a legal document that outlines an employee's agreement to work in a foreign country. This form is crucial for businesses in Idaho that send employees overseas. It protects both the employer's and employee's rights while clarifying job expectations and obligations under an Idaho Contract with Employee to Work in a Foreign Country.

Idaho does enforce non-compete agreements, provided they meet certain legal standards. The courts will examine factors such as the reasonableness of the restrictions and the interests of both parties. Thus, when forming an Idaho Contract with Employee to Work in a Foreign Country, it is crucial to understand how to write enforceable non-compete provisions to ensure compliance.

Yes, non-compete agreements can be enforceable in Idaho, but there are specific conditions that must be met. The agreement must be reasonable in terms of duration, geographic scope, and the nature of the restrictions. When drafting an Idaho Contract with Employee to Work in a Foreign Country, ensuring that your non-compete clauses adhere to these criteria is essential for them to hold up legally.

In Idaho, Non-Disclosure Agreements (NDAs) are governed by principles of contract law. An NDA serves to protect confidential information shared between parties. It is beneficial to include an NDA in an Idaho Contract with Employee to Work in a Foreign Country to safeguard sensitive information and ensure compliance with Idaho laws.

Generally, US employment laws do not apply to employees who work in foreign countries; local laws tend to take precedence. However, some federal laws may still have relevance depending on the circumstances. Therefore, it’s crucial to draft an Idaho Contract with Employee to Work in a Foreign Country that aligns with both US and local legislation to avoid legal pitfalls.