The Idaho HIPAA Release Form for Insurance is an essential legal document used in the healthcare industry to protect an individual's privacy rights and disclose their health information in accordance with the Health Insurance Portability and Accountability Act (HIPAA). This form serves as a written authorization allowing healthcare providers, insurance companies, and other covered entities to share an individual's protected health information (PHI) for various purposes related to insurance claims and coverage. The primary goal of the Idaho HIPAA Release Form for Insurance is to ensure that patients have control over the use and disclosure of their personal health information, thereby maintaining privacy and security. By signing this form, individuals grant permission for their healthcare providers to release their protected health information to insurance companies for the purposes of claims processing, eligibility verification, and coordinating benefits. Typically, the Idaho HIPAA Release Form for Insurance contains several key elements, such as: 1. Patient Information: This section requires the individual to provide their full name, date of birth, address, contact information, and any other relevant identification details to ensure accurate identification. 2. Authorized Parties: Here, the form lists the authorized individuals or entities who are permitted to receive the individual's health information. This may include insurance companies, third-party administrators, medical providers, or any other parties involved in the insurance process. 3. Purpose of Disclosure: This section outlines the specific reasons for which the protected health information can be disclosed. Common purposes include claims processing, insurance coverage determination, appeals, and coordination of benefits with other insurance carriers. 4. Effective Date and Expiration: The form specifies the time period during which the authorization is valid. Typically, the release is valid for a limited period, usually determined by the specific purpose or need for the disclosure. 5. Signature and Consent: This is the crucial part where the individual consents to the release of their health information by signing and dating the form. It confirms that they understand the implications and voluntarily authorize the use and disclosure of their protected health information. It is worth noting that there may be variations of the Idaho HIPAA Release Form for Insurance, depending on the specific purpose or type of insurance coverage. For instance, there may be separate release forms for medical insurance, dental insurance, vision insurance, or disability insurance. Each form will cater to the unique requirements of the respective insurance coverage type.

Idaho Hippa Release Form for Insurance

Description

How to fill out Idaho Hippa Release Form For Insurance?

Are you in a situation that you will need papers for sometimes company or person purposes virtually every day time? There are a variety of legitimate record templates available on the net, but finding kinds you can trust isn`t straightforward. US Legal Forms gives a huge number of kind templates, just like the Idaho Hippa Release Form for Insurance, which can be composed to meet federal and state needs.

Should you be previously informed about US Legal Forms internet site and have a merchant account, simply log in. After that, it is possible to download the Idaho Hippa Release Form for Insurance design.

Unless you have an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you require and ensure it is to the appropriate city/state.

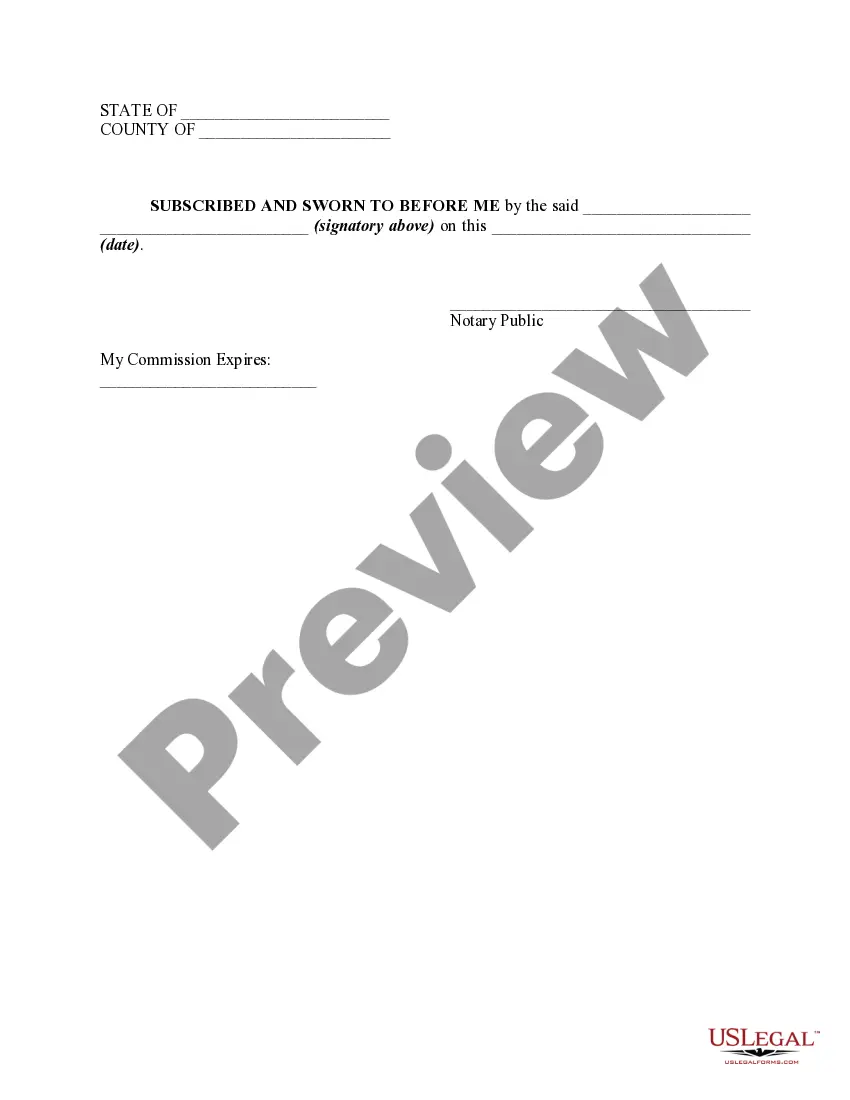

- Take advantage of the Preview option to examine the form.

- Look at the information to actually have selected the proper kind.

- If the kind isn`t what you are trying to find, make use of the Research area to get the kind that fits your needs and needs.

- Whenever you find the appropriate kind, simply click Acquire now.

- Opt for the rates program you would like, submit the required information to create your account, and purchase your order utilizing your PayPal or Visa or Mastercard.

- Choose a practical data file file format and download your backup.

Find all the record templates you may have bought in the My Forms food list. You can obtain a more backup of Idaho Hippa Release Form for Insurance at any time, if needed. Just select the needed kind to download or printing the record design.

Use US Legal Forms, by far the most extensive selection of legitimate kinds, to conserve time and steer clear of faults. The service gives professionally created legitimate record templates which you can use for a range of purposes. Produce a merchant account on US Legal Forms and begin producing your daily life easier.