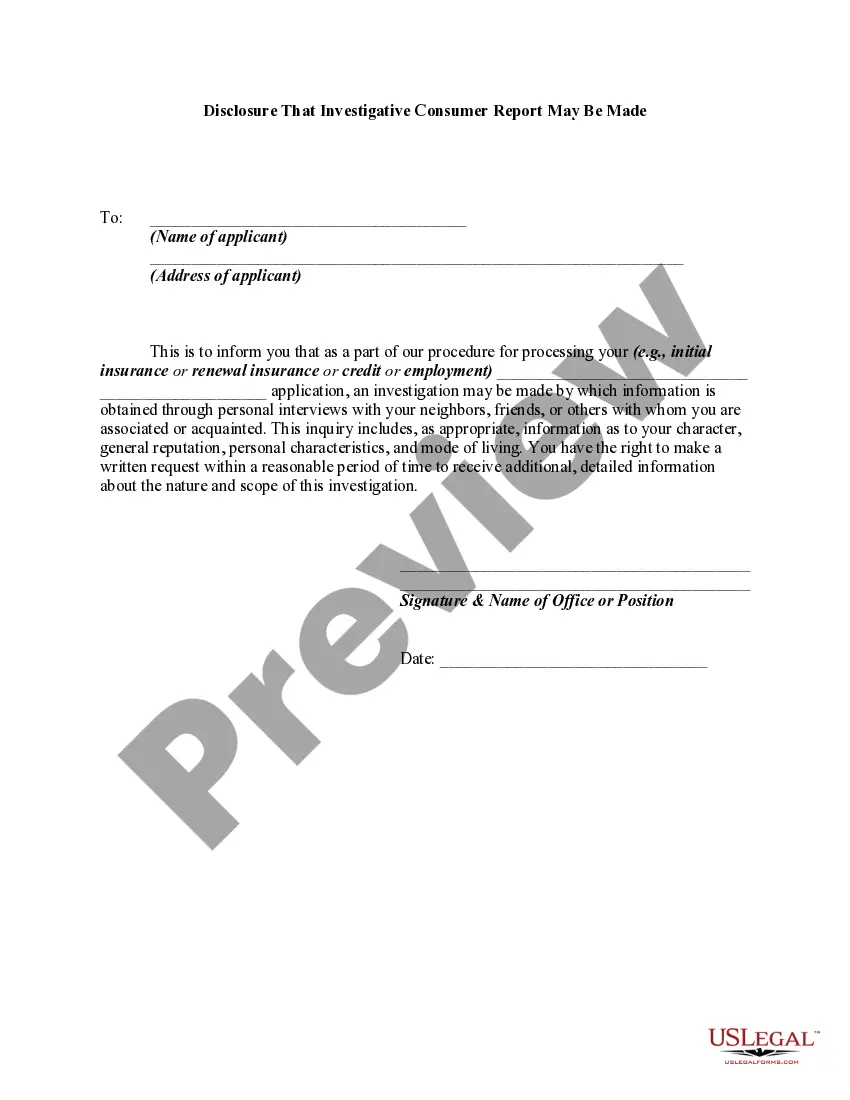

Under the Fair Credit Reporting Act, a person may not procure or cause to be prepared an investigative consumer report on any consumer unless: (1) it is clearly and accurately disclosed to the consumer that an investigative consumer report, including information as to character, general reputation, personal characteristics, and mode of living, whichever is or are applicable, may be made, and such disclosure: (a) is made in a writing mailed, or otherwise delivered, to the consumer not later than three days after the date on which the report was first requested; and (b) includes a statement informing the consumer of the right to request additional disclosures from the person requesting the report and the written summary of rights of the consumer prepared pursuant to ?§ 1681g(c) of the Act; and (2) the person certifies or has certified to the consumer reporting agency that the person has made the proper disclosures to the consumer as required under the Act.

