Idaho Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

Are you presently in a circumstance where you require documents for either organizational or personal purposes almost every day.

There are numerous legal document templates accessible on the internet, but finding forms you can rely on is not easy.

US Legal Forms offers a vast array of form templates, such as the Idaho Revocable Trust for Real Estate, which are designed to comply with federal and state requirements.

If you find the correct form, click Purchase now.

Select the payment plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Idaho Revocable Trust for Real Estate at any time if needed; just select the desired form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service offers professionally created legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Idaho Revocable Trust for Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

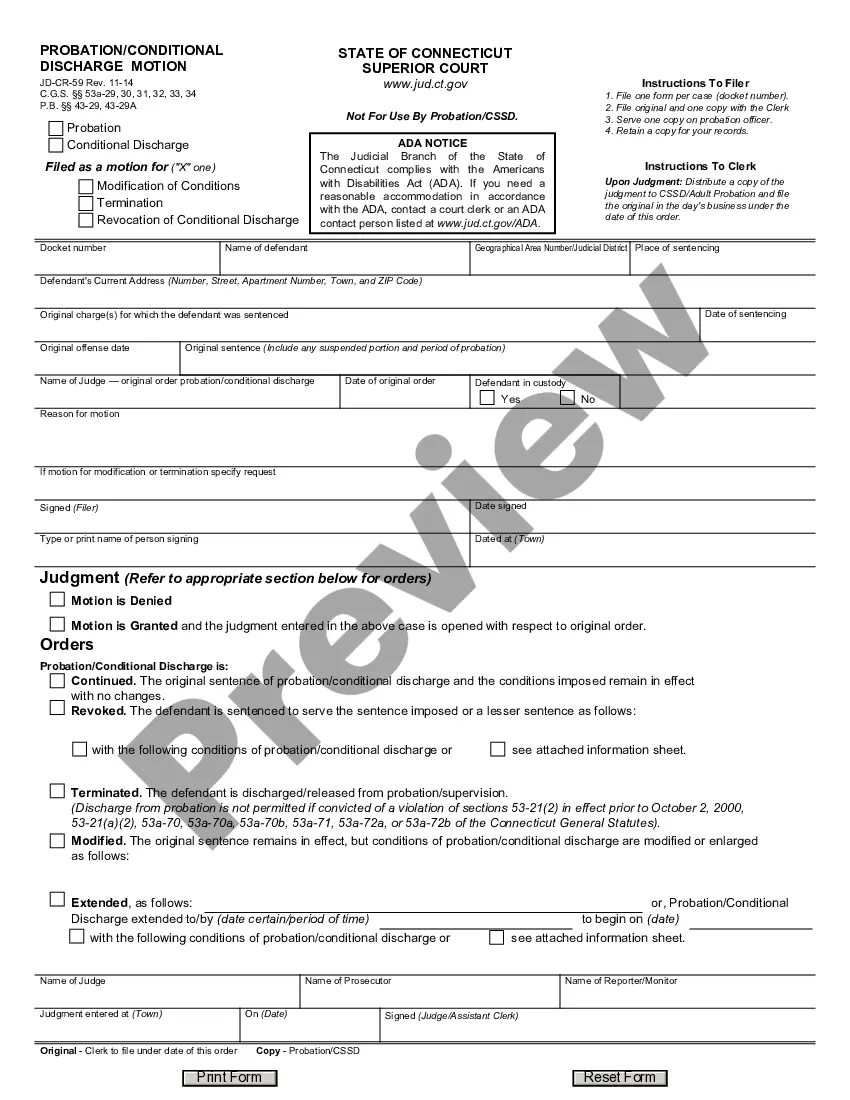

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that fits your needs.

Form popularity

FAQ

Unfortunately, an Idaho Revocable Trust for Real Estate does not help you avoid estate taxes that may apply to your estate after you pass away. While the trust provides efficient management and transfer of assets, estate tax considerations will still be based on your overall estate value. It's wise to consult a tax advisor to understand how your estate will be taxed and to explore other estate planning strategies.

To place your house in an Idaho Revocable Trust for Real Estate, start by creating the trust document, which outlines the terms and conditions. Next, you will need to transfer the title of your property into the trust by completing a deed and filing it with your local government. Working with a legal professional or a platform like US Legal Forms can simplify this process and ensure that everything is done correctly.

While an Idaho Revocable Trust for Real Estate offers many advantages, there are disadvantages to consider. For instance, you will need to transfer the title of your home into the trust, which may involve some upfront legal fees. Additionally, this type of trust does not provide protection against creditors, so it is important to weigh the pros and cons before making your decision.

The Idaho Revocable Trust for Real Estate stands out as an excellent choice for homeowners. This type of trust allows for flexibility, as you can modify or revoke it at any time during your life. By utilizing this trust, you can enjoy the benefits of easy management and efficient transfer of your real estate assets upon your passing.

Putting your house in an Idaho Revocable Trust for Real Estate can be a smart move. It allows you to maintain control over your property during your lifetime while also simplifying the transfer process to your beneficiaries. This trust helps you avoid the probate process, which can be lengthy and expensive, providing peace of mind for you and your loved ones.

Filing taxes for a revocable trust can be straightforward since the trust is typically treated as a disregarded entity for tax purposes. This means that income generated by an Idaho Revocable Trust for Real Estate is reported on your personal tax return. It’s important to keep accurate records of the trust’s income and expenses. Consider consulting a tax advisor to navigate specific requirements and ensure compliance.

Yes, you can create a revocable trust yourself, but it’s essential to understand the complexities involved. An Idaho Revocable Trust for Real Estate requires specific legal language and compliance with state laws. While DIY options are available, seeking guidance from professionals can save you potential headaches later on. Services like USLegalForms offer valuable resources to help you create a trust correctly.

Putting your property in a trust in Idaho follows a similar process to putting your house in a trust. You will need to establish an Idaho Revocable Trust for Real Estate and execute a deed that lists the trust as the new owner. It’s crucial to ensure that the property is properly titled to avoid complications in the future. Consulting with a legal expert or using a service like USLegalForms can help simplify this process.

To put your house in a trust in Idaho, you will need to create your Idaho Revocable Trust for Real Estate and then transfer the property title to the trust. This process involves drafting a deed that names the trust as the new owner. It’s best to work with a lawyer or use a reliable platform like USLegalForms to ensure that all legal requirements are met and that the transfer is properly documented.

One significant mistake parents often make when setting up an Idaho Revocable Trust for Real Estate is not clearly outlining their wishes. Without specific instructions, there may be confusion about asset distribution after their passing. Additionally, failing to communicate their intentions to beneficiaries can lead to disputes. It’s important to consult with a legal expert to ensure thorough planning and clear communication.