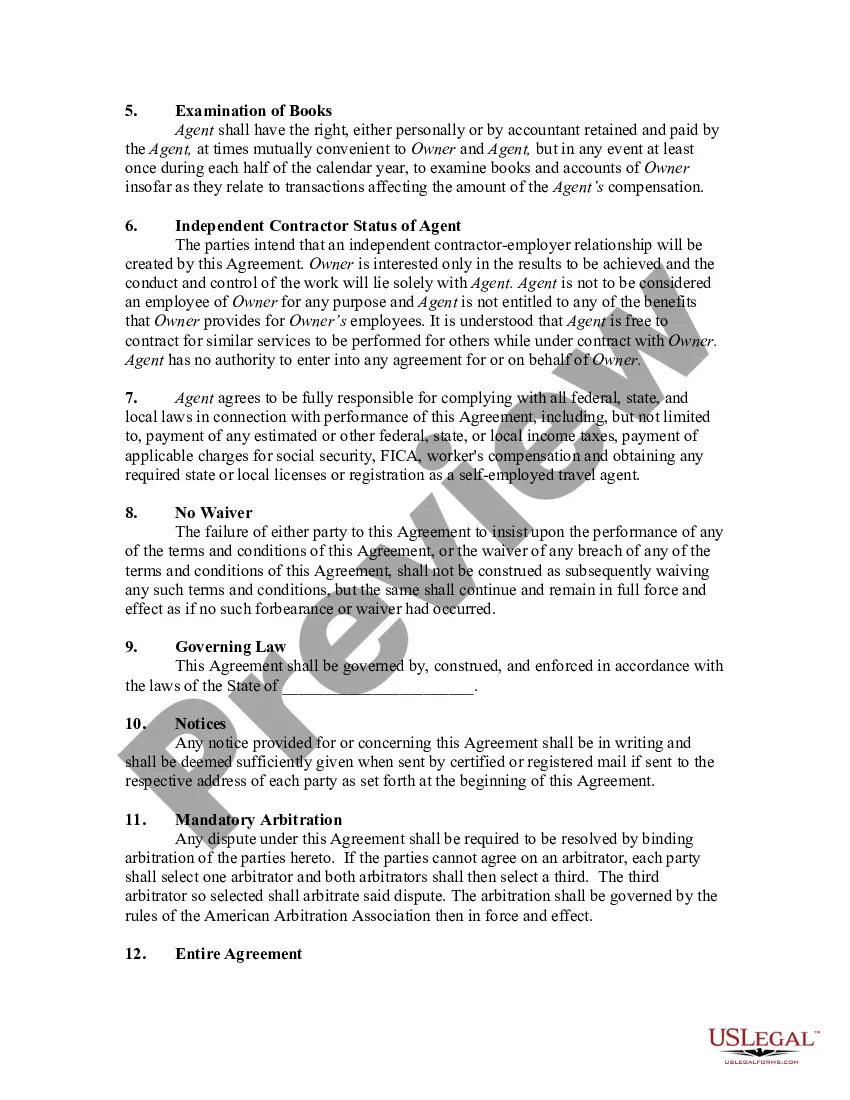

A travel agency is a business that sells travel related products and services, particularly package tours, to end-user customers on behalf of third party travel suppliers, such as airlines, hotels, tour companies, and cruise lines. This form agreement only deals with the sale of lodging to a particular hotel for a commission. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Agreement Between Travel Agent and Hotel Owner to Sell Lodging at Hotel in Return for a Commission Description: An Idaho Agreement Between Travel Agent and Hotel Owner is a legally binding contract that outlines the terms and conditions under which a travel agent can sell lodging at a hotel in Idaho in exchange for a commission. This agreement ensures a mutually beneficial partnership between the travel agent and hotel owner, establishing clear expectations and guidelines for both parties. Keywords: 1. Idaho: This agreement specifically pertains to the state of Idaho, ensuring that all the provisions and legal requirements align with the state's laws and regulations. 2. Agreement: This document represents a formal agreement between the travel agent and hotel owner, presenting a legally binding contract. 3. Travel Agent: Referring to an individual or company actively engaged in the business of selling travel-related services, such as hotel reservations and accommodations, to clients. 4. Hotel Owner: Describing an individual or entity that owns and operates a hotel or lodging establishment in Idaho. 5. Sell Lodging: This phrase highlights the main objective of the agreement, which is for the travel agent to market and sell lodging accommodations offered by the hotel owner. 6. Commission: The compensation structure established in the agreement, where the travel agent receives a predetermined percentage or amount of each lodging sale made as a result of their efforts. 7. Partnership: The agreement establishes a partnership or business relationship between the travel agent and hotel owner, emphasizing the cooperation and collaboration required to achieve mutual success. 8. Terms and Conditions: This agreement clearly outlines the rights, responsibilities, and obligations of both parties, including payment terms, cancellation policies, marketing strategies, and other relevant provisions. 9. Expectations: The agreement specifies the performance expectations for both the travel agent and hotel owner, ensuring accountability and the achievement of agreed-upon goals. 10. Guidelines: The agreement provides guidelines or rules to follow when selling lodging accommodations, ensuring compliance with the hotel's policies, operations, and branding. Types of Idaho Agreements Between Travel Agent and Hotel Owner: 1. Exclusive Agreement: This type of agreement grants exclusive rights to one travel agent, prohibiting the hotel owner from entering into similar agreements with competitors. 2. Non-Exclusive Agreement: This agreement allows the hotel owner to work with multiple travel agents simultaneously, giving them the flexibility to collaborate with different agencies. 3. Commission Structure Agreement: This type of agreement defines the specific commission structure, including the percentage or amount the travel agent will receive for each lodging sale. 4. Duration Agreement: This agreement sets a specific timeframe during which the travel agent has the authority to sell lodging accommodations for the hotel owner. 5. Performance-Based Agreement: This type of agreement outlines specific performance goals, bonuses, or incentives based on the travel agent's successful sales or achieved targets. 6. Renewal Agreement: In some cases, when both parties are satisfied with the partnership, they may choose to renew the agreement for an extended period, modifying any necessary terms or provisions.