The Idaho Agreement to Repay Cash Advance on a Credit Card is a legal document that outlines the terms and conditions between a credit card holder and their credit card issuer when acquiring a cash advance. This agreement specifies the responsibilities and obligations of both parties involved in the transaction. When it comes to cash advances on credit cards, there are typically two types of agreements available in Idaho: 1. Standard Cash Advance Agreement: This type of agreement is the most common and widely used in Idaho. It establishes the terms for obtaining a cash advance through a credit card, including the maximum amount that can be withdrawn, applicable fees and interest rates, repayment terms, and any specific conditions set by the credit card issuer. 2. Promotional Cash Advance Agreement: Sometimes credit card companies introduce promotional offers for cash advances that have different terms compared to the standard agreement. This type of agreement may include lower interest rates or special repayment options for a limited time period. It is essential for consumers to carefully read and understand the specific terms and conditions of any promotional agreement before taking advantage of such offers. In both types of Idaho Agreement to Repay Cash Advance on Credit Card, certain keywords are critical to understanding the terms and obligations involved. Here is a list of relevant keywords: 1. Cash Advance: The process of borrowing money against the available credit line on a credit card. 2. Credit Card Holder: The individual who owns or is authorized to use the credit card. 3. Credit Card Issuer: The financial institution or credit card company that issued the credit card. 4. Maximum Limit: The highest amount of cash that can be borrowed as a cash advance. 5. Fees: Additional charges associated with obtaining a cash advance, such as transaction fees or service fees. 6. Interest Rate: The percentage of interest charged on the cash advance amount until it is fully repaid. 7. Repayment Terms: The agreed-upon conditions for returning the cash advance, including minimum monthly payments, due dates, and late payment penalties. 8. Promotional Offers: Special deals or incentives provided by credit card issuers for cash advances, subject to specific terms and timeframes. 9. Agreement Termination: The clauses outlining the circumstances under which either party can terminate the agreement, such as default on payments or violation of terms. It is crucial for credit card holders in Idaho to thoroughly read, understand, and agree to the terms stated in the Agreement to Repay Cash Advance on Credit Card before acquiring a cash advance. This ensures both parties are aware of their responsibilities and helps prevent any disputes or misunderstandings in the future.

