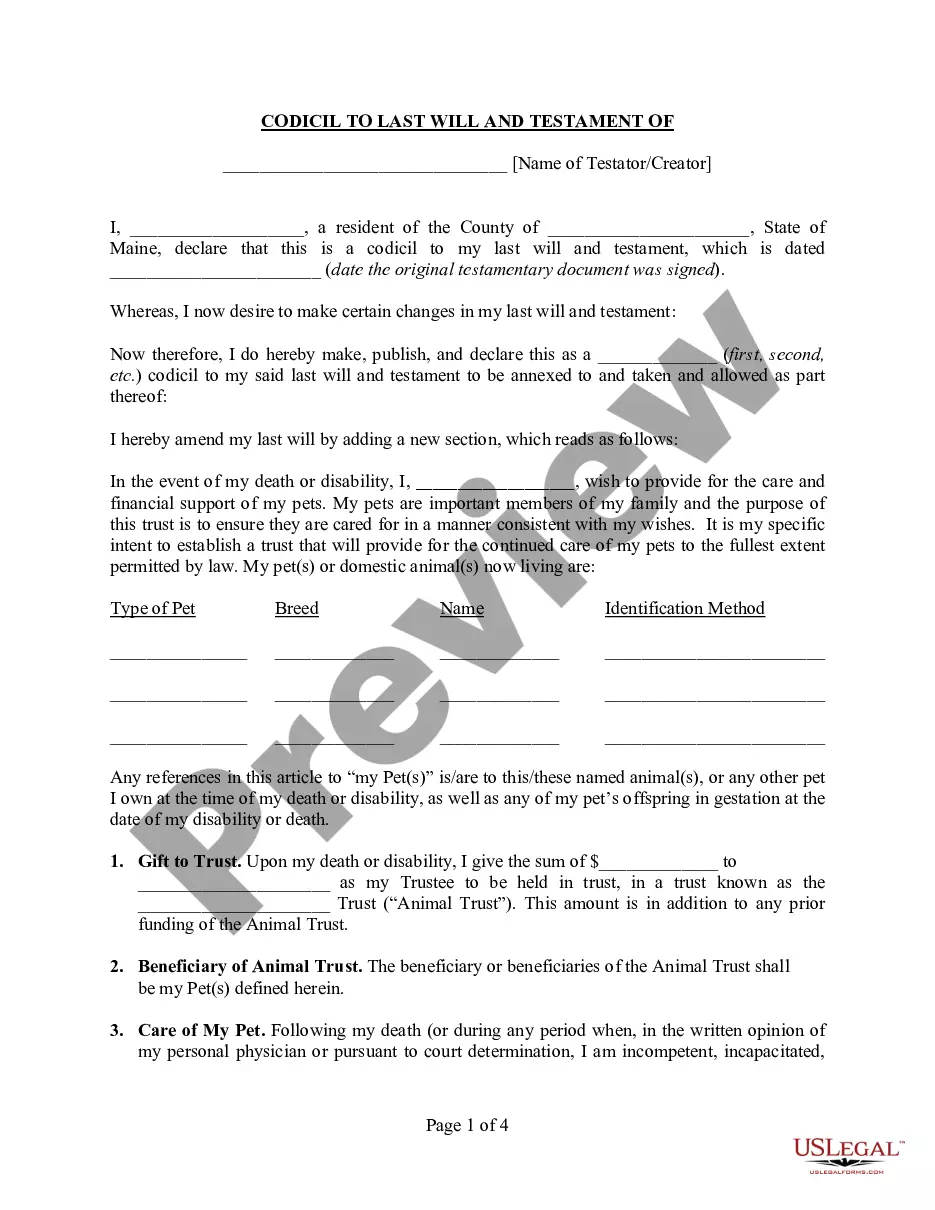

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. This form is a sample of a trustor amending the trust agreement in order to extend the term of the trust. It is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

An Idaho Agreement to Extend the Duration or Term of a Trust refers to a legal document that allows individuals to extend the time period for which a trust remains active. A trust is a legal arrangement that involves a settler (person creating the trust), a trustee (person or institution managing the trust assets), and beneficiaries (individuals who benefit from the trust). Trusts are typically created to protect and manage assets for the benefit of the beneficiaries. In Idaho, there are two primary types of Agreements to Extend the Duration or Term of a Trust: 1. Idaho Agreement to Extend the Duration or Term of a Trust — Revocable Trust: This type of agreement applies to revocable trusts, which are trusts that can be changed, modified, or terminated by the settler during their lifetime. The Agreement to Extend the Duration or Term of a Revocable Trust allows the settler to extend the trust's term beyond its original expiration date. It ensures that the assets and benefits of the trust continue to be safeguarded and managed according to the settler's wishes. 2. Idaho Agreement to Extend the Duration or Term of a Trust — Irrevocable Trust: Unlike revocable trusts, irrevocable trusts cannot be easily modified or terminated without the consent of the beneficiaries. Therefore, the Agreement to Extend the Duration or Term of an Irrevocable Trust permits the settler and the beneficiaries to mutually agree upon an extension of the trust's duration. This agreement ensures that the assets within the trust remain protected and available for the beneficiaries for an extended period. It is important to note that Idaho has specific laws and regulations regarding the extension of trust terms. The Agreement to Extend the Duration or Term of a Trust complies with these legal requirements and must be executed in accordance with Idaho trust laws. Consulting an attorney with expertise in estate planning and trust law is advisable to ensure compliance and proper execution of the agreement. In conclusion, an Idaho Agreement to Extend the Duration or Term of a Trust enables individuals to extend the lifespan of their trusts, whether they are revocable or irrevocable. By using this legally binding document, settlers and beneficiaries can ensure their assets are effectively managed and distributed according to their wishes, even beyond the original expiration date of the trust.