An Idaho owner financing contract for mobile homes is a legal agreement between the seller (the owner of the mobile home) and the buyer, where the buyer agrees to make regular payments directly to the seller for the purchase of the mobile home. This type of contract allows individuals who may not qualify for traditional bank financing to become homeowners. Idaho owner financing contracts for mobile homes can vary depending on the specific terms and conditions agreed upon by both the buyer and seller. Here are a few common types: 1. Installment Sale Contract: This type of contract involves the buyer making a down payment to the seller and paying the remaining balance, along with interest, in regular installments over an agreed-upon period. The seller retains ownership of the mobile home until the entire payment is completed. 2. Lease-to-Own Contract: In this type of contract, the buyer leases the mobile home from the seller for a specific period, making monthly lease payments. At the end of the lease term, the buyer has the option to purchase the mobile home. A portion of the lease payments may be credited towards the future purchase price. 3. Contract for Deed: Also known as a land contract or installment land contract, this type of contract allows the buyer to take possession of the mobile home while making payments to the seller. The seller retains legal title until the buyer completes all the payments. Once the payments are finalized, the seller transfers the title to the buyer. 4. Promissory Note and Mortgage: This type of contract resembles a traditional bank loan, where the buyer signs a promissory note committing to repay the loan, and a mortgage is created as a security interest in the mobile home. The buyer makes monthly payments to the seller, who retains a mortgage on the mobile home until the loan is fully paid. Idaho owner financing contracts for mobile homes should include essential details such as the purchase price, down payment amount, interest rate (if applicable), payment schedule, late payment penalties, and default consequences. It is crucial for both parties to seek legal advice and ensure that the contract adheres to all applicable laws and regulations in Idaho. Keywords: Idaho owner financing contract, mobile home, installment sale contract, lease-to-own contract, contract for deed, promissory note, mortgage, legal agreement, seller, buyer, down payment, interest rate, payment schedule, default consequences, laws and regulations.

Idaho Owner Financing Contract for Moblie Home

Description

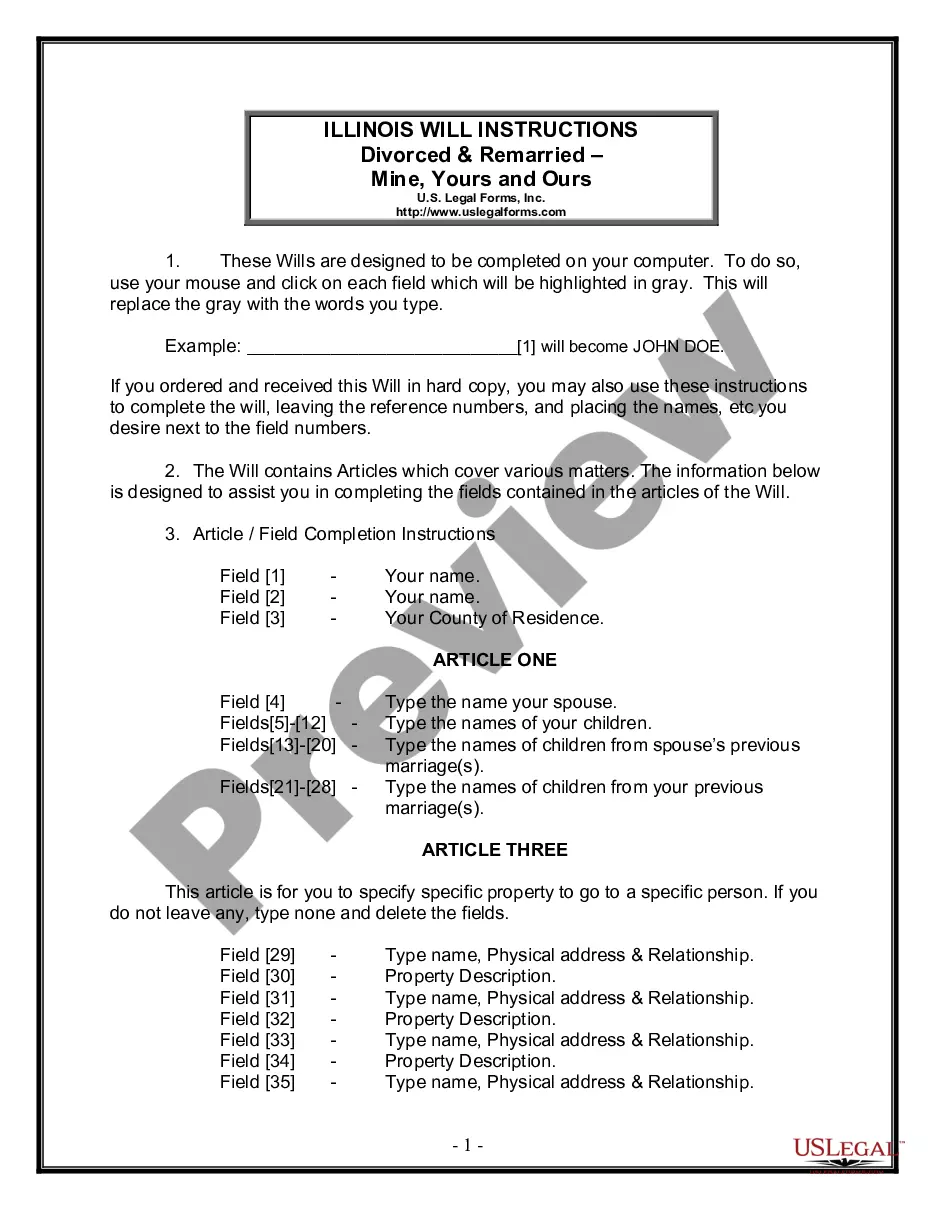

How to fill out Idaho Owner Financing Contract For Moblie Home?

