Idaho Employment Verification Letter for Independent Contractor

Description

How to fill out Employment Verification Letter For Independent Contractor?

If you wish to completely, download, or print credible document templates, utilize US Legal Forms, the largest selection of legal forms that are available online.

Employ the site’s simple and efficient search function to locate the documents you require. Numerous templates for business and personal use are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Idaho Employment Verification Letter for Independent Contractor with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete, download, and print the Idaho Employment Verification Letter for Independent Contractor with US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Idaho Employment Verification Letter for Independent Contractor.

- You can also access forms you previously saved inside the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

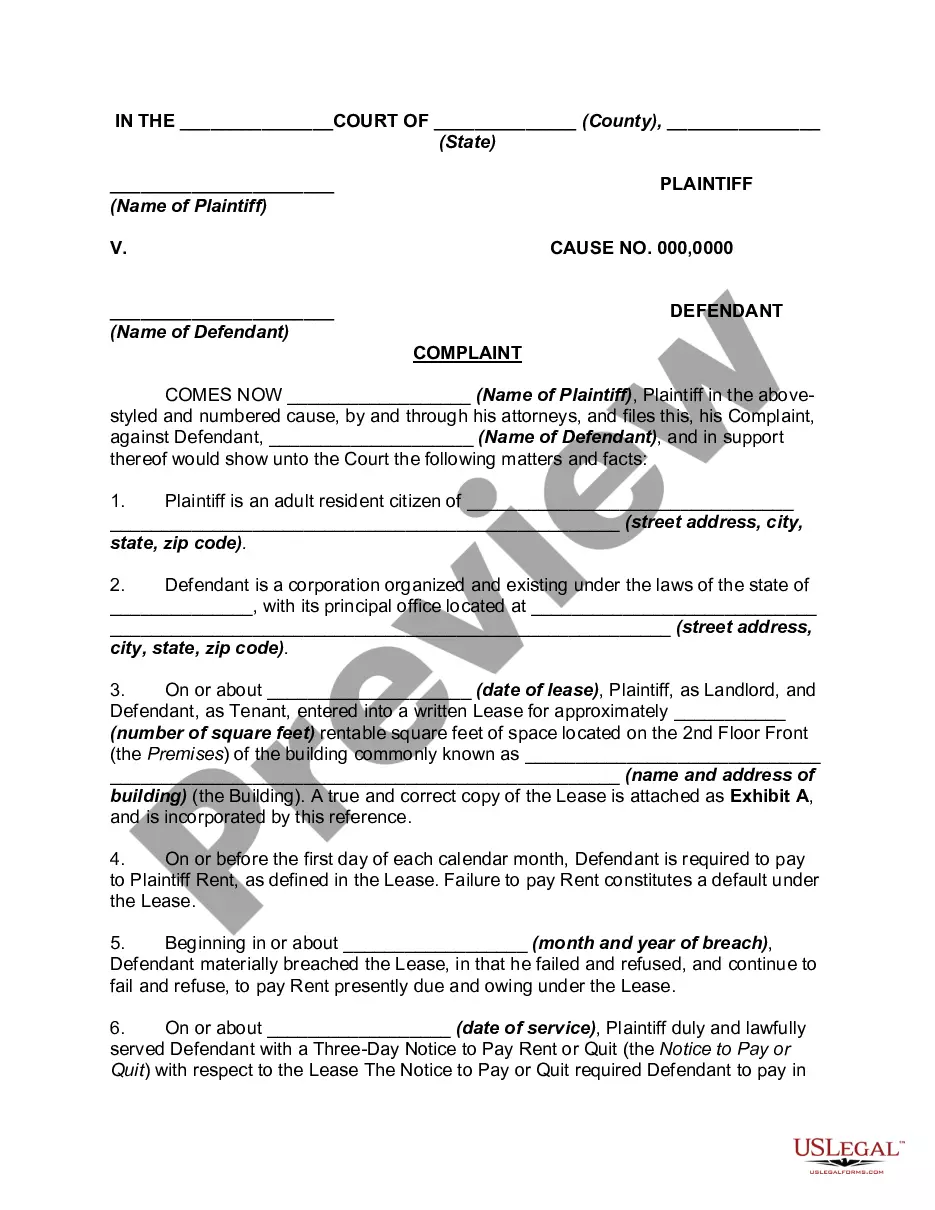

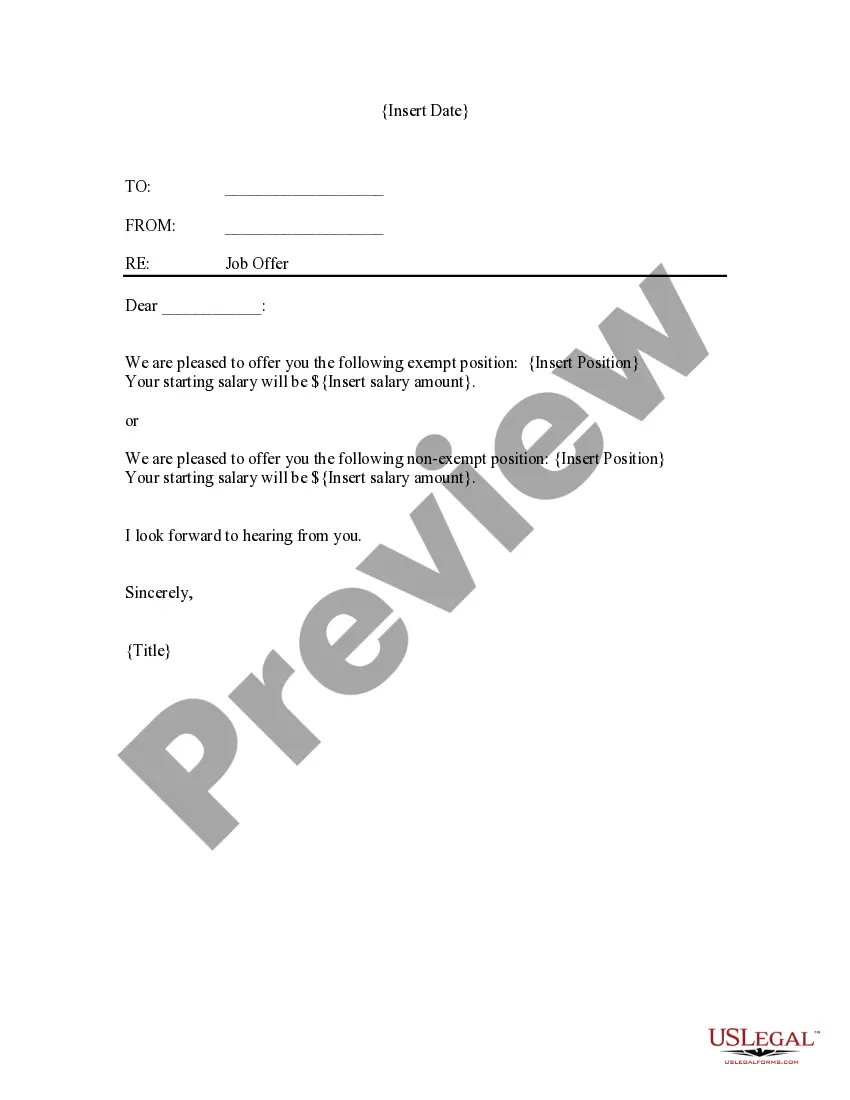

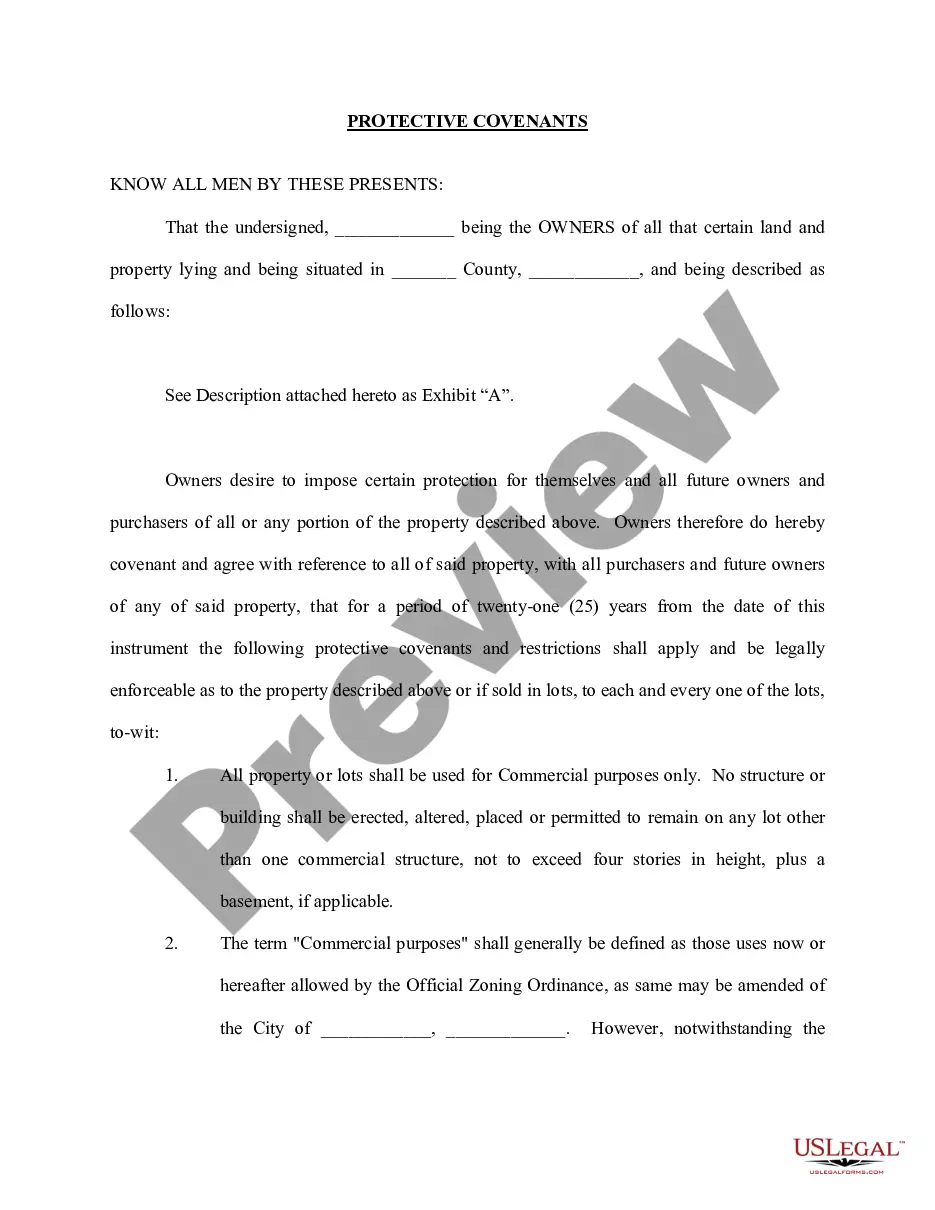

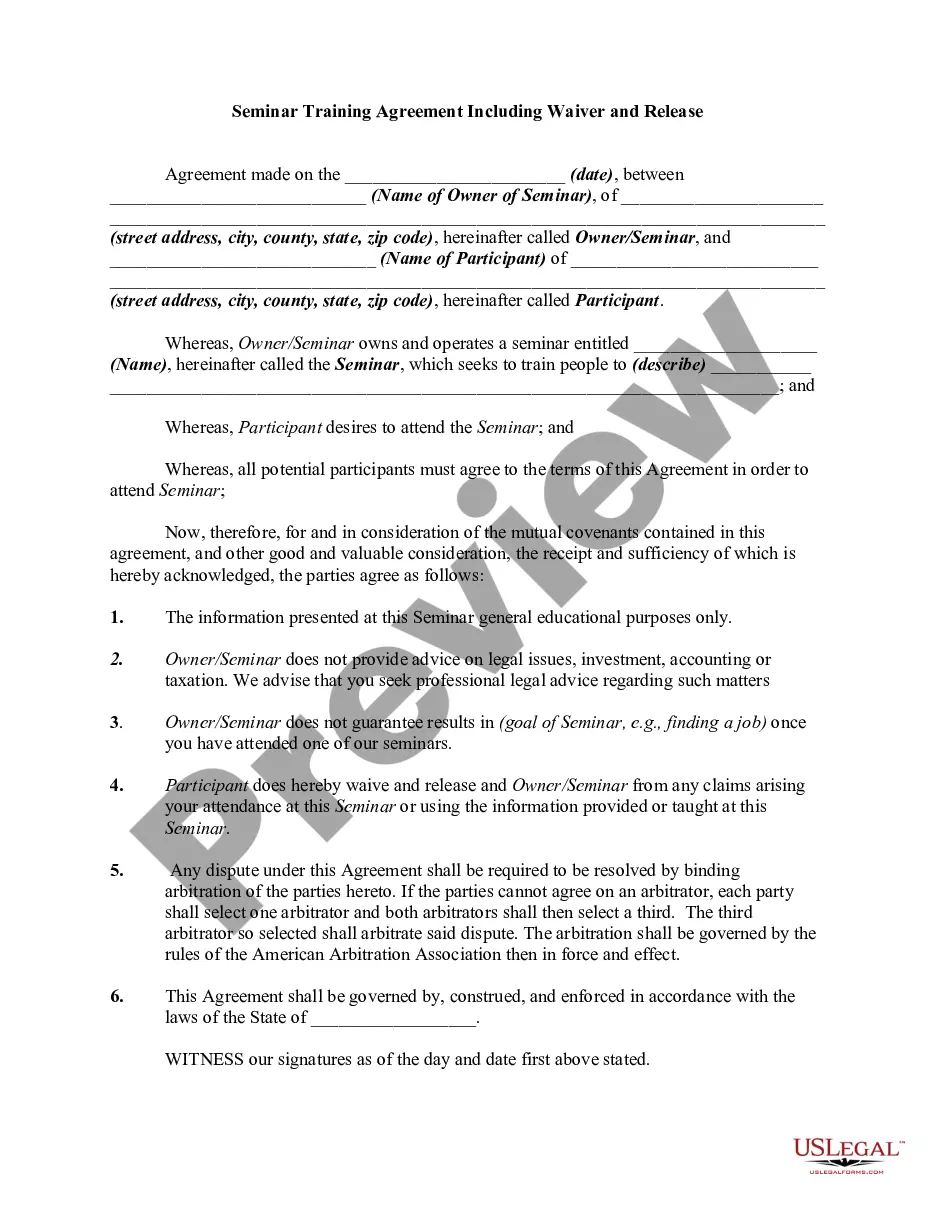

- Step 2. Utilize the Preview feature to review the form’s details. Make sure to read the description.

- Step 3. If you are not pleased with the document, use the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get it now option. Select the pricing plan you prefer and input your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Idaho Employment Verification Letter for Independent Contractor.

Form popularity

FAQ

Yes, independent contractors may need a business license in Idaho, depending on the nature of their work and the locality in which they operate. It's important to check with local authorities to confirm licensing requirements specific to your business type. By obtaining appropriate licenses, independent contractors can enhance their credibility and ensure a smoother process when gathering documents like an Idaho Employment Verification Letter for Independent Contractor.

The difference between an employee and an independent contractor in Idaho revolves around the relationship they have with their paying party. While employees may receive benefits and have taxes withheld from their paychecks, independent contractors typically operate as separate entities, managing their business expenses and taxes. When obtaining an Idaho Employment Verification Letter for Independent Contractor, understanding these contrasts ensures you present the correct status.

Several factors determine whether a worker is classified as an employee or independent contractor, including the degree of control the employer has and the nature of the working relationship. Key considerations include how payments are made, the worker's ability to make independent decisions, and the overall nature of the work arrangement. Clarity on these points is critical for acquiring the correct Idaho Employment Verification Letter for Independent Contractor.

