Are you currently in a place where you require papers for both company or individual uses almost every day time? There are tons of legitimate papers layouts accessible on the Internet, but locating versions you can rely is not straightforward. US Legal Forms provides a large number of develop layouts, like the Idaho Assignment of Certificate of Deposit Agreement, which are created to fulfill federal and state demands.

When you are currently acquainted with US Legal Forms internet site and also have your account, basically log in. Afterward, you are able to acquire the Idaho Assignment of Certificate of Deposit Agreement design.

If you do not offer an bank account and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you require and ensure it is for your correct metropolis/area.

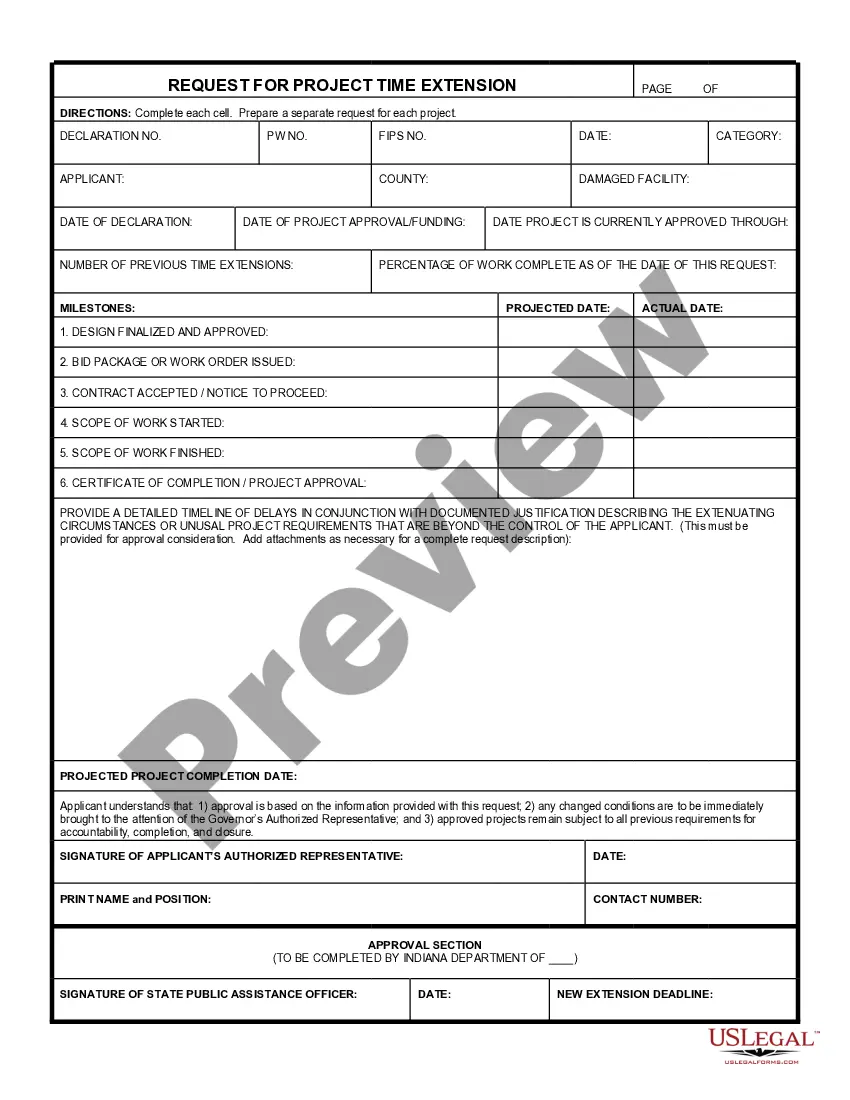

- Make use of the Review key to analyze the shape.

- Read the outline to ensure that you have selected the correct develop.

- In case the develop is not what you`re trying to find, use the Lookup field to get the develop that meets your requirements and demands.

- Whenever you get the correct develop, simply click Acquire now.

- Pick the rates plan you need, complete the necessary details to generate your money, and pay money for your order with your PayPal or bank card.

- Choose a hassle-free file format and acquire your copy.

Find each of the papers layouts you possess purchased in the My Forms menu. You may get a additional copy of Idaho Assignment of Certificate of Deposit Agreement anytime, if possible. Just click the required develop to acquire or produce the papers design.

Use US Legal Forms, one of the most extensive assortment of legitimate forms, to save efforts and stay away from faults. The support provides expertly created legitimate papers layouts that you can use for a variety of uses. Create your account on US Legal Forms and commence creating your lifestyle a little easier.