Are you presently within a situation in which you will need documents for sometimes company or personal purposes nearly every time? There are tons of legal record templates available on the net, but finding kinds you can depend on is not simple. US Legal Forms offers a huge number of develop templates, such as the Idaho Owner Financing Contract for Moblie Home, which can be composed to satisfy federal and state specifications.

When you are already knowledgeable about US Legal Forms web site and also have a free account, simply log in. Following that, you are able to obtain the Idaho Owner Financing Contract for Moblie Home template.

Should you not provide an bank account and need to begin using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is for that appropriate area/county.

- Take advantage of the Preview button to examine the form.

- Read the outline to ensure that you have chosen the correct develop.

- If the develop is not what you`re trying to find, utilize the Research field to find the develop that suits you and specifications.

- Whenever you discover the appropriate develop, click Acquire now.

- Choose the costs plan you need, complete the necessary info to produce your bank account, and purchase the order utilizing your PayPal or credit card.

- Select a handy paper file format and obtain your backup.

Find every one of the record templates you may have purchased in the My Forms food selection. You can get a extra backup of Idaho Owner Financing Contract for Moblie Home anytime, if possible. Just click on the necessary develop to obtain or print the record template.

Use US Legal Forms, probably the most extensive collection of legal forms, to save lots of efforts and prevent faults. The services offers professionally produced legal record templates that can be used for an array of purposes. Make a free account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

In most owner financing arrangements, a traditional lender does not hold the deed. Instead, the seller retains ownership until the buyer fulfills their payment obligations. This process differs from conventional loans where lenders often maintain the deed until full repayment. To navigate this unique situation smoothly, utilizing an Idaho Owner Financing Contract for Mobile Home can provide guidance and formality, ensuring all parties understand their positions.

While owner financing can be beneficial, it does have potential downsides. Sellers may face risks if buyers default on their payments, leading to possible foreclosure situations. Additionally, buyers may face higher interest rates compared to traditional loans. It’s important to weigh these factors carefully and use an Idaho Owner Financing Contract for Mobile Home to clarify terms and minimize risks for all parties involved.

In seller financing agreements, the property deed typically remains with the seller until the buyer fulfills the payment obligations. This arrangement provides security for the seller, ensuring they maintain a legal claim to the home. Although the buyer has equitable interest in the home, it’s essential to outline this structure clearly in an Idaho Owner Financing Contract for Mobile Home to protect both parties’ rights.

In owner financing, the seller usually retains the deed until the buyer pays off the financing fully. This means the buyer can occupy the property, but the seller holds legal ownership until all terms are satisfied. Understanding this dynamic is vital when drafting an Idaho Owner Financing Contract for Mobile Home, as it clarifies expectations for both parties involved. Clarity helps prevent misunderstandings down the line.

If a buyer defaults on an owner financing agreement, the seller typically retains the right to reclaim the property. This can be done through a process called foreclosure, outlined in the Idaho Owner Financing Contract for Mobile Home. It's essential for sellers to understand this process, as it may vary based on local laws and the terms set in the contract. Properly managing defaults can safeguard the seller's investment.

Securing financing for a manufactured home can be more challenging than for traditional properties. The unique nature of manufactured homes, such as their lower appraised values, may affect lender options. However, an Idaho Owner Financing Contract for Mobile Home can provide a practical solution, allowing buyers to bypass traditional banks and negotiate terms directly with sellers. This flexibility can make the process smoother for many buyers.

Setting up owner financing for your property involves several steps. First, you will need to draft an Idaho Owner Financing Contract for Mobile Home that outlines the terms and conditions, such as down payment, interest rate, and payment schedule. Next, consult local regulations to ensure compliance. Finally, use a reliable platform like US Legal Forms to create a legally binding agreement tailored to your unique situation.

Financing a mobile home can often be more challenging than financing a traditional home due to stricter lender requirements. However, using an Idaho Owner Financing Contract for Mobile Home can simplify the process. By working directly with a seller, buyers may bypass some of the hurdles associated with conventional loans, thereby enhancing their chances of success.

Yes, you can owner finance a mobile home under an Idaho Owner Financing Contract for Mobile Home. This option allows buyers to bypass traditional lenders, making homeownership more accessible. It’s essential to have a clear contract that protects both the buyer and seller while detailing all payment terms and responsibilities.

The average credit score needed to buy a mobile home typically falls between 620 and 640 for traditional financing. However, if you pursue an Idaho Owner Financing Contract for Mobile Home, the requirements can be more flexible, allowing buyers with lower credit scores access to financing. It’s essential to discuss your situation with potential sellers or financing partners to understand available options.

More info

Mortgage For me, it was pretty simple: Buy a house — you get money back for the mortgage plus interest and taxes. Mortgage For me, it was pretty straightforward: Make sure I get a low interest mortgage that will let me pay interest only on what I have borrowed. Mortgage For me the mortgage was easy as I had a great credit score, a good credit score. My credit score usually means: A good credit score means more money down to pay the mortgage, that is the “default” option. So, my “best” mortgage would be a fixed rate. Homeownership My mortgage had me paying interest and taxes. I don't get a tax benefit but the tax payments and interest payments are the same price of my house — if not a little cheaper. Mortgage Interest rates for mortgages have gone down quite a bit over the last 3 years, and it has made the mortgage more attractive for many people. Many people can obtain a lower rate using government-subsidized insurance.