A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

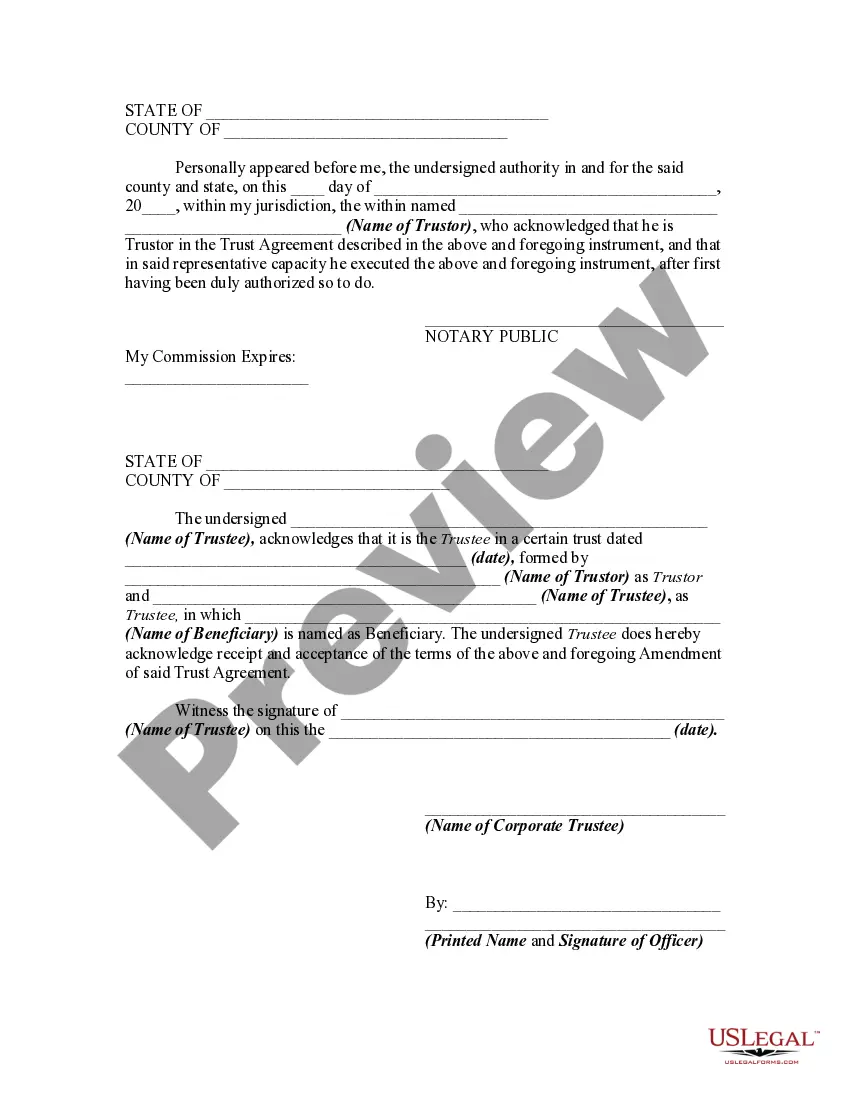

Idaho Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee An Idaho Amendment to Trust Agreement is a legal document used to modify the terms or provisions of an existing trust. This specific amendment focuses on the withdrawal of property from an inter vivos trust, also known as a living trust, with the consent of the trustee. When it becomes necessary to withdraw property from an inter vivos trust, an Idaho Amendment to Trust Agreement provides the means to alter the original terms of the trust to accommodate this transaction. This amendment allows the settler, or creator of the trust, to remove specific assets or property from the trust, while ensuring the trustee is properly notified and grants their consent. The purpose of this amendment is to ensure that the trust remains flexible and adaptable to changing circumstances. It allows the settler to make adjustments to the trust as their needs or circumstances change, such as when they wish to withdraw property from the trust for personal or financial reasons. It is important to note that there may be various types of Idaho Amendments to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee, depending on the specific situation and the complexity of the trust. Some possible variations may include: 1. Partial Property Withdrawal Amendment: This type of amendment is used when the settler wishes to withdraw only specific assets or property from the trust, rather than the entire trust corpus. 2. Full Property Withdrawal Amendment: In cases where the settler intends to completely dissolve the inter vivos trust and withdraw all property held within it, a full property withdrawal amendment is utilized. 3. Limited Consent of Trustee Amendment: This amendment may be employed when the settler and trustee agree on specific conditions or restrictions regarding the withdrawal of property from the inter vivos trust. It allows the trustee to give their consent based on predetermined terms. 4. Major Amendment with Consent of Trustee: In situations where significant changes need to be made to the trust, beyond just the withdrawal of property, this type of amendment is utilized. It requires the consent of the trustee, as it may impact their duties and responsibilities. In conclusion, an Idaho Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee is a legal document that facilitates the modification of an inter vivos trust to allow the withdrawal of property. It provides flexibility to adapt the trust as necessary, while ensuring the trustee's consent is obtained. The specific type of amendment may vary based on the extent and conditions of property withdrawal or other adjustments to the trust.Idaho Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee An Idaho Amendment to Trust Agreement is a legal document used to modify the terms or provisions of an existing trust. This specific amendment focuses on the withdrawal of property from an inter vivos trust, also known as a living trust, with the consent of the trustee. When it becomes necessary to withdraw property from an inter vivos trust, an Idaho Amendment to Trust Agreement provides the means to alter the original terms of the trust to accommodate this transaction. This amendment allows the settler, or creator of the trust, to remove specific assets or property from the trust, while ensuring the trustee is properly notified and grants their consent. The purpose of this amendment is to ensure that the trust remains flexible and adaptable to changing circumstances. It allows the settler to make adjustments to the trust as their needs or circumstances change, such as when they wish to withdraw property from the trust for personal or financial reasons. It is important to note that there may be various types of Idaho Amendments to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee, depending on the specific situation and the complexity of the trust. Some possible variations may include: 1. Partial Property Withdrawal Amendment: This type of amendment is used when the settler wishes to withdraw only specific assets or property from the trust, rather than the entire trust corpus. 2. Full Property Withdrawal Amendment: In cases where the settler intends to completely dissolve the inter vivos trust and withdraw all property held within it, a full property withdrawal amendment is utilized. 3. Limited Consent of Trustee Amendment: This amendment may be employed when the settler and trustee agree on specific conditions or restrictions regarding the withdrawal of property from the inter vivos trust. It allows the trustee to give their consent based on predetermined terms. 4. Major Amendment with Consent of Trustee: In situations where significant changes need to be made to the trust, beyond just the withdrawal of property, this type of amendment is utilized. It requires the consent of the trustee, as it may impact their duties and responsibilities. In conclusion, an Idaho Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee is a legal document that facilitates the modification of an inter vivos trust to allow the withdrawal of property. It provides flexibility to adapt the trust as necessary, while ensuring the trustee's consent is obtained. The specific type of amendment may vary based on the extent and conditions of property withdrawal or other adjustments to the trust.