Idaho Gift Affidavit Form

Description

How to fill out Gift Affidavit Form?

US Legal Forms - one of the top libraries of legal documents in the United States - offers an extensive selection of legal document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Idaho Gift Affidavit Form within moments.

If you already have an account, Log In and retrieve the Idaho Gift Affidavit Form from the US Legal Forms library. The Download button will appear on each template you view. You can access all previously downloaded forms in the My documents section of your account.

Choose the format and download the template onto your device.

Make modifications. Fill out, edit, print, and sign the downloaded Idaho Gift Affidavit Form. Every document you added to your account does not have an expiration date and is yours forever. So, if you wish to download or print another copy, simply visit the My documents section and click on the template you need. Gain access to the Idaho Gift Affidavit Form with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

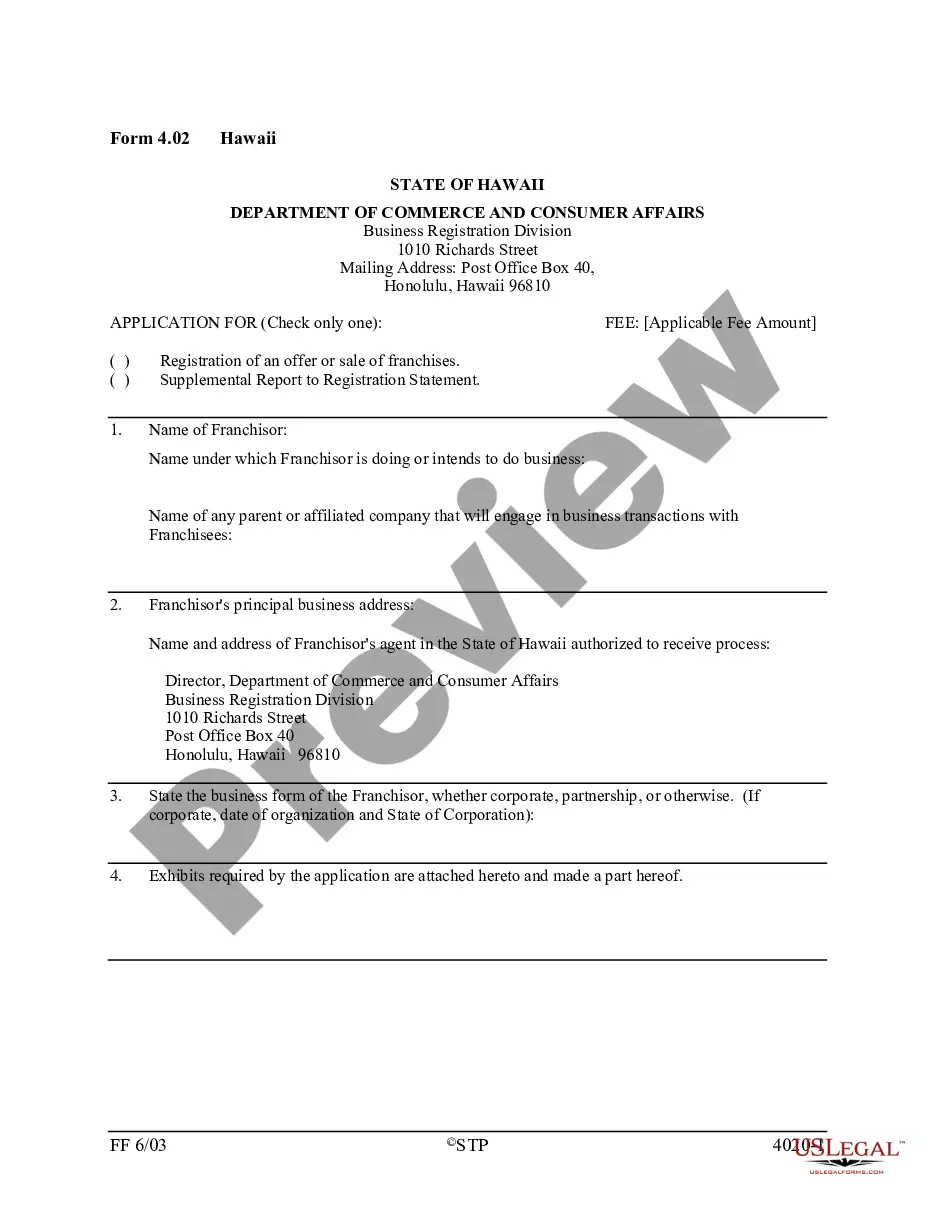

- strong>Make sure you have selected the correct form for your locality/state. Click the Preview button to review the form’s details.

- Check the form description to ensure that you have chosen the right template.

- If the template does not meet your requirements, utilize the Search field at the top of the page to locate one that does.

- When you are satisfied with the template, confirm your selection by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to register for the account.

- strong>Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

To gift a car to a family member in Idaho, start by completing the Idaho Gift Affidavit Form. This form confirms that the transfer of ownership is a gift. Then, fill out the title with the recipient’s information, and submit the documents to your local DMV to complete the title transfer process. This simple procedure ensures that you can easily share your vehicle with your loved ones.

In Idaho, you cannot complete a title transfer entirely online; however, you can begin the process. You will need to gather documents such as the Idaho Gift Affidavit Form and the vehicle title. After filling these out, you must visit a DMV office to finalize the transfer either by scheduling an appointment or visiting in person.

To gift a vehicle to a family member in Idaho, you should complete the appropriate paperwork. This includes filling out the Idaho Gift Affidavit Form, which verifies the transfer is a gift. Additionally, visit the local DMV to handle the title transfer, ensuring all documents are in order for a smooth process.