Idaho Agreement to Repay Cash Advance on Credit Card

Description

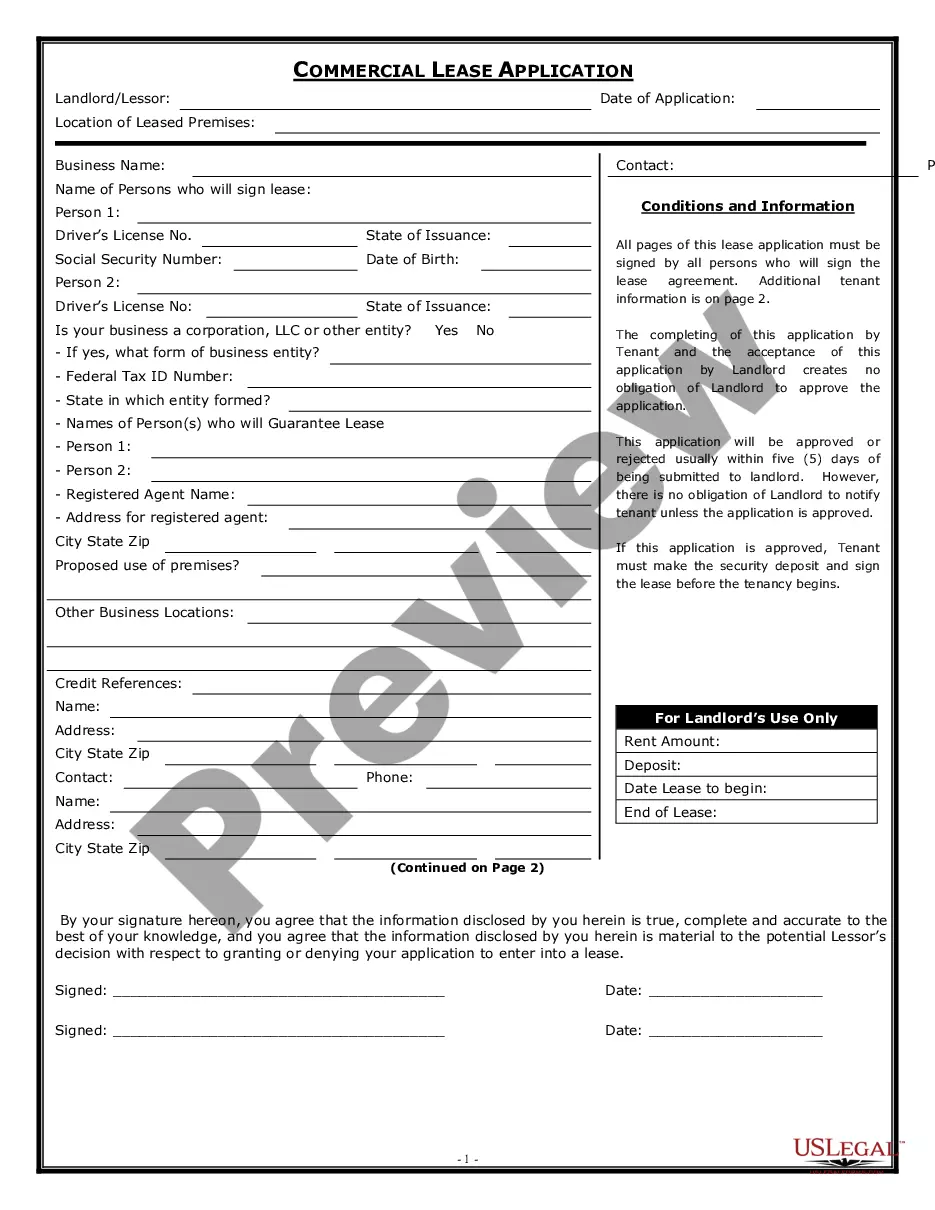

How to fill out Agreement To Repay Cash Advance On Credit Card?

Have you found yourself in a situation where you require documentation for various business or personal purposes almost every day you work.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of templates, including the Idaho Agreement to Repay Cash Advance on Credit Card, designed to comply with federal and state regulations.

If you find the suitable form, click on Buy now.

Choose a payment plan that suits you, fill in the necessary details to create your account, and finalize the transaction using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Afterward, you can download the Idaho Agreement to Repay Cash Advance on Credit Card template.

- If you do not have an account and wish to start using US Legal Forms, follow these procedures.

- Locate the form you need and ensure it corresponds to the correct city/region.

- Utilize the Review button to examine the document.

- Check the description to confirm that you have chosen the appropriate form.

- If the form is not what you're seeking, use the Lookup field to find a form that meets your requirements.

Form popularity

FAQ

Nearly every credit card allows you to borrow cash with cash advances, however, it is probably not a good idea. After all, fees and high interest rates are a great way for issuers to make money, as you can see in this example. Check the cardholder agreement that came with your card to make sure.

You can also withdraw money from a credit card in the same way you would a debit card. But, credit card companies charge large fees and interest when you take money out known as a cash advance making it a more expensive way to get cash than withdrawing from your debit card.

Withdraw money from an ATM where your credit card is accepted. Select "credit" when prompted to make a withdrawal from checking, savings or credit. Go to a bank to withdraw money against the limit on your credit card. Check that the bank offers advances from your credit card issuer, such as Mastercard or Visa.

Exceeding your cash advance limit can result in over the limit charges and higher interest rates. Take out only what you need, nothing more. Avoid the temptation to withdraw just a little more so you have some extra money. Remember, you're paying a fee based on the amount of the advance.

Do a cash advance: You can make an ATM withdrawal with your credit card to turn some of your available credit into cash. You just need to get a PIN from the card's issuer. You can withdraw up to the cash advance limit listed on your statement.

You can ask the teller to withdraw funds from your credit card and deposit them into your bank account. The second option is to do the same process yourself at an ATM. You'll put your credit card into the machine and withdraw cash. Then you can start another transaction and deposit the funds into your bank account.

Cash advances are typically capped at a percentage of your card's credit limit. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

Thanks to the Credit CARD Act of 2009, lenders are legally required to give cardholders a minimum of 21 days between the end of their monthly billing cycle and their bill due date to pay off their credit card balance before interest charges kick in.

Net bankingstep 1: open your bank's website.step 2: log in to your credit card account.step 3: select the transfer option.step 4: enter the amount you want to transfer.step 5: enter the required details mentioned in the form.step 6: follow the prompts to complete transactions.

At your bank: You can ask your teller for a cash advance with your credit card. At an ATM: You can insert your card, enter your PIN and receive your cash. With a check: If you've been given checks by your credit card issuer, you can fill one out to yourself. Then you can either cash it or deposit it at your bank.

Interesting Questions

More info

The terms of the mortgage loan servicing agreements are intended to govern Moss activities under loan servicing agreements. In addition to providing services, a service must have a legitimate interest in enforcing the terms of the mortgage loan servicing agreement. An MOH must negotiate the terms of the MSA with the service, and the MOH must provide the service with a written copy of the MSA before the MOH submits it to the Federal Reserve for processing (for example, a service files an FFR). The service has the right to reject or modify an MSA at any time before it goes through the Federal Reserve for processing. However, an MOH that submits the MSA to the Federal Reserve does not have to honor the service's rejection without penalty. To avoid penalties, a service (even a third-party service) should use reasonable diligence in examining each mortgage loan serviced on or after July 2009.