The Idaho Cash Flow Statement is a financial document that provides an overview of the cash inflows and outflows of a business or organization in the state of Idaho. It serves as a crucial tool for analyzing the liquidity and financial health of an entity, helping investors, creditors, and stakeholders make informed decisions. The Idaho Cash Flow Statement records and categorizes all cash transactions during a specific accounting period, typically a fiscal year. It includes three main sections: operating activities, investing activities, and financing activities. The operating activities section of the Idaho Cash Flow Statement includes cash flows directly related to the day-to-day operations of the organization. This encompasses revenues from sales of goods or services, payments to suppliers and employees, taxes paid, and other operational expenses. It helps assess the profitability and efficiency of the company's core operations. The investing activities section represents cash flows associated with the acquisition or disposal of long-term assets or investments. It includes purchase or sale of property, plant, and equipment, investments in other businesses or securities, and proceeds from the sale of these assets. This section helps evaluate how well the business is utilizing its resources for long-term growth. The financing activities section captures cash flows related to external sources of funding and the distribution of dividends to shareholders. It includes proceeds from issuing equity or debt, repayment of debt or lease liabilities, and dividend payments. This section provides insights into how the business finances its operations and investments. Different types of Idaho Cash Flow Statements may include the direct method and indirect method. The direct method presents specific cash inflows and outflows from operating activities, such as cash received from customers and cash paid to suppliers. The indirect method starts with net income and adjusts it for non-cash items and changes in working capital to derive the cash flow from operating activities. Both methods provide valuable information on a company's cash generation and sources. Overall, the Idaho Cash Flow Statement is a vital financial statement that complements the balance sheet and income statement. It informs stakeholders about the cash movements of a business and enhances their understanding of its financial performance, ability to meet obligations, and potential for growth.

Idaho Cash Flow Statement

Description

How to fill out Idaho Cash Flow Statement?

US Legal Forms - among the largest collections of legal documents in the United States - offers an extensive selection of legal document templates that you can download or print.

By using the website, you can discover numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the most current forms like the Idaho Cash Flow Statement in just seconds.

If you are already a member, Log In to download the Idaho Cash Flow Statement from the US Legal Forms catalog. The Download button will be available on every form you examine. You have access to all previously saved forms under the My documents tab in your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finish the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Idaho Cash Flow Statement. Every template you save to your account does not expire and belongs to you indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the desired form. Access the Idaho Cash Flow Statement with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize countless specialized and state-specific templates that meet your business or personal obligations and requirements.