Filling out an Idaho Gift Affidavit Form is straightforward. Start by providing both the giver's and receiver's information, including names and addresses. Next, specify the type of gift being transferred and include any relevant details that clarify the transaction. Once completed, ensure that both parties sign and date the affidavit.

To gift a vehicle to a family member in Idaho, start by completing a gift transfer form and the necessary paperwork at your local DMV. Ensure the title is transferred properly to avoid complications later. For larger gifts, using the Idaho Gift Affidavit Form can protect both parties and provide legal clarity during the transfer process.

In Idaho, family members may be eligible for a sales tax exemption by completing and submitting the appropriate sales tax exemption form provided by the Idaho State Tax Commission. This form acts as a legal document to certify the relationship and the reason for the exemption. Using the Idaho Gift Affidavit Form along with this can further clarify intentions in any family property or financial gift transactions.

In Idaho, there is no state inheritance tax; therefore, you can inherit any amount without incurring state tax obligations. While federal inheritance tax may apply in certain scenarios, it's rare for most taxpayers. To simplify the process of asset transfer, consider the Idaho Gift Affidavit Form, which helps in formalizing and documenting any gifts or inheritances.

In Idaho, seniors aged 65 and older can qualify for property tax relief programs that may reduce their property tax burden. Eligibility requirements vary depending on income and other factors. To ensure you understand your options, consider applying using the Idaho Gift Affidavit Form if you are transferring property to a senior. This form can help simplify the transfer and maintain benefits.

Yes, Idaho does not impose a state gift tax, which means you can give gifts to individuals without worrying about state taxation. However, federal gift tax regulations may still apply, so it’s wise to consult with a tax professional. Utilizing the Idaho Gift Affidavit Form can help you formalize the gift transfer process and ensure compliance with any necessary documentation.

To obtain a sales tax exemption certificate in Idaho, you can fill out the appropriate form, which is available on the Idaho State Tax Commission's website. You must provide details about your organization or your specific exemption eligibility. Once completed, submit your form to the tax commission for review. With this certificate, you can make tax-exempt purchases, easing the financial burden for eligible purchases.