Title: Understanding the Idaho Disclosure That an Investigative Consumer Report May Be Made Keywords: Idaho, disclosure, investigative consumer report, background check, consumer rights Introduction: The Idaho Disclosure That an Investigative Consumer Report May Be Made refers to a legal requirement aimed at protecting consumer rights. This detailed description will provide an overview of what this disclosure entails, its purpose, and the different types of disclosures within Idaho legislation. 1. Overview of the Idaho Disclosure Requirement: Idaho law mandates that before an employer obtains an investigative consumer report on a job applicant or employee, they must provide a specific disclosure. This disclosure informs the individual that an investigation into their background (often referred to as an investigative consumer report) may be conducted to gather personal information. 2. Purpose of the Idaho Disclosure: The purpose of this disclosure is to ensure transparency and give individuals the opportunity to understand that an investigative consumer report may be conducted and that their consent is required. It allows individuals to exercise their privacy rights and take certain steps to address any inaccuracies or discrepancies found in the report. 3. Components of the Idaho Disclosure: The Idaho Disclosure That an Investigative Consumer Report May Be Made typically includes: a. Identification of the employer or entity that may obtain the report. b. The individual's rights, such as the right to request a copy of the report and the right to dispute any findings. c. A statement indicating that the individual's consent is required before obtaining the investigative consumer report. d. Contact information for the consumer reporting agency responsible for preparing the report. e. An explanation of the purpose and scope of the investigation. 4. Different Types of Idaho Disclosures: While the main Idaho Disclosure pertains to the use of investigative consumer reports during employment background checks, there are also several specific disclosures applicable in different scenarios. These may include: a. Rental Application Disclosures: Landlords or property management companies may use investigative consumer reports to screen potential tenants. Applicants must be provided with a disclosure explaining that such a report may be obtained. b. Insurance Disclosures: Insurance companies may need to conduct an investigative consumer report before issuing policies, particularly for high-risk or specialized types of coverage. Policyholders should receive a disclosure informing them of this investigation. c. Credit Application Disclosures: Financial institutions and lenders may request an investigative consumer report when considering loan applications. Individuals seeking credit must be provided with a disclosure stating that their credit history may be evaluated. Conclusion: Understanding the Idaho Disclosure That an Investigative Consumer Report May Be Made is crucial for both employers and consumers. By ensuring compliance with the disclosure requirements, employers uphold transparency, protect consumer rights, and allow individuals the opportunity to address any issues that may arise during background checks. This fosters a fair and equitable process for all parties involved in obtaining investigative consumer reports in Idaho.Title: Understanding the Idaho Disclosure That an Investigative Consumer Report May Be Made Keywords: Idaho, disclosure, investigative consumer report, background check, consumer rights Introduction: The Idaho Disclosure That an Investigative Consumer Report May Be Made refers to a legal requirement aimed at protecting consumer rights. This detailed description will provide an overview of what this disclosure entails, its purpose, and the different types of disclosures within Idaho legislation. 1. Overview of the Idaho Disclosure Requirement: Idaho law mandates that before an employer obtains an investigative consumer report on a job applicant or employee, they must provide a specific disclosure. This disclosure informs the individual that an investigation into their background (often referred to as an investigative consumer report) may be conducted to gather personal information. 2. Purpose of the Idaho Disclosure: The purpose of this disclosure is to ensure transparency and give individuals the opportunity to understand that an investigative consumer report may be conducted and that their consent is required. It allows individuals to exercise their privacy rights and take certain steps to address any inaccuracies or discrepancies found in the report. 3. Components of the Idaho Disclosure: The Idaho Disclosure That an Investigative Consumer Report May Be Made typically includes: a. Identification of the employer or entity that may obtain the report. b. The individual's rights, such as the right to request a copy of the report and the right to dispute any findings. c. A statement indicating that the individual's consent is required before obtaining the investigative consumer report. d. Contact information for the consumer reporting agency responsible for preparing the report. e. An explanation of the purpose and scope of the investigation. 4. Different Types of Idaho Disclosures: While the main Idaho Disclosure pertains to the use of investigative consumer reports during employment background checks, there are also several specific disclosures applicable in different scenarios. These may include: a. Rental Application Disclosures: Landlords or property management companies may use investigative consumer reports to screen potential tenants. Applicants must be provided with a disclosure explaining that such a report may be obtained. b. Insurance Disclosures: Insurance companies may need to conduct an investigative consumer report before issuing policies, particularly for high-risk or specialized types of coverage. Policyholders should receive a disclosure informing them of this investigation. c. Credit Application Disclosures: Financial institutions and lenders may request an investigative consumer report when considering loan applications. Individuals seeking credit must be provided with a disclosure stating that their credit history may be evaluated. Conclusion: Understanding the Idaho Disclosure That an Investigative Consumer Report May Be Made is crucial for both employers and consumers. By ensuring compliance with the disclosure requirements, employers uphold transparency, protect consumer rights, and allow individuals the opportunity to address any issues that may arise during background checks. This fosters a fair and equitable process for all parties involved in obtaining investigative consumer reports in Idaho.