Idaho Account Stated for Construction Work

Description

How to fill out Account Stated For Construction Work?

If you want to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and efficient search to find the documents you require. Various templates for commercial and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Idaho Account Stated for Construction Work in just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Compete and acquire, and print the Idaho Account Stated for Construction Work with US Legal Forms. There are millions of professional and state-specific templates you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Idaho Account Stated for Construction Work.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

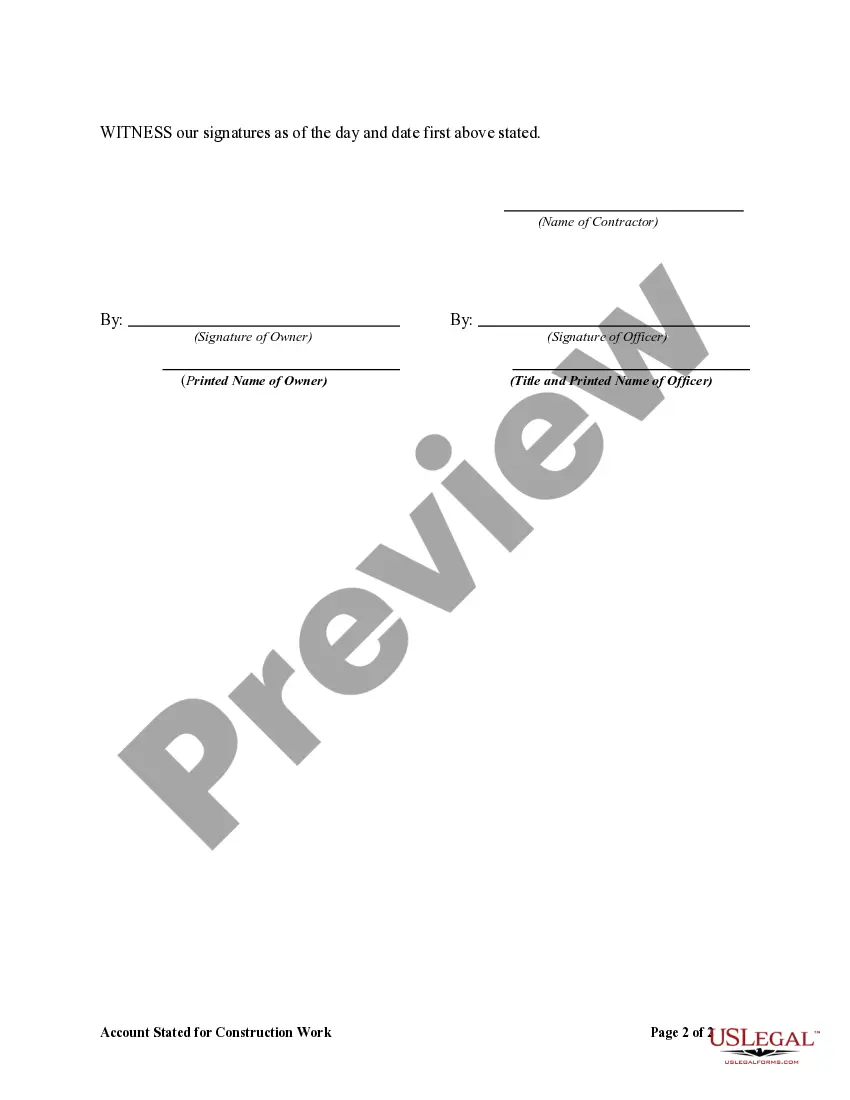

- Step 2. Utilize the Preview option to review the form's details. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Idaho Account Stated for Construction Work.

Form popularity

FAQ

Building construction is a regulated activity in Idaho. All contractors are required by Idaho law to be registered with the Idaho Contractors Board, which is a division of the State of Idaho, Bureau of Occupational Licenses.

Idaho requires everyone who performs work as a contractor to be licensed with the Idaho Contractors Board. Only employees and companies working on projects of less than $2,000 are not required to be licensed.

Parts used to make repairs are taxable. Labor to parts isn't taxable (e.g., installing parts in a car after the sale of the car). Labor to repair goods you own isn't taxable.

54-5208. Denial of lien rights. A contractor who is not registered as set forth in this chapter, unless otherwise exempt, shall be denied and shall be deemed to have conclusively waived any right to place a lien upon real property as provided for in chapter 5, title 45, Idaho Code.

The Idaho Contractor Registration Act requires anyone who holds themself out as a contractor or engages in contracting work to register with the Bureau of Occupational Licenses. Homeowners and employees of registered contractors are not required to register.

Contractors and sales and use taxes: an overview Contractors must also pay sales tax when they buy building materials and fixtures. In Idaho, this includes real property improvements they make to property owned by individuals, businesses, churches, educational institutions, and government entities.

Registering a general contractor business in Idaho is mandatory before you can start operating in the state. Your first step is to decide on your business structure. Your status as a sole proprietor, partnership, LLC, or corporation determines the application and documentation you'll need.

Search Idaho Statutes 54-5204. Registration required. (1) On and after January 1, 2006, it shall be unlawful for any person to engage in the business of, or hold himself out as, a contractor within this state without being registered as required in this chapter.