Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: A Comprehensive Guide Introduction: The Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan is a legal document that outlines the terms and conditions for victims of identity theft or fraud in Idaho to establish a repayment plan with the identified imposter. This agreement aims to facilitate the process of recovering financial losses incurred by victims and promotes a structured approach to resolving the issue. Key Elements and Relevant Keywords: 1. Identity Theft: The agreement addresses cases involving identity theft, where unauthorized individuals assume the identity of innocent victims to commit fraudulent activities, such as taking out loans, opening credit accounts, or making purchases. 2. Known Imposter: This agreement specifically focuses on situations where the victim knows or can identify the individual responsible for the fraudulent activities. It may involve a family member, neighbor, coworker, or any person with access to personal information. 3. Financial Repercussions: The agreement acknowledges the financial losses suffered by the victim due to the imposter's actions. This may include unauthorized charges, outstanding debts, credit scores impact, legal fees, or any related expenses. 4. Repayment Plan: The letter agreement primarily aims to establish a fair and feasible repayment plan between the victim and the known imposter. It outlines the terms and conditions under which the imposter agrees to repay the victim's losses over an agreed-upon duration. 5. Terms of Repayment: The agreement specifies the repayment terms, such as the amount to be paid, the frequency of payments (e.g., monthly, quarterly), the method of payment (e.g., checks, electronic transfers), and the duration of the repayment plan. 6. Interest and Penalties: If applicable, the agreement may address the inclusion of interest on the outstanding amount or penalties for missed or delayed payments, enabling a fair resolution to the financial harm experienced by the victim. 7. Confidentiality: The agreement emphasizes the need for confidentiality to protect the parties involved. Both the victim and the imposter must agree not to disclose personal information or details about the agreement to third parties, ensuring privacy and security. 8. Legal Acknowledgment: The letter agreement may include a section where both parties acknowledge that signing the agreement does not release the imposter from potential legal consequences if law enforcement agencies proceed with criminal charges against them. Types of Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: Although variations may exist based on individual circumstances, some potential types of Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan include: 1. Individual Agreement: This refers to a repayment plan between a single victim and a known imposter. It involves only two parties directly affected by the identity theft or fraud. 2. Family Agreement: In certain cases, where the imposter is a family member, the agreement may be specific to addressing familial ties and dynamics. It ensures a more personalized approach to resolving the issue within a closely related group. Conclusion: The Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan provides a structured framework for victims of identity theft to recover their losses through an agreed-upon repayment plan. By clearly outlining the terms and conditions, this agreement aims to resolve financial-related disputes and contribute to the restitution process for victims in Idaho.

Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

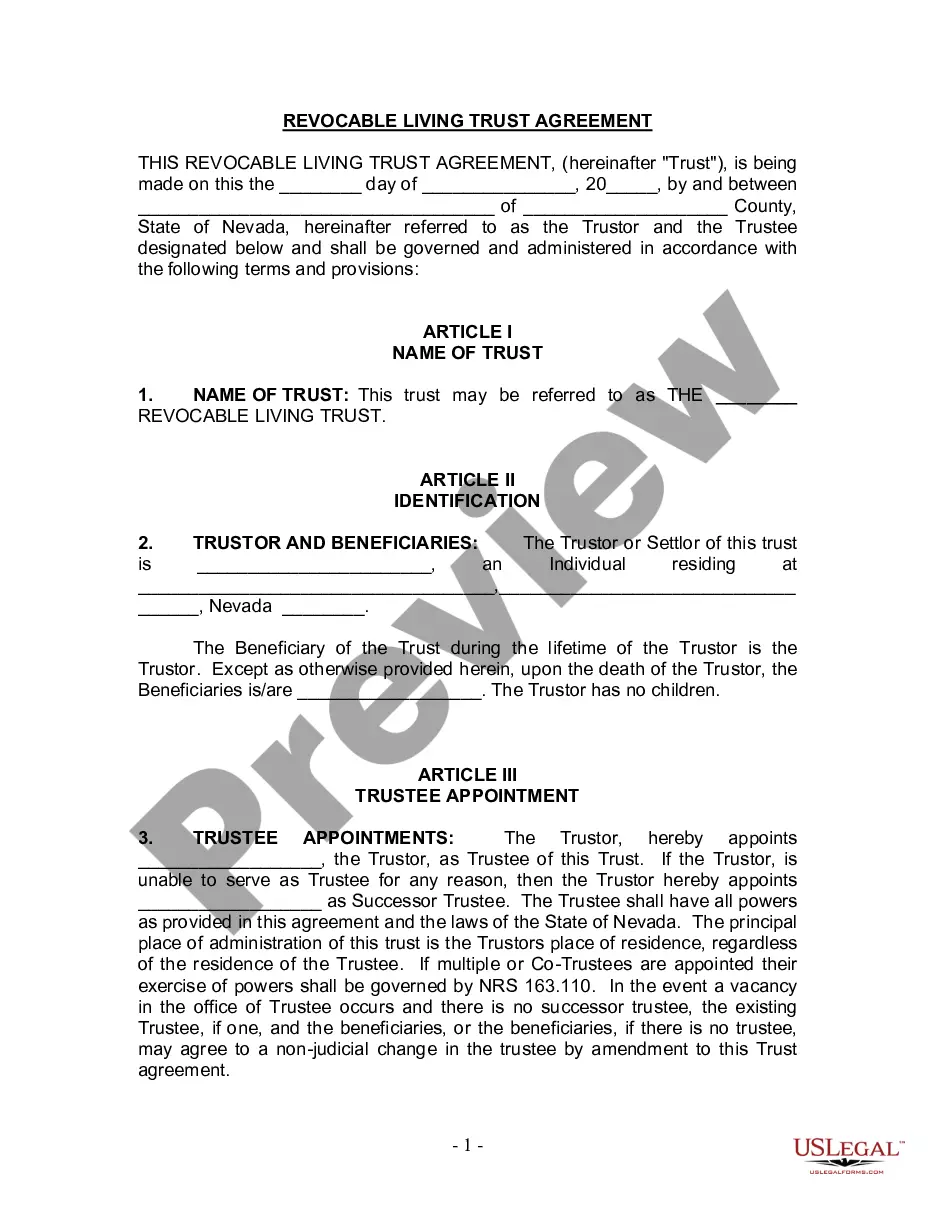

How to fill out Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

Have you been within a situation in which you require documents for possibly organization or specific purposes almost every time? There are a lot of legitimate papers themes accessible on the Internet, but getting types you can rely on is not simple. US Legal Forms provides thousands of form themes, like the Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, which can be created to fulfill state and federal needs.

When you are currently familiar with US Legal Forms internet site and have a merchant account, just log in. Afterward, you are able to download the Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan design.

Should you not come with an accounts and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is to the right city/area.

- Utilize the Review button to review the shape.

- Read the outline to actually have chosen the correct form.

- In the event the form is not what you are searching for, utilize the Look for discipline to find the form that fits your needs and needs.

- Once you discover the right form, click Get now.

- Choose the prices program you would like, submit the desired details to produce your money, and buy the order utilizing your PayPal or charge card.

- Choose a convenient document structure and download your duplicate.

Get each of the papers themes you might have purchased in the My Forms food list. You may get a more duplicate of Idaho Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan at any time, if required. Just click the essential form to download or produce the papers design.

Use US Legal Forms, by far the most comprehensive collection of legitimate kinds, to save some time and stay away from mistakes. The services provides professionally manufactured legitimate papers themes that can be used for a selection of purposes. Make a merchant account on US Legal Forms and start generating your way of life easier.