Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

Idaho Agreement Between Heirs as to Division of Estate

Description

How to fill out Agreement Between Heirs As To Division Of Estate?

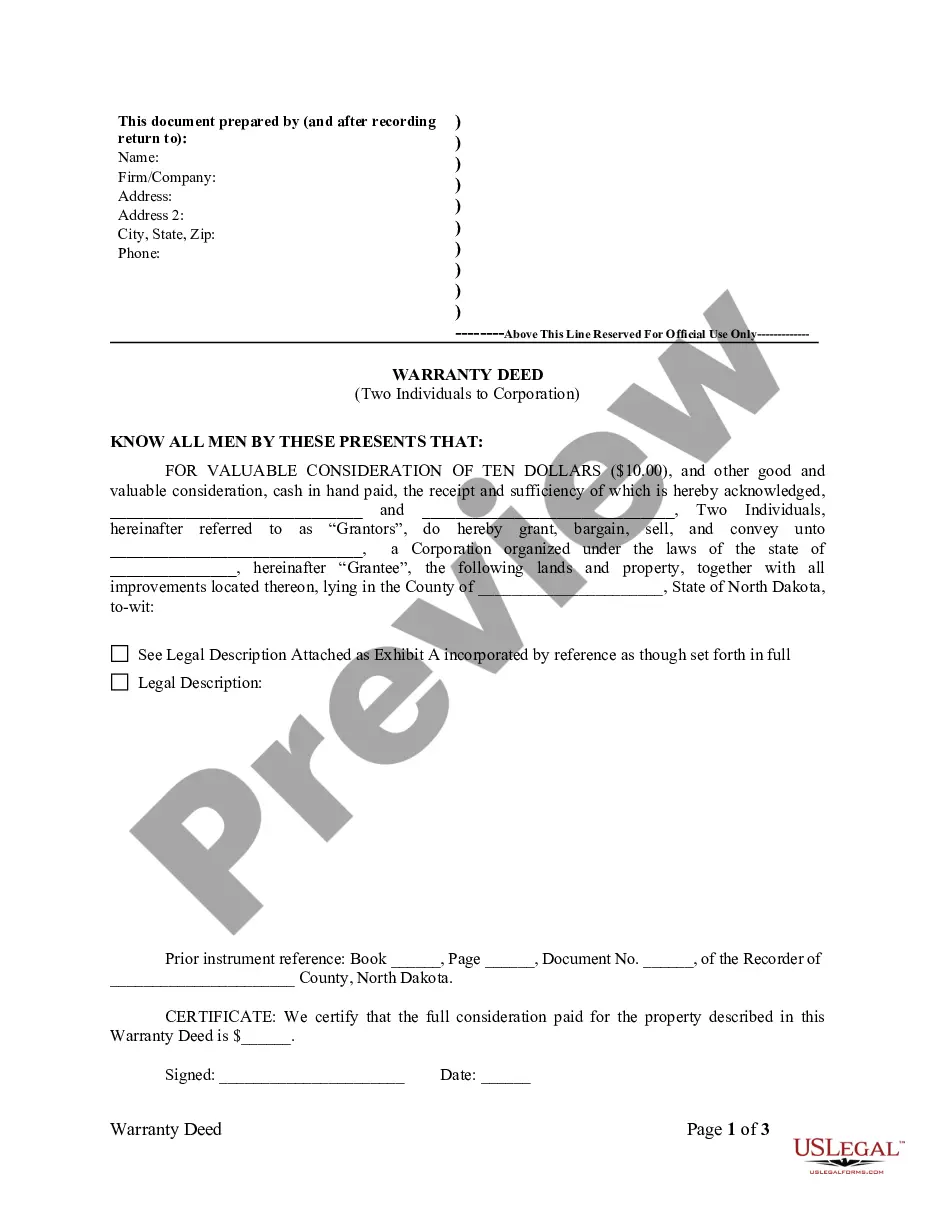

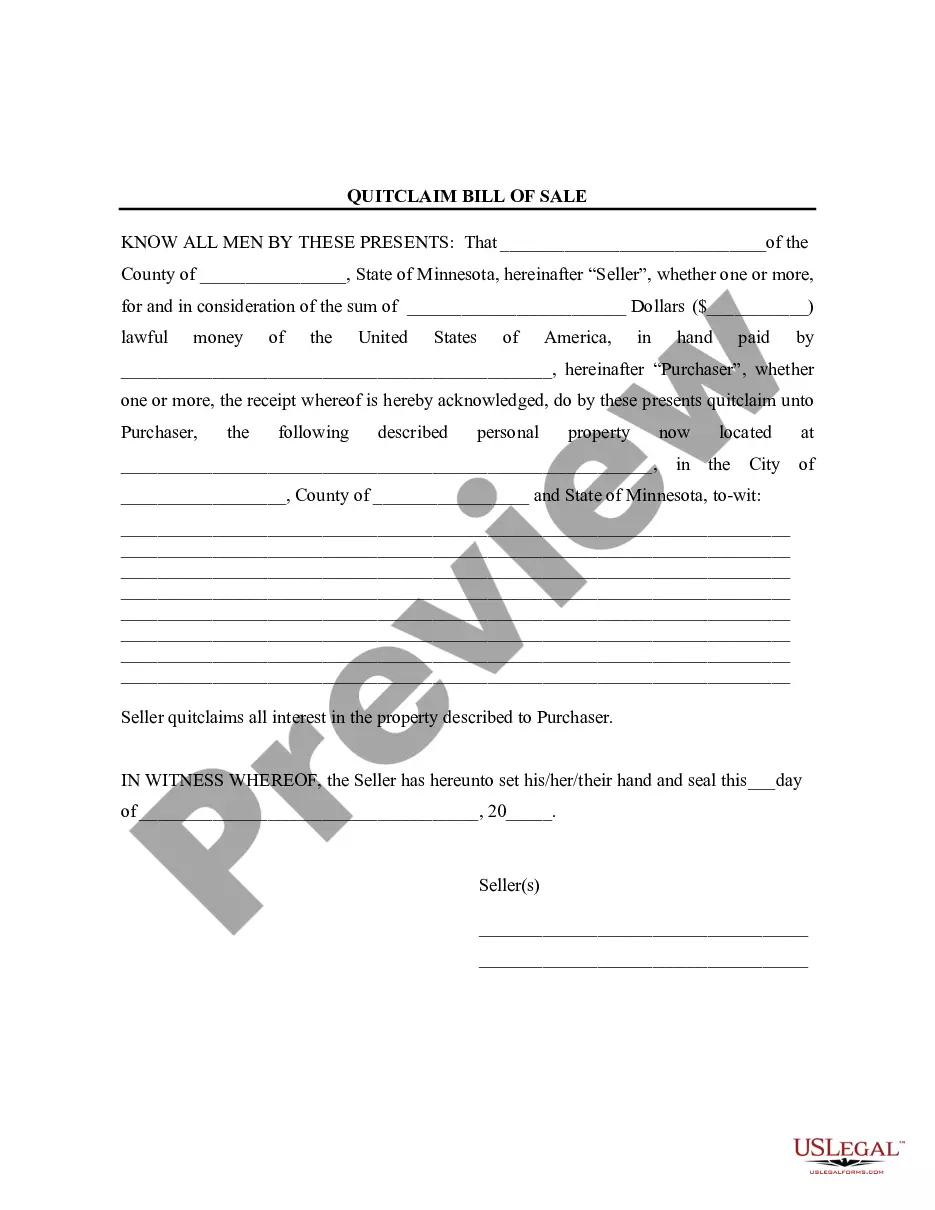

Choosing the right lawful papers web template could be a battle. Naturally, there are a lot of templates available on the net, but how can you discover the lawful type you want? Utilize the US Legal Forms web site. The service gives thousands of templates, including the Idaho Agreement Between Heirs as to Division of Estate, which you can use for enterprise and private requirements. All of the types are checked out by pros and meet up with state and federal requirements.

In case you are currently authorized, log in to the account and click on the Download button to find the Idaho Agreement Between Heirs as to Division of Estate. Make use of your account to appear from the lawful types you may have bought earlier. Go to the My Forms tab of the account and acquire one more version of the papers you want.

In case you are a whole new user of US Legal Forms, here are simple guidelines so that you can stick to:

- Initial, be sure you have selected the appropriate type for your personal metropolis/area. It is possible to look over the shape utilizing the Preview button and look at the shape outline to make certain this is the best for you.

- When the type is not going to meet up with your requirements, utilize the Seach discipline to obtain the proper type.

- When you are positive that the shape is proper, select the Buy now button to find the type.

- Choose the prices strategy you need and enter the necessary details. Build your account and purchase the order using your PayPal account or bank card.

- Select the submit file format and obtain the lawful papers web template to the device.

- Full, change and print out and indication the attained Idaho Agreement Between Heirs as to Division of Estate.