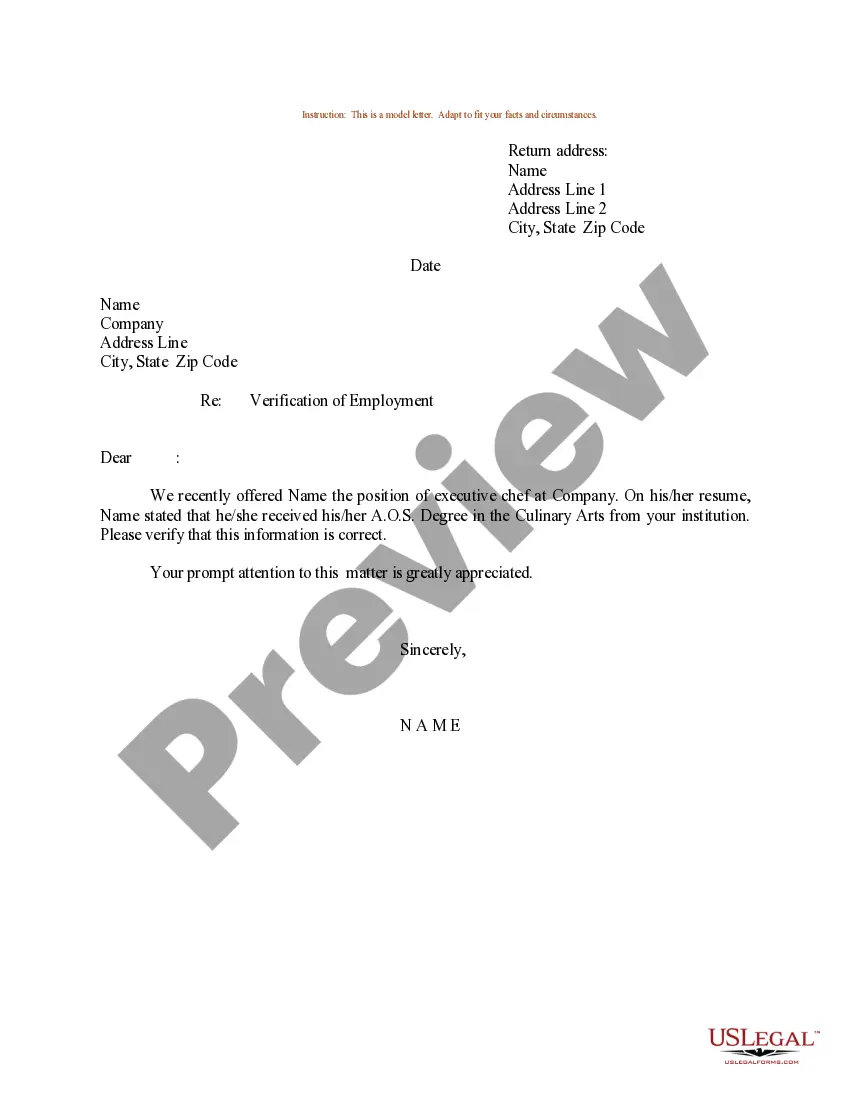

To request an employment verification letter, you should reach out to your employer or the entity that engaged your services as an independent contractor. Specify the purpose of the letter and any details required, such as dates of service and nature of work. If you're unsure about the content needed, templates from uslegalforms can assist in crafting an effective Idaho Employment Verification Letter for Independent Contractor.

The IRS considers an independent contractor as a self-employed individual who provides services to clients under terms specified in a contract. Unlike employees, independent contractors receive payments without tax withholdings, meaning they handle their tax obligations. When seeking an Idaho Employment Verification Letter for Independent Contractor purposes, it's essential to comply with IRS guidelines to ensure proper classification.

In Idaho, the distinction between an independent contractor and an employee involves the level of control and independence each has in their work. Independent contractors generally have the freedom to set their schedules and methods, while employees typically follow employer directives. For documentation, such as the Idaho Employment Verification Letter for Independent Contractor, this distinction is important for accurate representation of your work status.

If you are self-employed, you can list your business name as your employer. Ensure to provide any necessary registration details or evidence of your business operations. Using an Idaho Employment Verification Letter for Independent Contractor can reinforce this information and provide clarity regarding your self-employment status.

A statement of self-employment should clearly highlight your business details, such as its name and address, alongside your role and the services you provide. Include your income information and a brief declaration of your business structure. This document can complement an Idaho Employment Verification Letter for Independent Contractor to provide a comprehensive proof of your professional status.

Writing an employment verification letter for an independent contractor starts by clearly stating the contractor's name, business, and duration of service. Specify the nature of the work performed and any relevant details about job responsibilities. This letter should clearly state that it serves as an Idaho Employment Verification Letter for Independent Contractor to help the contractor in various verification situations.

To provide proof of employment when self-employed, consider gathering financial records such as bank statements, tax documents, and contracts. You may also write an Idaho Employment Verification Letter for Independent Contractor to summarize your professional relationship with clients. Using multiple forms of verification can increase your credibility.