Idaho Suggestion for Writ of Garnishment

Description

How to fill out Suggestion For Writ Of Garnishment?

Are you presently in the situation the place you will need files for possibly business or specific purposes nearly every working day? There are plenty of authorized file themes accessible on the Internet, but locating types you can rely isn`t effortless. US Legal Forms gives a huge number of develop themes, just like the Idaho Suggestion for Writ of Garnishment, that happen to be composed to fulfill state and federal demands.

If you are currently familiar with US Legal Forms web site and get a free account, just log in. Following that, you are able to acquire the Idaho Suggestion for Writ of Garnishment design.

Unless you have an account and wish to begin using US Legal Forms, follow these steps:

- Obtain the develop you will need and make sure it is for that appropriate area/state.

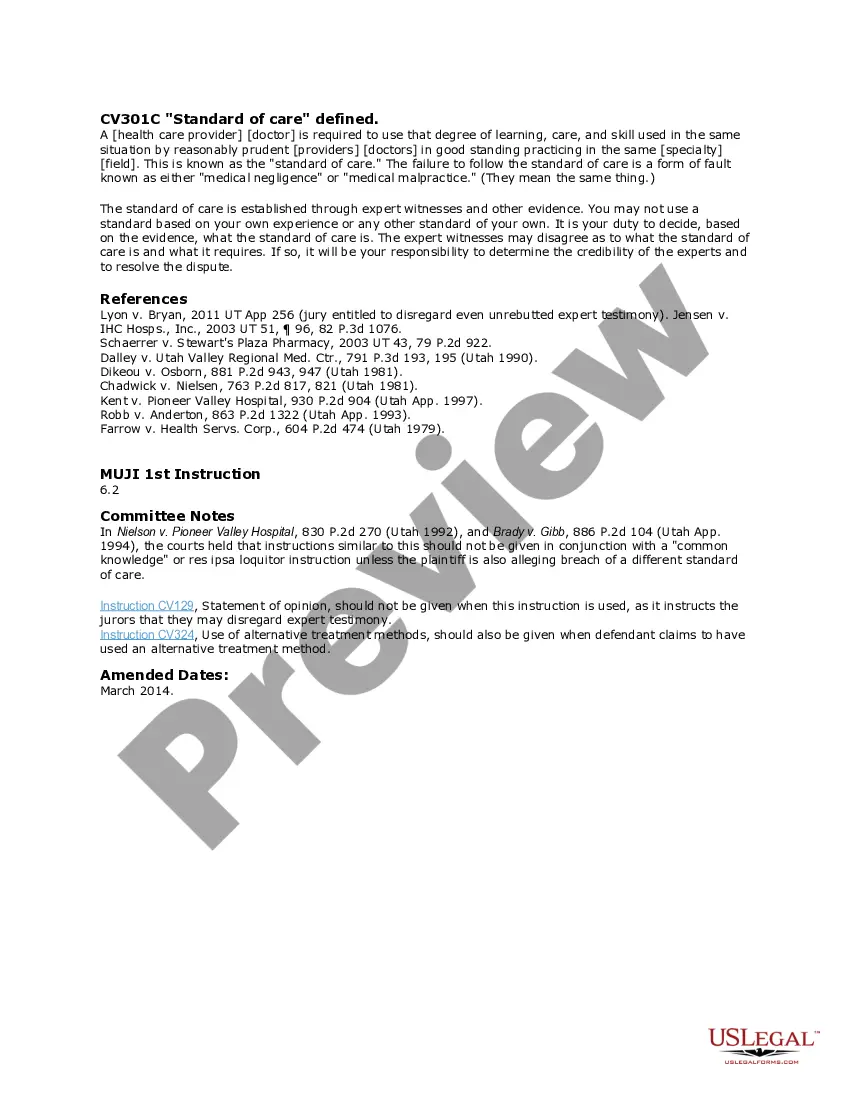

- Take advantage of the Preview switch to examine the form.

- See the description to actually have chosen the proper develop.

- In the event the develop isn`t what you`re looking for, make use of the Search field to discover the develop that meets your needs and demands.

- Whenever you obtain the appropriate develop, click on Purchase now.

- Select the prices program you need, fill in the desired info to create your money, and purchase an order making use of your PayPal or credit card.

- Pick a practical paper formatting and acquire your duplicate.

Find all the file themes you possess bought in the My Forms menu. You can obtain a additional duplicate of Idaho Suggestion for Writ of Garnishment anytime, if required. Just click on the necessary develop to acquire or print out the file design.

Use US Legal Forms, the most substantial variety of authorized varieties, to save some time and stay away from blunders. The service gives appropriately made authorized file themes that you can use for a range of purposes. Generate a free account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

Idaho and federal law protect certain wages, funds, benefits and property from being taken to pay certain types of judgments. These protected wages, funds, benefits and property are exempt from garnishment. To protect your wages, funds, benefits and property, you must file a Claim of Exemption.

Collect evidence showing how detrimental the wage garnishment is to your financial stability or how you qualify for an exemption. In either case, the creditor may agree to a solution that doesn't involve a garnishment, such as an adjustment payment plan or a settlement for a lump sum.

Idaho's wage garnishment laws are the same as federal wage garnishment laws. For the most part, creditors with judgments can take only 25% of your wages. But in some cases, you could lose more to a garnishment. Get debt relief now.

On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage. (Idaho Code Ann. § 11-207, § 11-712).

Idaho and federal law protect certain wages, funds, benefits and property from being taken to pay certain types of judgments. These protected wages, funds, benefits and property are exempt from garnishment. To protect your wages, funds, benefits and property, you must file a Claim of Exemption.

Idaho Code §11-701 and §11-704 describe that a continuous garnishment that is served upon an employer of a judgment debtor ?shall continue in force and effect until the judgment is satisfied.? Stated otherwise, the wages and salary, etc.

Generally, money you receive from Social Security income, pensions, veteran's benefits, spousal support, child support, and life insurance are exempt from garnishment.

Idaho and federal law protect certain wages, funds, benefits and property from being taken to pay certain types of judgments. These protected wages, funds, benefits and property are exempt from garnishment. To protect your wages, funds, benefits and property, you must file a Claim of Exemption.

11-719. ANSWER TO INTERROGATORIES -- JUDGMENT AGAINST GARNISHEE. Upon a copy of the interrogatories being served upon him, the garnishee shall make full and true answer to the same under oath and filed in the cause within five (5) days thereafter.