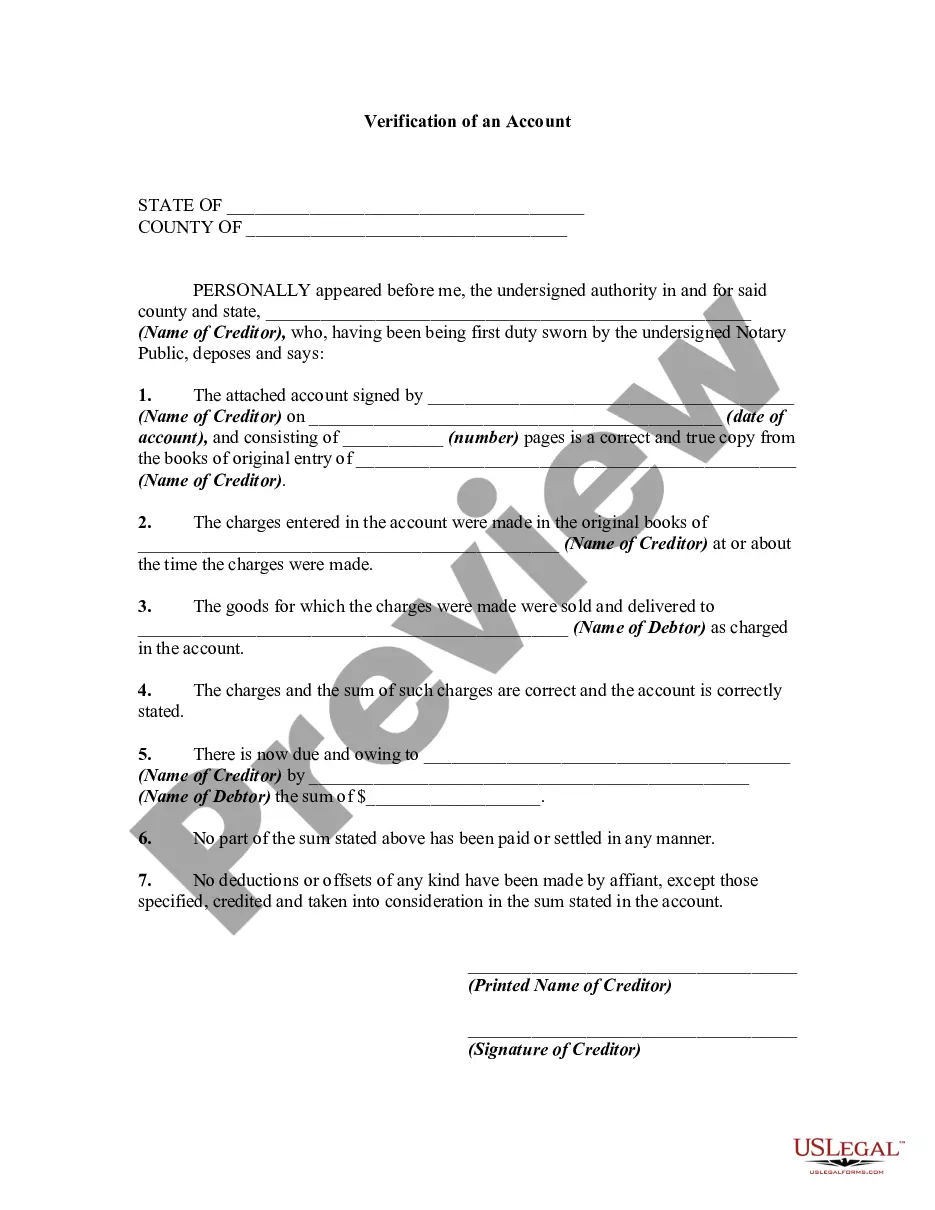

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Verification of an Account is a process implemented by financial institutions or service providers to ensure the accuracy and authenticity of customer information. It is a crucial step in preventing identity theft, fraud, and money laundering. During the Idaho Verification of an Account process, individuals are required to provide valid identification and supporting documents to confirm their identity and account details. This may include government-issued identification such as a driver's license, passport, or social security card. Residential address proof, utility bills, and bank statements are commonly requested as supporting documents. By conducting an Idaho Verification of an Account, financial institutions can safeguard customer data and comply with legal and regulatory commitments. It helps maintain the integrity of the financial system, ensures compliance with anti-money laundering (AML) laws, and prevents unauthorized access to accounts. There are a few different types of Idaho Verification of an Account processes commonly used by financial institutions: 1. In-Person Verification: This type of verification requires customers to visit a bank branch or service provider's office in person. Customers present their identification documents, and the institution's staff verifies the information and compares it to the provided documents. 2. Online Verification: With the advancement of technology, online verification processes have become popular. Customers may upload scanned copies or photographs of their identification documents through a secure online portal. The institution's verification team then reviews the documents and cross-references them with information provided during the account creation process. 3. Phone Verification: In some cases, institutions may opt for phone verification. A representative from the institution calls the customer and asks specific questions to confirm their identity, such as date of birth, address, or details from their application. Idaho Verification of an Account is a necessary step to establish trust and protect both individuals and financial institutions from potential risks. It allows for transparency, reduces the likelihood of fraudulent activities, and ensures compliance with applicable laws and regulations.Idaho Verification of an Account is a process implemented by financial institutions or service providers to ensure the accuracy and authenticity of customer information. It is a crucial step in preventing identity theft, fraud, and money laundering. During the Idaho Verification of an Account process, individuals are required to provide valid identification and supporting documents to confirm their identity and account details. This may include government-issued identification such as a driver's license, passport, or social security card. Residential address proof, utility bills, and bank statements are commonly requested as supporting documents. By conducting an Idaho Verification of an Account, financial institutions can safeguard customer data and comply with legal and regulatory commitments. It helps maintain the integrity of the financial system, ensures compliance with anti-money laundering (AML) laws, and prevents unauthorized access to accounts. There are a few different types of Idaho Verification of an Account processes commonly used by financial institutions: 1. In-Person Verification: This type of verification requires customers to visit a bank branch or service provider's office in person. Customers present their identification documents, and the institution's staff verifies the information and compares it to the provided documents. 2. Online Verification: With the advancement of technology, online verification processes have become popular. Customers may upload scanned copies or photographs of their identification documents through a secure online portal. The institution's verification team then reviews the documents and cross-references them with information provided during the account creation process. 3. Phone Verification: In some cases, institutions may opt for phone verification. A representative from the institution calls the customer and asks specific questions to confirm their identity, such as date of birth, address, or details from their application. Idaho Verification of an Account is a necessary step to establish trust and protect both individuals and financial institutions from potential risks. It allows for transparency, reduces the likelihood of fraudulent activities, and ensures compliance with applicable laws and regulations.