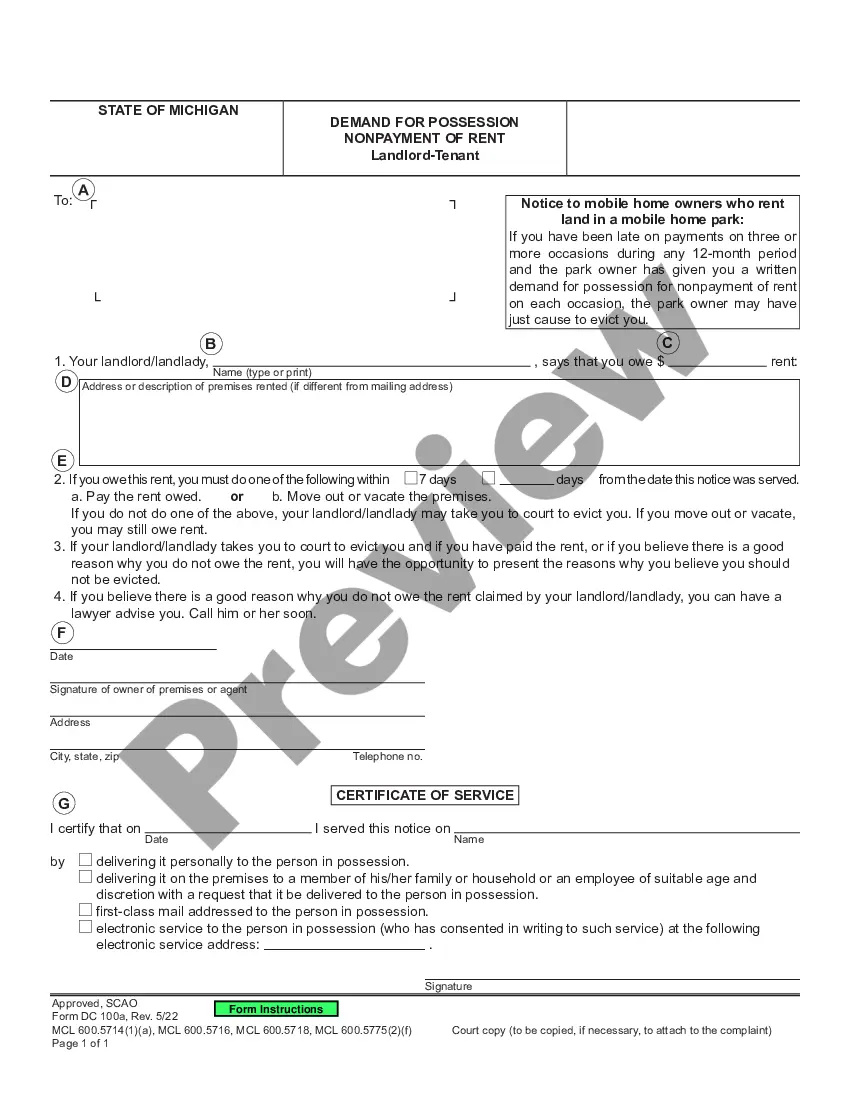

No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Idaho Collection Agency's Return of Claim as Uncollectible

Description

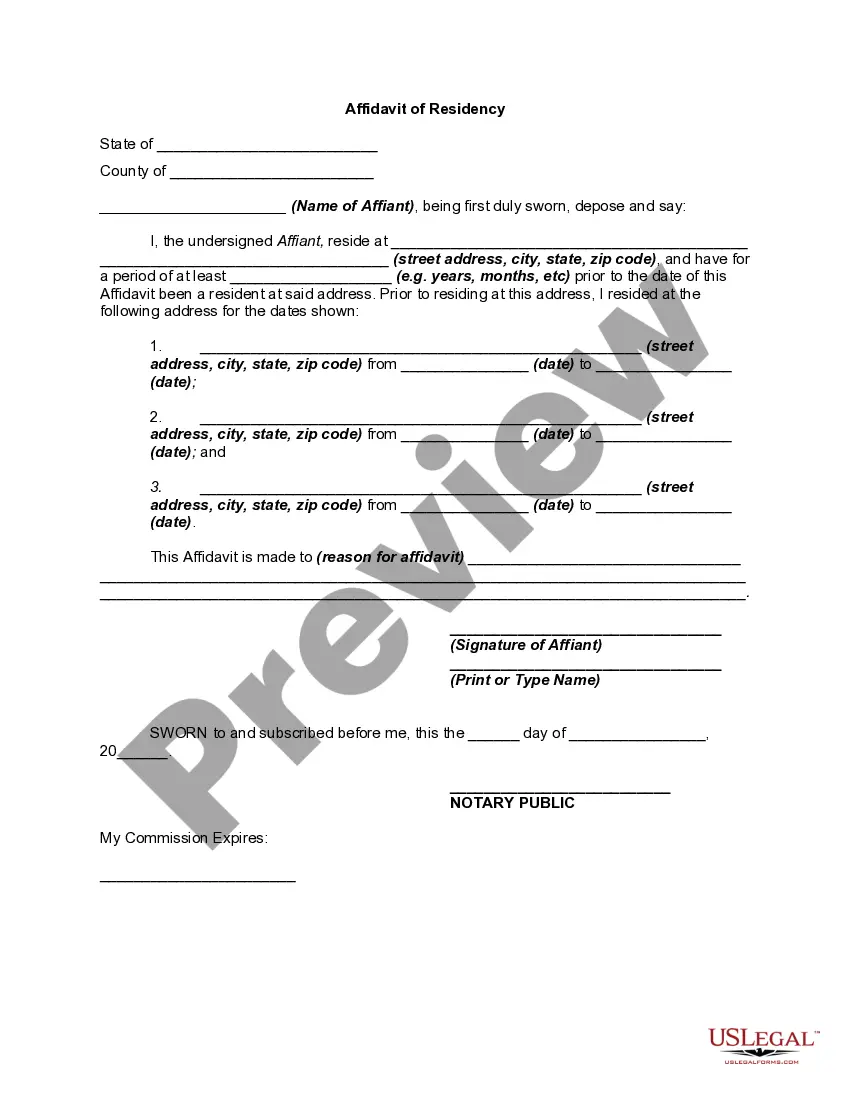

How to fill out Collection Agency's Return Of Claim As Uncollectible?

If you want to be thorough, download or print legal document templates, use US Legal Forms, the largest selection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to find the documents you need.

Different templates for business and personal purposes are organized by categories and locations, or keywords.

Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find other versions in the legal form template.

Step 4. Once you find the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Use US Legal Forms to locate the Idaho Collection Agency's Return of Claim as Uncollectible in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to get the Idaho Collection Agency's Return of Claim as Uncollectible.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, please follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview button to review the form’s details. Don’t forget to read the summary.

Form popularity

FAQ

Old (Time-Barred) Debts In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Federal law says that after receiving written notice of a debt, consumers have a 30-day window to respond with a debt dispute letter.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

In Idaho, a collection action based on a written contract must be brought within five years (I.C. § 5-216). If a collection matter is based on an oral contract, the action must be brought within four years (I.C. A§ 5- 217).

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

If you get a summons notifying you that a debt collector is suing you, don't ignore it. If you do, the collector may be able to get a default judgment against you (that is, the court enters judgment in the collector's favor because you didn't respond to defend yourself) and garnish your wages and bank account.

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days. But at that point, the debt is considered valid, and a debt collector is still legally allowed to continue contacting you.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.