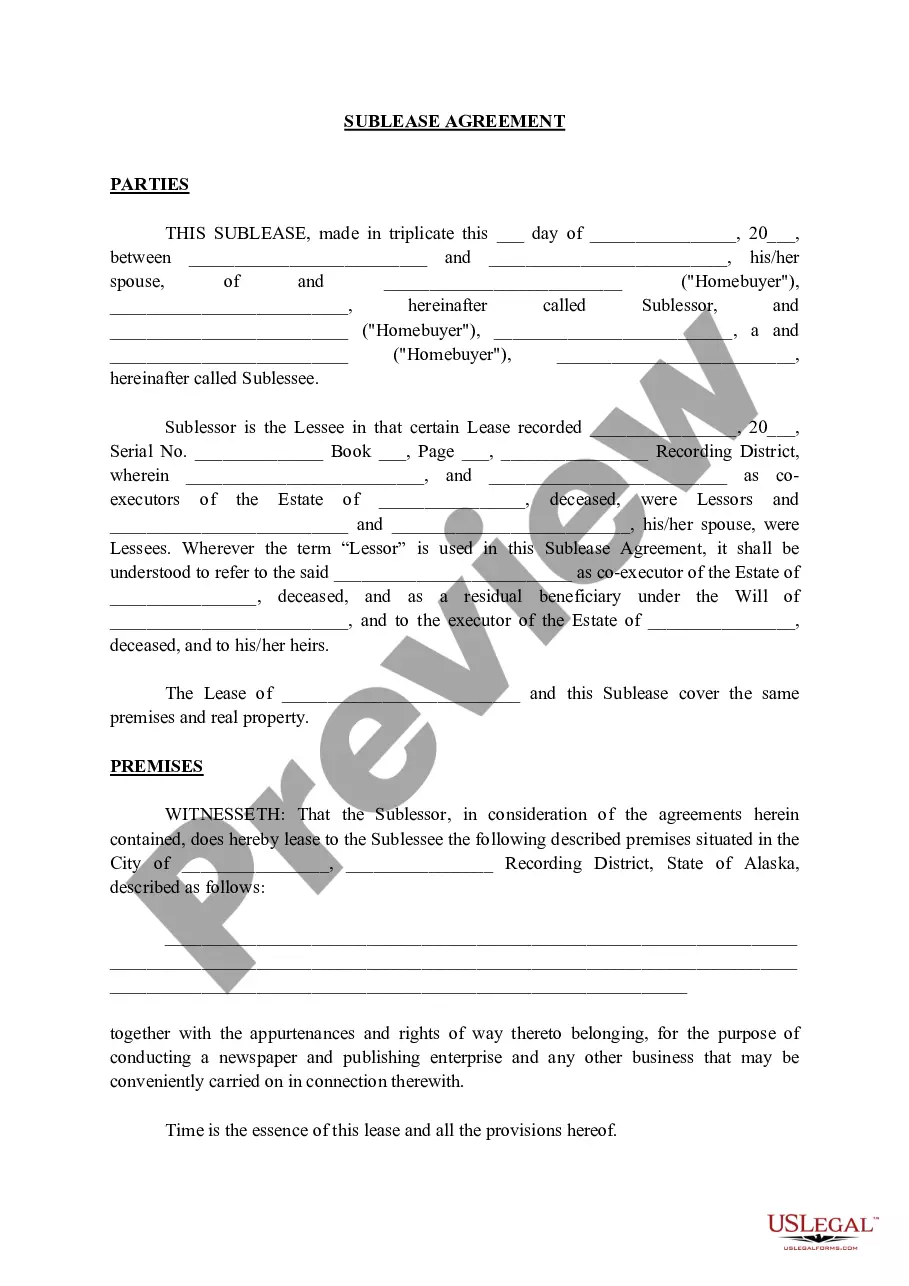

In this form, the beneficiary consents to the revocation of the trust of which he/she is a beneficiary and consents to the delivery to the trustor by the trustee of any and all monies or property of every kind, whether principal or income, in trustee's possession by virtue of the Trust Agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Consent to Revocation of Trust by Beneficiary

Description

How to fill out Consent To Revocation Of Trust By Beneficiary?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template files that you may download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Idaho Consent to Revoke Trust by Beneficiary in just minutes.

