Idaho Sample Letter for Special Discount Offer

Description

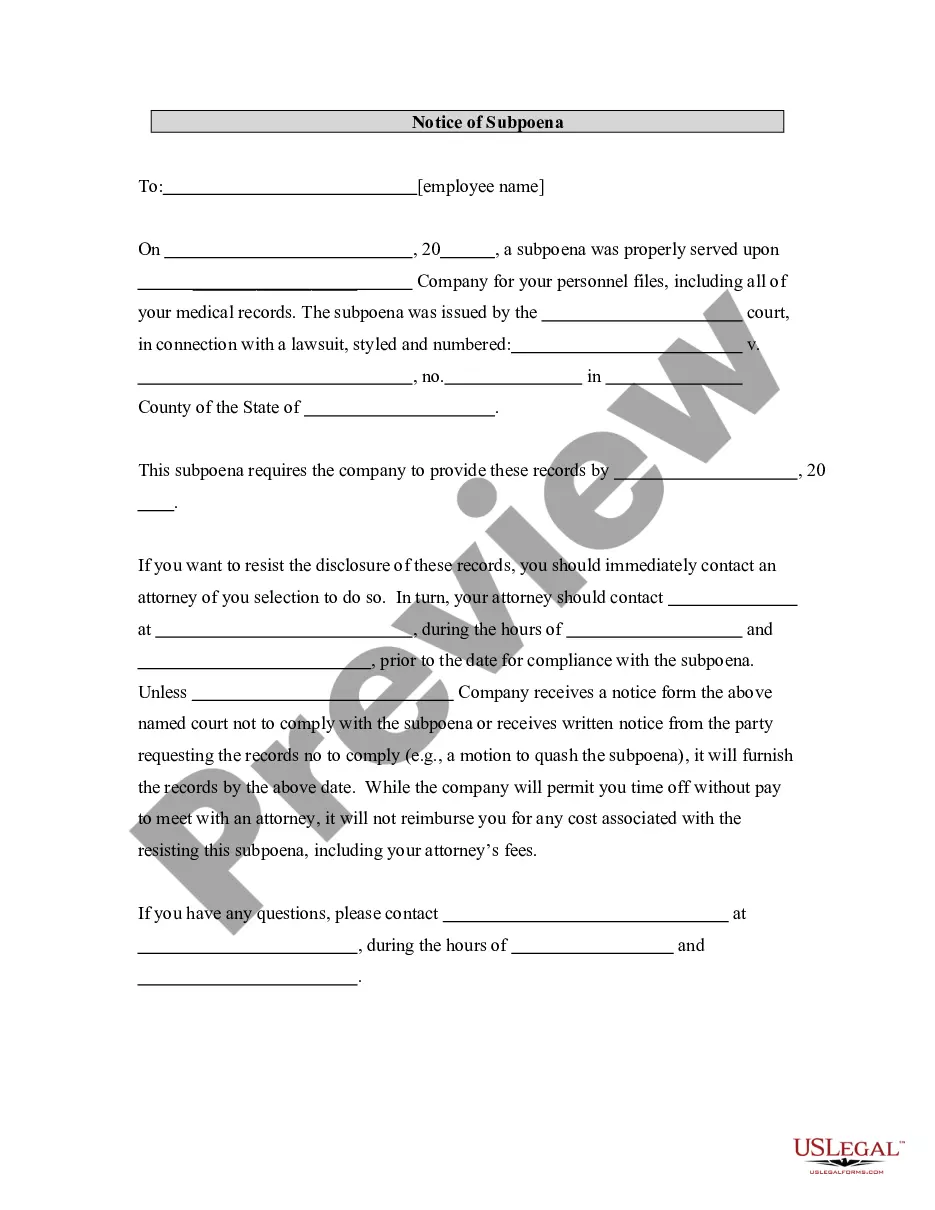

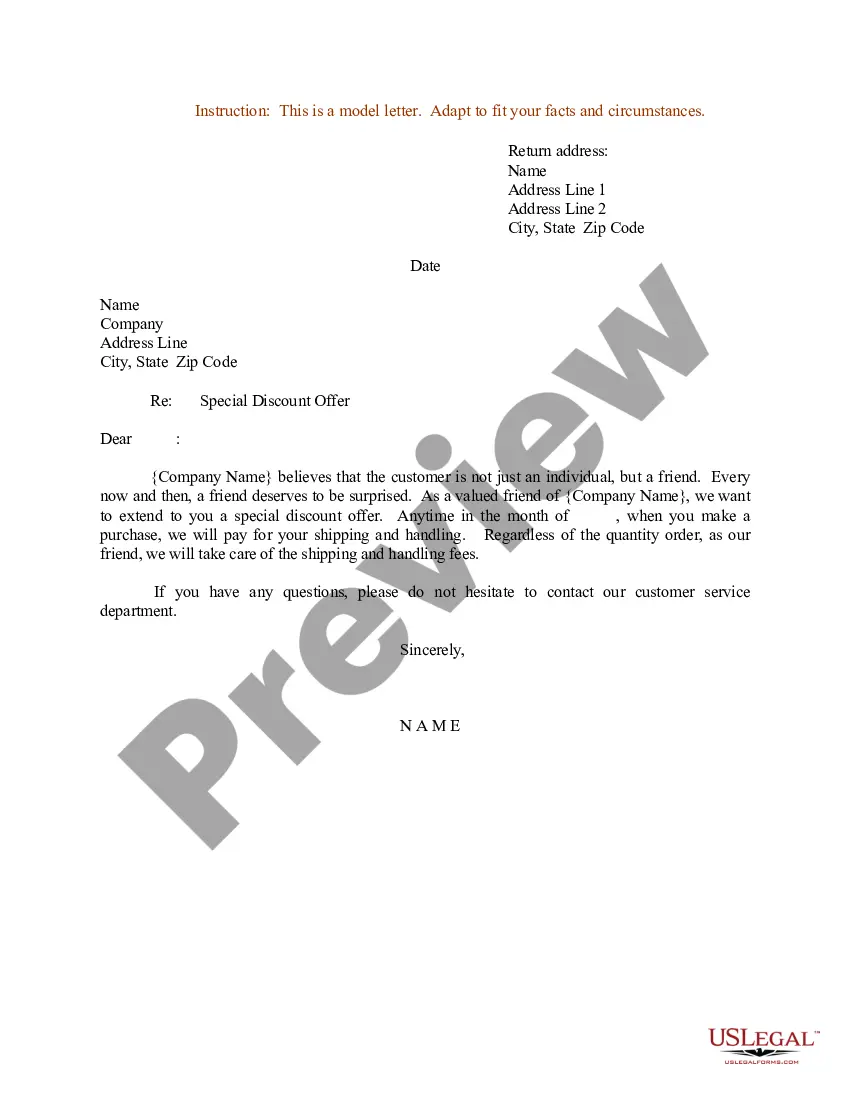

How to fill out Sample Letter For Special Discount Offer?

It is feasible to invest hours online searching for the legal document template that aligns with the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been evaluated by experts.

You can easily obtain or print the Idaho Sample Letter for Special Discount Offer from the service.

If available, use the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Idaho Sample Letter for Special Discount Offer.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

In Idaho, a resale certificate is required for businesses that want to make tax-exempt purchases on items for resale. Without this certificate, you may be liable for sales tax on your purchases. To help you understand this process, consider our Idaho Sample Letter for Special Discount Offer, which can guide you in fulfilling your requirements accurately.

To verify a resale certificate, you should consult each state's tax authority to ensure the certificate is valid. Many states provide online databases for verification, which can simplify the process. For Idaho, checking the specifics can save time and confusion. Leverage resources like the Idaho Sample Letter for Special Discount Offer on our platform for assistance.

Idaho generally does not accept out-of-state resale certificates unless they comply with Idaho's tax laws. It is important to use the proper Idaho Resale Certificate for your transactions. If you need more clarity on this, the Idaho Sample Letter for Special Discount Offer can provide valuable insights to help streamline your purchasing process.

Typically, resale certificates are valid in the state where they are issued. However, some states may accept out-of-state resale certificates if they meet specific requirements. It is crucial to check the state's regulations where you intend to use your certificate. For detailed guidance, explore the Idaho Sample Letter for Special Discount Offer on our platform.