US Legal Forms will be the largest local library of lawful types that you will find various papers templates. Utilize the company to obtain expertly-produced papers that stick to status requirements.

Form popularity

FAQ

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

Separate property is any of these things: Property that you or your spouse owned separately before your marriage. Property that you or your spouse received separately as a gift or inheritance, even if you received it after you were married. Property either you or your spouse bought using separate-property funds.

32-906. Community property ? Income from separate and community property ? Conveyance between spouses. (1) All other property acquired after marriage by either husband or wife is community property.

In general, a surviving spouse receives all of the community property and the spouse and children share the decedent's separate property. If there is no surviving spouse, the decedent's property is equally divided among the decedent's children, with special rules for deceased children.

Who Gets What in Idaho? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendants or parentsspouse inherits everythingparents but no spouse or descendantsparents inherit everything2 more rows

Ing to Idaho's statutes, any property that a spouse brings into the marriage is considered separate property. Additionally any inheritance that a spouse receives even if received when married is considered the separate property of the spouse that receives it.

Spouses in Idaho Inheritance Law As a general rule, community property is property you got while you were married, and separate property is property you got before you were married. However, gifts and inheritances given to one of the spouses counts as separate property, even if they are given during your marriage.

There is No Idaho State Inheritance Tax Just as with the Federal taxation process, the estate would be required to pay any existing state taxes before any distributions are made to any heirs. As a result, the heirs themselves will owe no taxes.