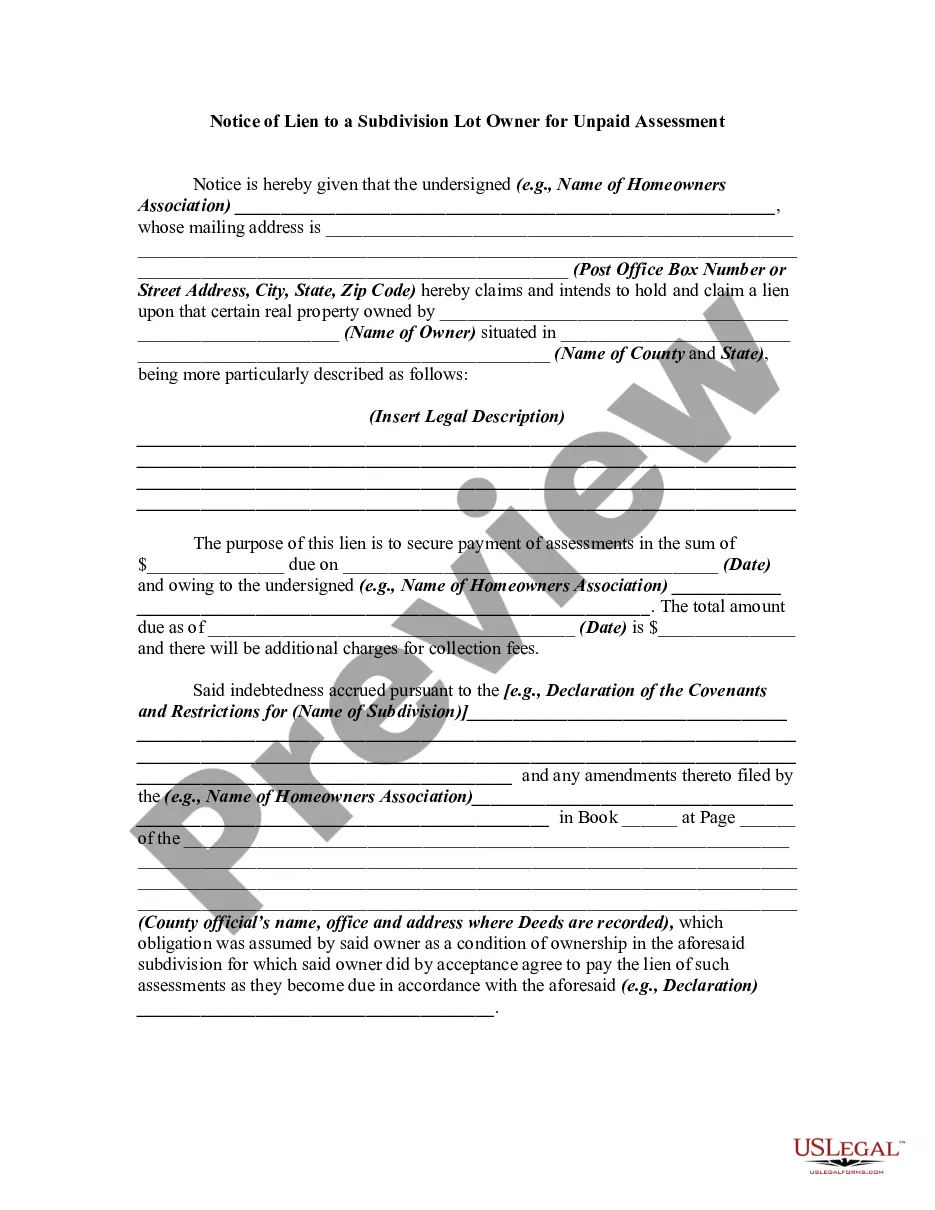

A subdivision is the development and division of a lot, tract, or parcel of land into two or more lots, plats, sites, or otherwise for the purpose of establishing or creating a subdivision through sale, lease, or building development. The developer will generally file a document called a Declaration of the Covenants and Restrictions of (Name of Subdivision). This Declaration is normally filed in the land records of the county where the subdivision is located, and will contain regulations regarding the administration and maintenance of the property, including payment of assessments by the owners.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Idaho Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment is a legal document that serves as a formal notice to inform a lot owner within a subdivision that they have unpaid assessments or dues. This notice is issued by the homeowners' association (HOA) or the governing body responsible for the maintenance and management of the subdivision. The purpose of the Idaho Notice of Lien is to notify the lot owner of their unpaid obligations and formally establish a claim against their property. It outlines the specific amount owed, the due date, and any penalties or interest that may have accrued. The lien acts as a legal claim against the property, giving the HOA or governing body the right to pursue collection efforts or even foreclosure if the debt remains outstanding. It is important for lot owners to understand the implications of receiving an Idaho Notice of Lien. Failure to address the unpaid assessments can lead to further legal actions and negatively impact the lot owner's creditworthiness. Resolving the matter promptly and communicating with the HOA or governing body is essential to prevent any further complications. There may be different types of Idaho Notices of Lien to a Subdivision Lot Owner For Unpaid Assessment, depending on the specific circumstances and the governing regulations. Some variations may include: 1. Voluntary Notice of Lien: This type of notice is issued when the lot owner has voluntarily entered into an agreement or contract to cover the assessments, but has failed to make the necessary payments as agreed. 2. Delinquency Notice of Lien: This notice is sent when the lot owner has fallen behind on their assessments or dues, typically after a certain grace period. It serves as a reminder to settle the outstanding balance promptly. 3. Enforcement Notice of Lien: If the lot owner continues to neglect their payment obligations even after receiving the previous notices, an enforcement notice may be necessary. This notice highlights the potential consequences of non-payment, which may include legal action or foreclosure. In conclusion, the Idaho Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment is a crucial legal document that facilitates the collection of outstanding dues within a subdivision. Lot owners should take this notice seriously and promptly address any unpaid assessments to avoid further complications and protect their property rights.