Typically, the custodian of the partnership or S corporation fills out the K1 form for each partner or shareholder. They must report the relevant income and other informational details for tax reporting purposes. For clarity and examples, refer to our Idaho Sample Letter for Special Discount Offer on uslegalforms.

A K1 form in Idaho is a tax document issued to partners in a partnership or shareholders in an S corporation. It provides details about each individual's share of income, losses, and deductions. If you require assistance understanding this form, the Idaho Sample Letter for Special Discount Offer on uslegalforms offers valuable information.

To avoid paying sales tax on a car in Idaho, consider transferring the vehicle as a gift or if you meet specific exemption criteria. It is essential to ensure proper documentation, such as notarized letters or proof of eligibility. Using the Idaho Sample Letter for Special Discount Offer from uslegalforms can help facilitate this process.

The purpose of a K1 tax form is to report income earned through partnerships, S corporations, estates, or trusts. This form outlines each partner's or shareholder's share of income, deductions, and credits. If you need assistance with this form, consider the Idaho Sample Letter for Special Discount Offer on uslegalforms for guidance.

In Idaho, seniors may qualify for property tax exemptions starting at age 65. These exemptions can significantly lower the amount of property tax owed. For a comprehensive understanding and further assistance, you may want to reference our Idaho Sample Letter for Special Discount Offer on uslegalforms.

In Idaho, gifting a vehicle to a family member requires you to complete the title transfer and provide a written gift statement if desired. Ensure that both the giver and receiver sign the title. For specific examples or templates, consider the Idaho Sample Letter for Special Discount Offer available on uslegalforms.