If you already have a membership, Log In and obtain the Idaho Consent to Revoke Trust by Beneficiary from the US Legal Forms collection. The Download button will appear on every document you view. You have access to all previously saved forms from the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the saved Idaho Consent to Revoke Trust by Beneficiary.

Every template added to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply return to the My documents section and click on the desired document. Access the Idaho Consent to Revoke Trust by Beneficiary through US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific forms that meet your business or personal needs and requirements.

- Ensure you have selected the correct document for your city/state.

- Click the Review button to examine the content of the document. Refer to the form description to confirm you have chosen the appropriate template.

- If the form does not match your requirements, use the Search field at the top of the screen to find one that does.

- Once satisfied with the document, confirm your selection by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Choose the format and download the document to your device.

Form popularity

FAQ

Section 45 1504 in Idaho pertains to the Idaho Consent to Revocation of Trust by Beneficiary, outlining the process for beneficiaries to revoke a trust with consent from the trustor. This section ensures that beneficiaries have the ability to participate in trust decisions, making estate management more flexible. Understanding this law is crucial for anyone involved with trusts in Idaho, as it directly impacts how trust changes can occur. For assistance in navigating these regulations, you can rely on the resources provided by US Legal Forms.

Revoking an irrevocable beneficiary is complex as it typically requires legal grounds for doing so. You might need to demonstrate a valid reason that aligns with state laws and the terms of the trust. Engaging with US Legal Forms can simplify this process and provide you with the necessary documents and information related to the Idaho Consent to Revocation of Trust by Beneficiary.

The 5 year rule in an irrevocable trust generally refers to the time frame that impacts asset exclusion for tax purposes. This rule is critical for Medicaid planning, where assets transferred into a trust may still count against eligibility within five years of application. Understanding this rule can be key, and US Legal Forms can help you navigate Idaho laws efficiently regarding the Idaho Consent to Revocation of Trust by Beneficiary.

Yes, a beneficiary of an irrevocable trust can be removed, but it often requires meeting specific legal criteria. The trust document may outline the process that must be followed for removal. If this is your situation, US Legal Forms provides resources to help with Idaho Consent to Revocation of Trust by Beneficiary, ensuring all steps are handled correctly.

Beneficiaries can withdraw from an irrevocable trust when the terms of the trust allow it. This typically occurs according to specific conditions laid out by the trust creator. If you're uncertain about your rights, consult relevant Idaho laws and utilize US Legal Forms to assist in understanding the Idaho Consent to Revocation of Trust by Beneficiary.

To remove a trust beneficiary, you need to follow the terms outlined in the trust document. You may require the consent of all existing beneficiaries or a valid legal reason under Idaho law. If you're navigating these complexities, consider using US Legal Forms for guidance on preparing the necessary documentation for Idaho Consent to Revocation of Trust by Beneficiary.

Removing a beneficiary from a trust typically requires a formal amendment to the trust document. This process involves clearly stating your intention to remove the beneficiary and ensuring compliance with state laws. Utilizing resources that explain Idaho Consent to Revocation of Trust by Beneficiary can help clarify this process, making it easier to execute the necessary changes with confidence.

Yes, you can change the beneficiaries of a trust, but the method can depend on the type of trust you have. You may need to amend the trust agreement or create a new trust. Familiarity with Idaho Consent to Revocation of Trust by Beneficiary is beneficial, as it details how beneficiaries can be legitimately altered according to state laws.

To remove someone from a family trust, review the trust documents to understand the process outlined for modifications. Generally, you'll need to formally amend the trust, ensuring you meet any state law requirements. If you are uncertain about the process, consider using tools or services that discuss Idaho Consent to Revocation of Trust by Beneficiary, which can guide you through the necessary steps.

Removing someone from being a beneficiary involves updating your trust agreement to reflect this change. You should document your decision clearly, specifying the beneficiary you want to remove. If you need assistance with these changes, understanding Idaho Consent to Revocation of Trust by Beneficiary can be crucial, as it outlines the necessary steps you should take.