Idaho Certificate of Trust for Mortgage

Description

How to fill out Certificate Of Trust For Mortgage?

Are you currently in a place the place you need to have papers for either company or person uses nearly every working day? There are a lot of legitimate papers templates available on the Internet, but discovering ones you can depend on is not easy. US Legal Forms gives a huge number of form templates, like the Idaho Certificate of Trust for Mortgage, that are written to satisfy state and federal needs.

In case you are currently familiar with US Legal Forms web site and possess an account, basically log in. Afterward, you can acquire the Idaho Certificate of Trust for Mortgage format.

If you do not provide an accounts and wish to start using US Legal Forms, follow these steps:

- Find the form you want and ensure it is for the proper town/state.

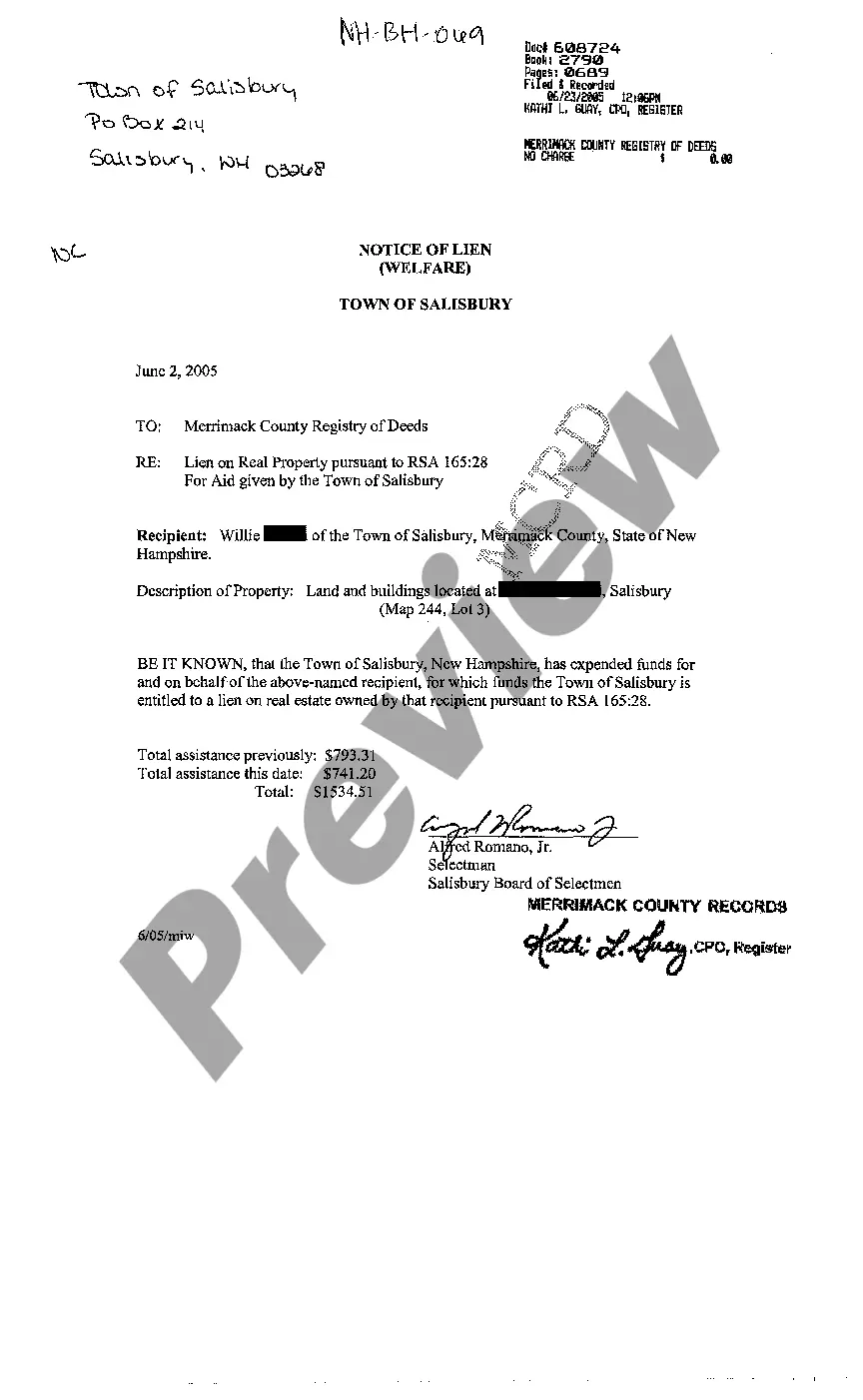

- Utilize the Preview key to review the form.

- Look at the description to ensure that you have chosen the proper form.

- In case the form is not what you are looking for, use the Search field to obtain the form that meets your requirements and needs.

- When you obtain the proper form, just click Get now.

- Choose the pricing program you want, fill out the specified info to make your bank account, and purchase an order utilizing your PayPal or credit card.

- Pick a convenient data file formatting and acquire your copy.

Discover each of the papers templates you may have purchased in the My Forms menu. You can get a additional copy of Idaho Certificate of Trust for Mortgage any time, if needed. Just select the required form to acquire or print the papers format.

Use US Legal Forms, the most considerable selection of legitimate forms, to save lots of efforts and prevent mistakes. The services gives appropriately made legitimate papers templates which you can use for an array of uses. Generate an account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

45-1502. Definitions ? Trustee's charge. As used in this act: (1) "Beneficiary" means the person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or his successor in interest, and who shall not be the trustee.

Create the trust document. You can get help from an attorney or use Willmaker & Trust (see below). Sign the document in front of a notary public. Change the title of any trust property that has a title document?such as your house or car?to reflect that you now own the property as trustee of the trust.

The trustee is named in the deed of trust, and, as codified at I.C. § 45-1504, ?can be a bank, lawyer, title insurance agent, or a licensed trust organization,? though it is generally a title insurance agent [1]. In Idaho, the lender is the beneficiary of the trust deed and the trustee holds the lien on the property.

Duty to register trusts. The trustee of a trust having its principal place of administration in this state shall register the trust in the court of this state at the principal place of administration.

15-7-303. Duty to inform and account to beneficiaries. The trustee shall keep the beneficiaries of the trust reasonably informed of the trust and its administration.

Although about 60% of the US states are mortgage states, Idaho is considered a deed state. A deed of trust is an agreement between a beneficiary, grantor, and trustee. A deed is signed to a trustee as a form of security to ensure that the performance of obligation is fulfilled.

To create a living trust in Idaho, you create and then sign a declaration of trust in front of a notary. You then transfer ownership of assets into the trust to fund it. At this point it becomes effective. A revocable living trust offers a variety of benefits that may appeal to you and fill your needs.

There are some important benefits to utilizing an irrevocable trust, including: Minimizing estate taxes. Protecting and sheltering assets. Helping a trust beneficiary qualify for government benefits.

Idaho Code Section 45-1503(1) prohibits the beneficiary of an obligation secured by a trust deed (usually a promissory note) from instituting judicial action to enforce the obligation unless one of four requirements is met: (1) the trust deed has been foreclosed; (2) the action is one for foreclosure of mortgages on ...

Although about 60% of the US states are mortgage states, Idaho is considered a deed state. A deed of trust is an agreement between a beneficiary, grantor, and trustee. A deed is signed to a trustee as a form of security to ensure that the performance of obligation is fulfilled.