If you want to complete, acquire, or printing legal papers themes, use US Legal Forms, the biggest selection of legal forms, which can be found on-line. Make use of the site`s simple and handy search to discover the documents you need. Different themes for company and person functions are categorized by groups and states, or key phrases. Use US Legal Forms to discover the Idaho Agreement Between Widow and Heirs as to Division of Estate in just a handful of mouse clicks.

If you are currently a US Legal Forms buyer, log in to your bank account and then click the Down load switch to get the Idaho Agreement Between Widow and Heirs as to Division of Estate. You can even gain access to forms you previously saved within the My Forms tab of your own bank account.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape to the correct area/country.

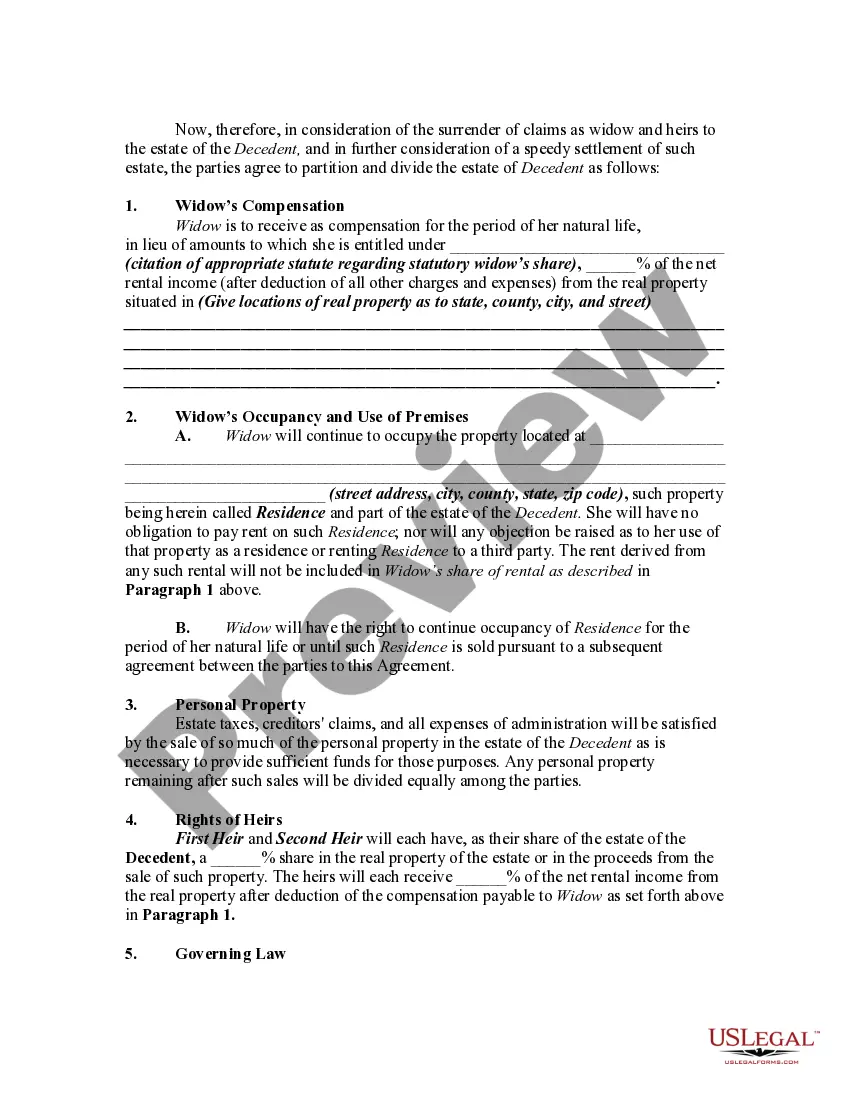

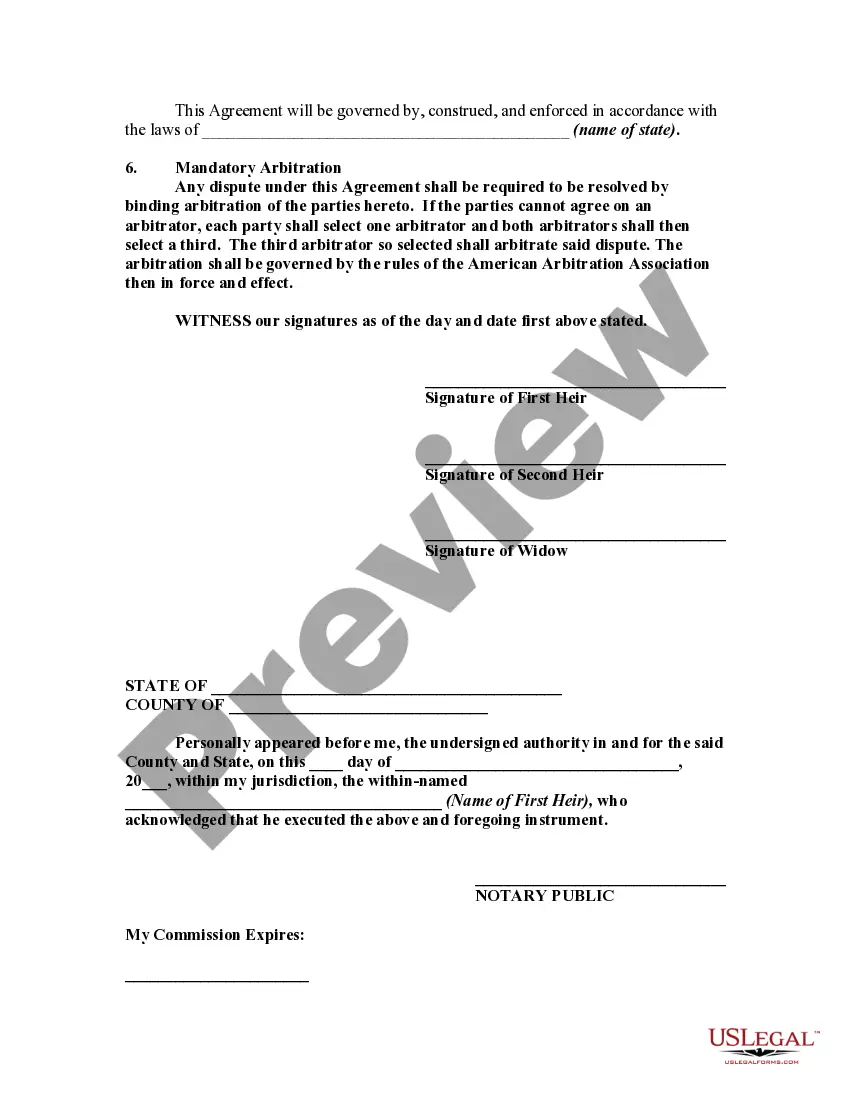

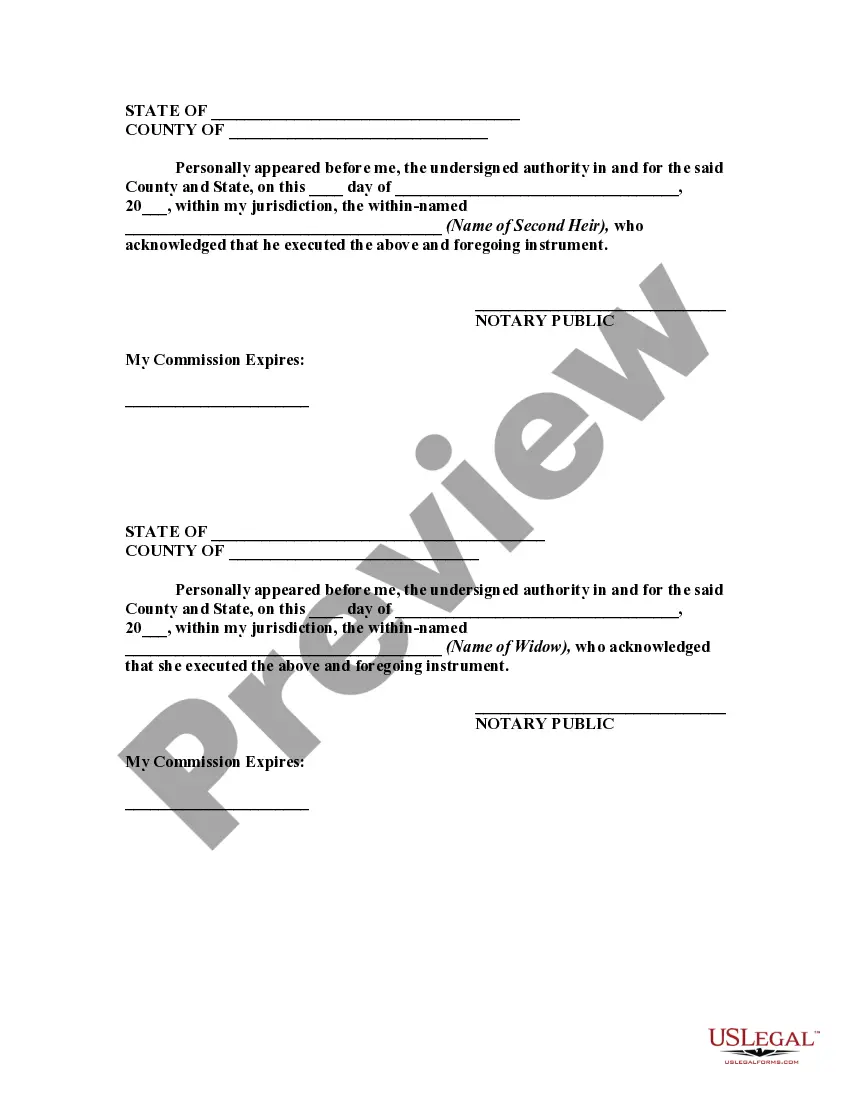

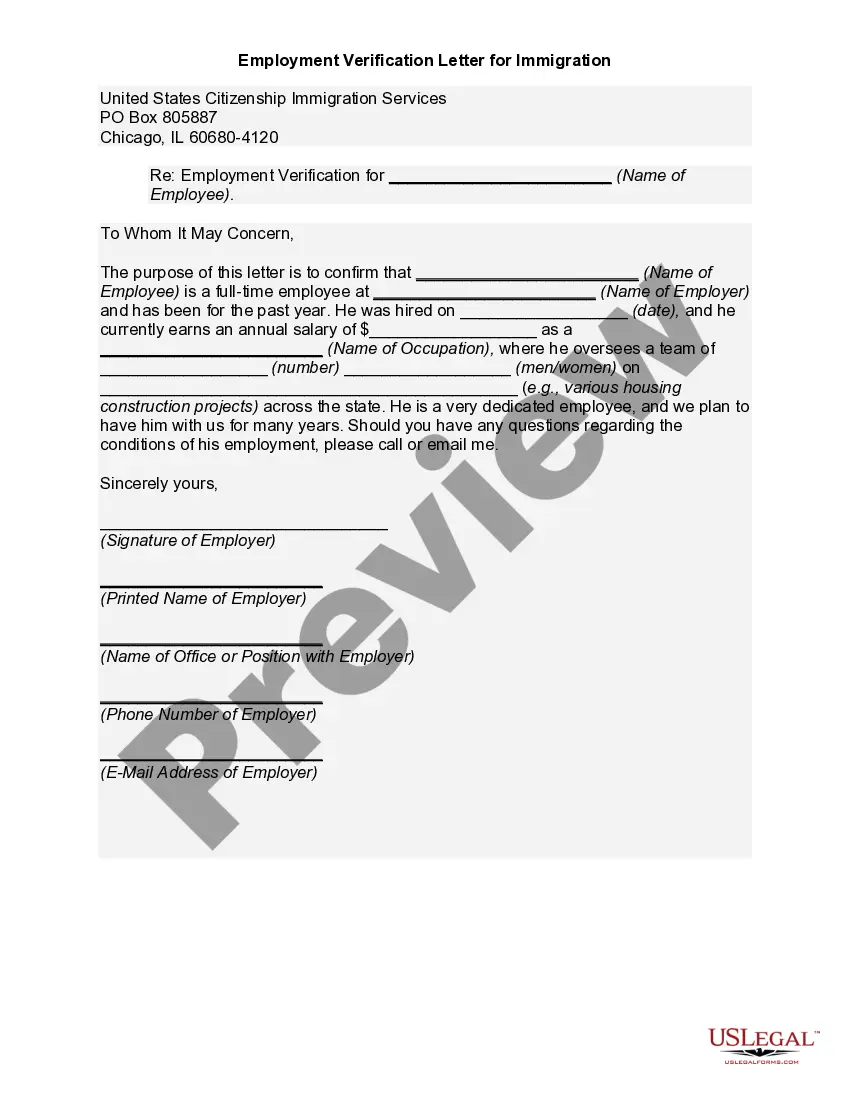

- Step 2. Use the Review option to check out the form`s content material. Do not neglect to read through the information.

- Step 3. If you are not happy with the kind, utilize the Lookup industry near the top of the display to find other variations in the legal kind template.

- Step 4. After you have located the shape you need, click the Get now switch. Select the rates plan you like and put your qualifications to register on an bank account.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Pick the structure in the legal kind and acquire it on the system.

- Step 7. Full, modify and printing or indicator the Idaho Agreement Between Widow and Heirs as to Division of Estate.

Each legal papers template you purchase is yours eternally. You have acces to each and every kind you saved within your acccount. Click the My Forms area and decide on a kind to printing or acquire yet again.

Compete and acquire, and printing the Idaho Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms. There are thousands of professional and status-specific forms you may use for your company or person needs.