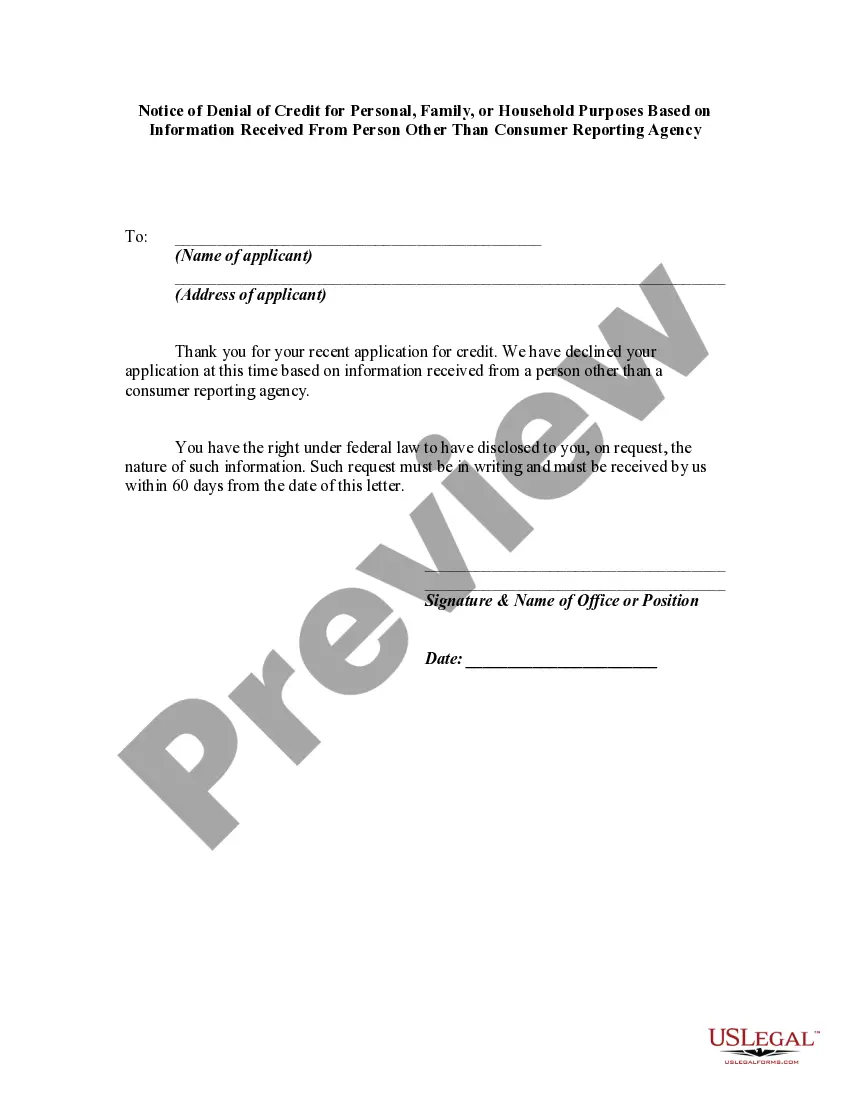

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

Idaho Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency?

Choosing the right legitimate record format could be a struggle. Naturally, there are tons of layouts available online, but how do you get the legitimate form you will need? Make use of the US Legal Forms internet site. The services provides thousands of layouts, including the Idaho Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency, that can be used for organization and personal needs. Every one of the kinds are inspected by pros and meet up with federal and state needs.

If you are already registered, log in in your bank account and then click the Obtain switch to obtain the Idaho Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency. Use your bank account to search from the legitimate kinds you might have bought previously. Go to the My Forms tab of your respective bank account and obtain another backup from the record you will need.

If you are a whole new consumer of US Legal Forms, listed here are basic recommendations that you can comply with:

- Very first, ensure you have chosen the appropriate form for your personal city/county. You can examine the shape while using Review switch and study the shape information to ensure this is the best for you.

- If the form does not meet up with your preferences, utilize the Seach industry to obtain the appropriate form.

- Once you are sure that the shape would work, click the Purchase now switch to obtain the form.

- Select the prices prepare you desire and type in the needed information. Build your bank account and pay money for your order with your PayPal bank account or charge card.

- Pick the data file structure and acquire the legitimate record format in your system.

- Comprehensive, modify and print and indication the attained Idaho Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency.

US Legal Forms will be the most significant library of legitimate kinds that you can see various record layouts. Make use of the company to acquire appropriately-created paperwork that comply with condition needs.

Form popularity

FAQ

(1) A person is guilty of a misdemeanor if he knowingly gives or causes to be given false information to any law enforcement officer, any state or local government agency or personnel, or to any person licensed in this state to practice social work, psychology or counseling, concerning the commission of an offense, ...

Every person who wilfully resists, delays or obstructs any public officer, in the discharge, or attempt to discharge, of any duty of his office or who knowingly gives a false report to any peace officer, when no other punishment is prescribed, is punishable by a fine not exceeding one thousand dollars ($1,000), and ...

18-6711. Use of telephone to terrify, intimidate, harass or annoy by false statements ? Penalties.

Any one or more public agencies may contract with any one or more other public agencies to perform any governmental service, activity, or undertaking which each public agency entering into the contract is authorized by law to perform, including, but not limited to joint contracting for services, supplies and capital ...

26-2222. Definitions. As used in this act: (1) "Agent" means any person who, for compensation or gain, or in the expectation of compensation or gain, contacts persons in Idaho in connection with the business activities of a licensee or person required to be licensed under this act.

In Idaho, it is a general misdemeanor to commit the offense of providing false information to a police officer. The penalties carry up to a one-thousand dollar fine ($1000.00) and up to six months in the county jail.

For collection of a debt on an account, where there is an agreement in writing, the statute of limitations is five years. (Refer to §5-216.) For collection of a debt on an account, where there is an oral agreement, the statute of limitations is four years. (Refer to §5-217.)

Idaho Statutes 15-3-711. Powers of personal representatives ? In general. Until termination of his appointment a personal representative has the same power over the title to property of the estate that an absolute owner would have, in trust however, for the benefit of the creditors and others interested in the estate.