Idaho Triple Net Lease for Residential Property is a legal agreement between a landlord and a tenant, commonly used in commercial real estate, where the tenant is responsible for paying property taxes, insurance, and maintenance expenses in addition to the rent. However, this type of lease is not commonly used for residential rental properties due to its complexity and additional financial responsibilities imposed on the tenant. In an Idaho Triple Net Lease for Residential Property, the tenant assumes the financial burden of property taxes, insurance premiums, and maintenance costs associated with the property. This means that in addition to paying the agreed-upon monthly rent, the tenant is also responsible for bearing the expenses typically handled by the landlord. Such a lease agreement provides the landlord with the advantage of receiving a net leasing income without worrying about the day-to-day management or unforeseen expenses of the property. Different Types of Idaho Triple Net Lease for Residential Property: 1. Absolute Triple Net Lease: This type of lease places the utmost responsibility on the tenant. The tenant is required to pay all property taxes, insurance costs, and maintenance expenses, leaving no financial burden on the landlord. 2. Modified Triple Net Lease: In a modified triple net lease, the tenant and landlord negotiate specific responsibilities. Unlike the absolute triple net lease, the tenant may only be required to pay a portion of property taxes, insurance premiums, or maintenance costs along with the monthly rent. The specifics will vary based on the negotiated terms. It is important to note that while Triple Net Leases are more commonly used in commercial real estate, they can also be applied to residential properties in Idaho. However, due to the added financial obligations and complexity associated with such agreements, they are relatively uncommon in the residential rental market. Additionally, it is crucial for both parties involved to thoroughly understand and review the terms and conditions of the lease before signing, as they can significantly impact the financial responsibilities and obligations of each party. In conclusion, Idaho Triple Net Lease for Residential Property involves a lease structure where the tenant assumes additional financial obligations, such as property taxes, insurance premiums, and maintenance costs, in addition to the monthly rent. Although not widely used in residential rentals, the two common types of Triple Net Leases for Residential Property in Idaho are the absolute triple net lease and the modified triple net lease.

Idaho Triple Net Lease for Residential Property

Description

How to fill out Idaho Triple Net Lease For Residential Property?

Are you currently in the place the place you require files for sometimes organization or individual purposes nearly every day? There are a variety of legitimate document themes available on the Internet, but discovering ones you can depend on isn`t simple. US Legal Forms gives 1000s of develop themes, like the Idaho Triple Net Lease for Residential Property, which can be written to satisfy federal and state requirements.

In case you are presently knowledgeable about US Legal Forms site and possess an account, merely log in. After that, you can download the Idaho Triple Net Lease for Residential Property design.

If you do not offer an accounts and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is for that right city/area.

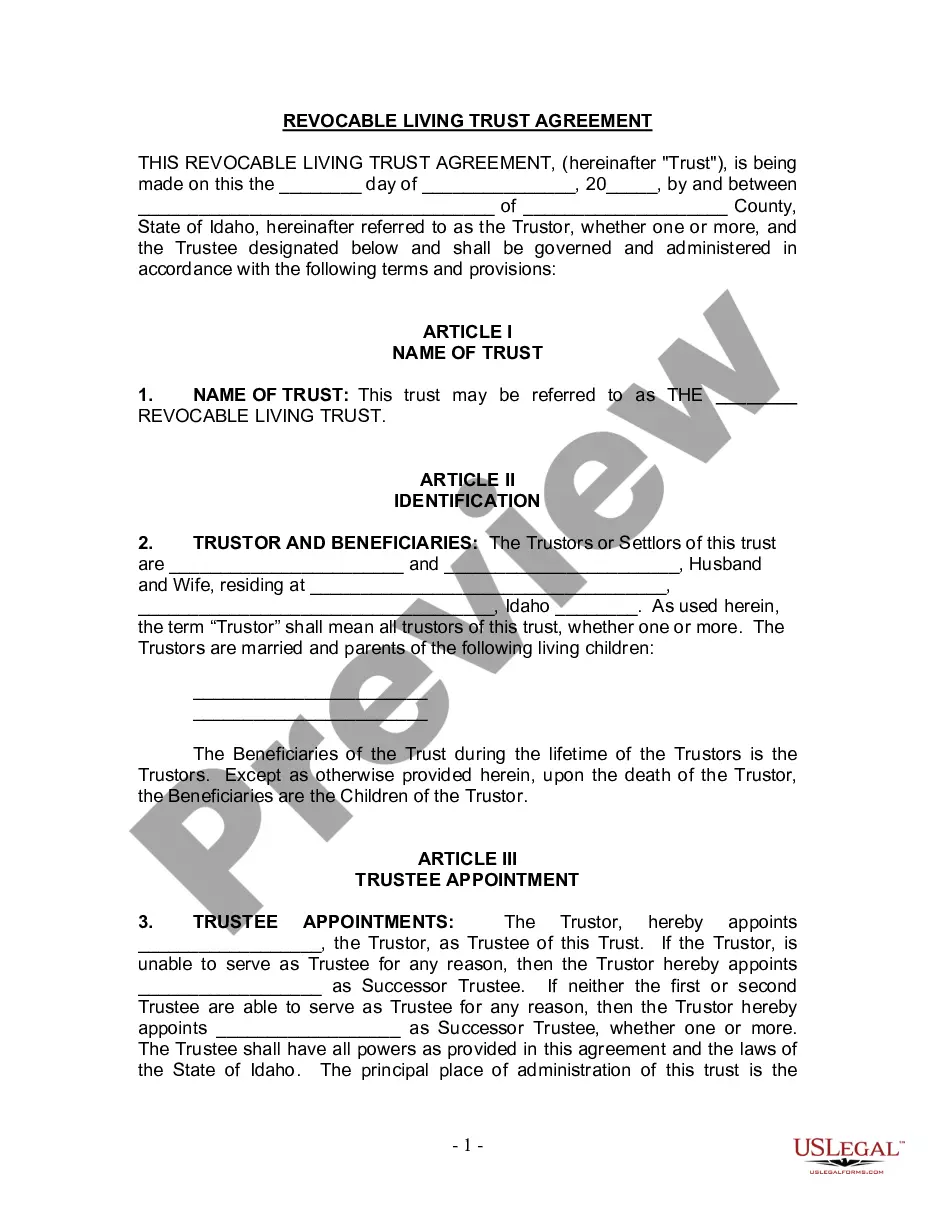

- Take advantage of the Preview button to examine the shape.

- Look at the explanation to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you are seeking, make use of the Research discipline to find the develop that suits you and requirements.

- If you get the right develop, click Get now.

- Select the costs prepare you need, fill in the specified info to produce your account, and buy your order with your PayPal or bank card.

- Decide on a hassle-free document file format and download your copy.

Get every one of the document themes you have purchased in the My Forms menu. You can aquire a extra copy of Idaho Triple Net Lease for Residential Property at any time, if required. Just click the needed develop to download or printing the document design.

Use US Legal Forms, one of the most considerable collection of legitimate forms, in order to save efforts and steer clear of errors. The support gives expertly manufactured legitimate document themes which can be used for a range of purposes. Create an account on US Legal Forms and begin generating your life easier.