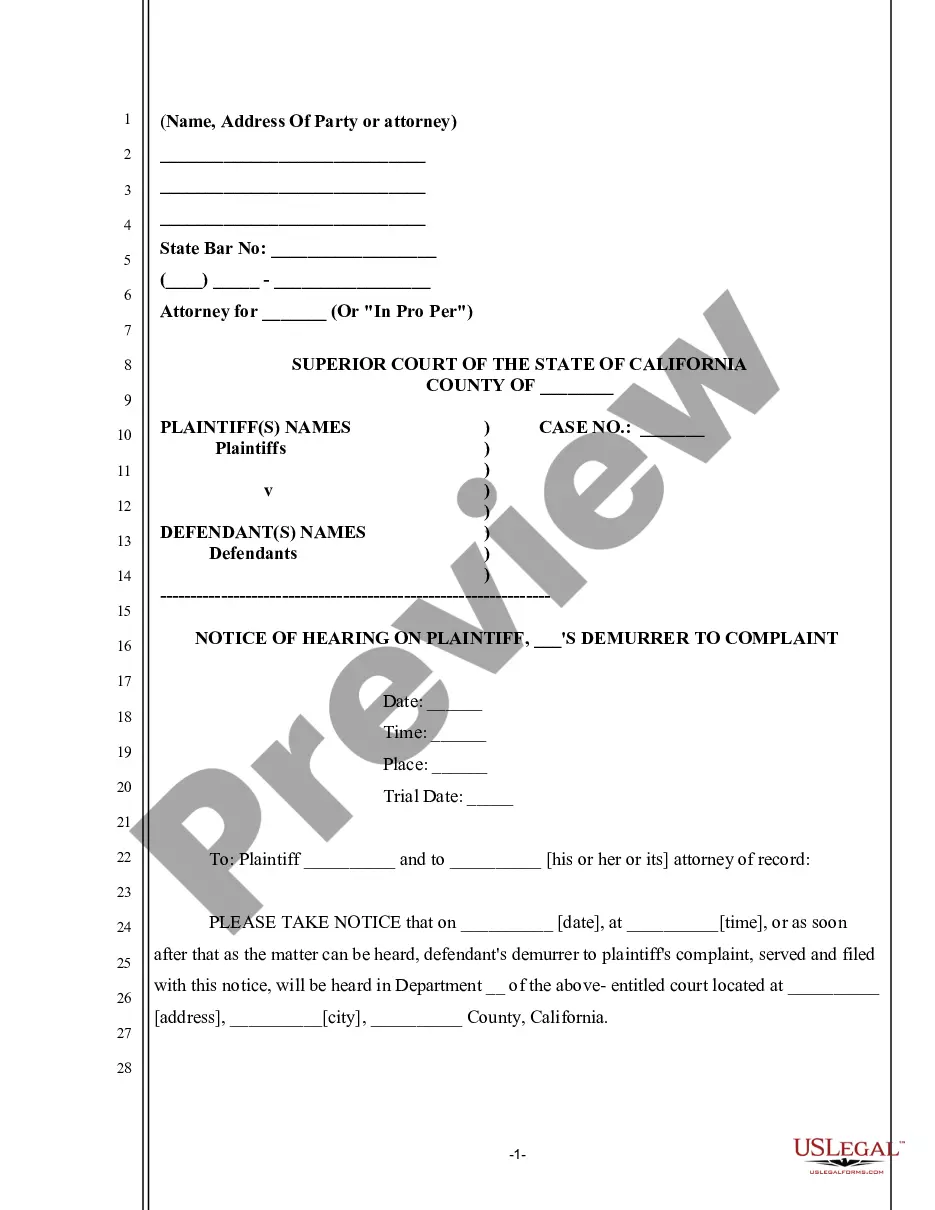

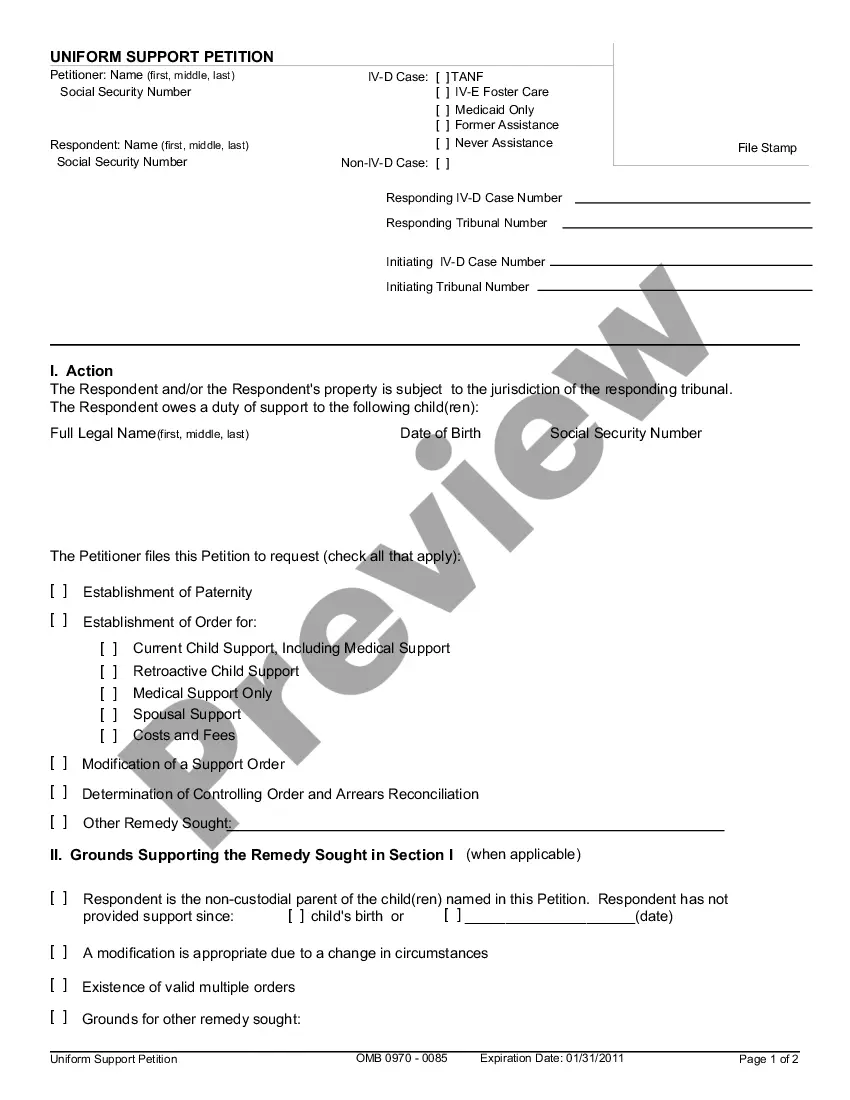

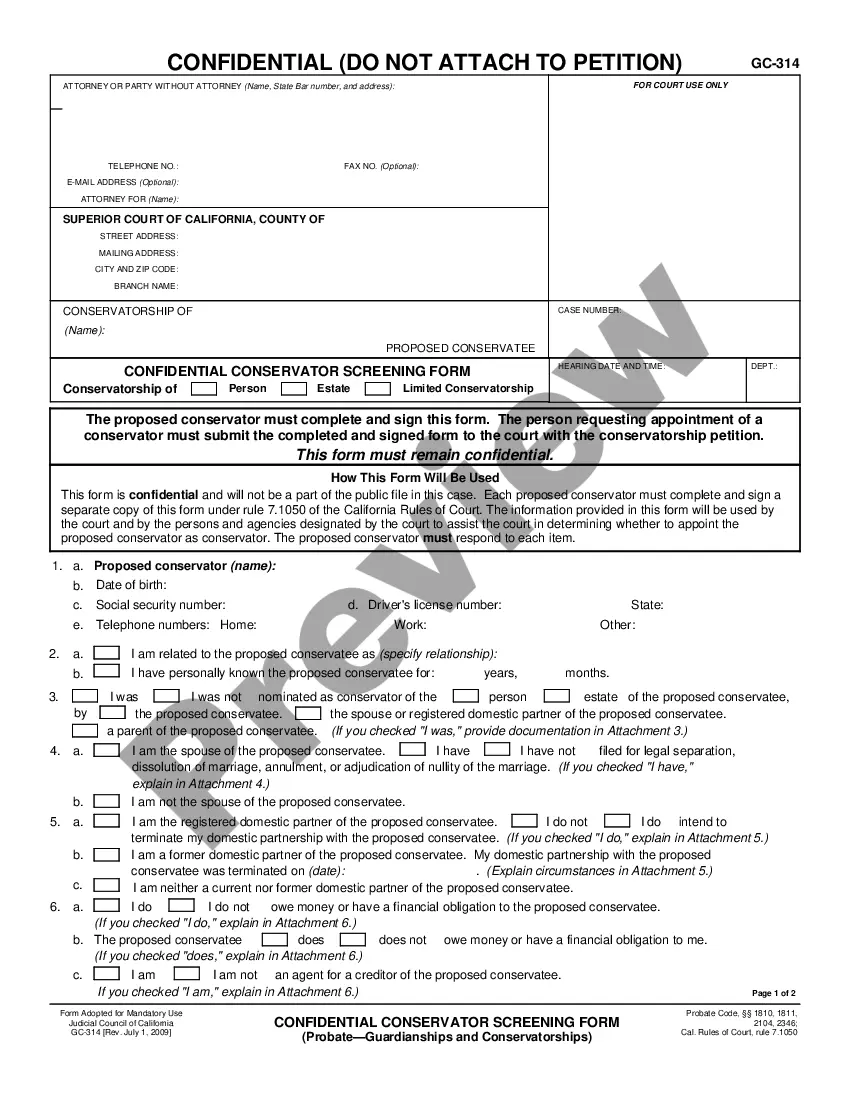

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your locality/region. Click on the Preview button to review the contents of the form.

- Check the form summary to confirm that you have picked the right document.

- If the form does not fulfill your needs, utilize the Search box at the top of the screen to find the one that does.

- Once satisfied with the document, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

There are three cash flow types that companies should track and analyze to determine the liquidity and solvency of the business: cash flow from operating activities, cash flow from investing activities and cash flow from financing activities. All three are included on a company's cash flow statement.

Format Of The Statement Of Cash FlowsCash involving operating activities. Cash involving investing activities. Cash involving financing activities. Supplemental information.

The main components of the CFS are cash from three areas: Operating activities, investing activities, and financing activities.

The cash flow statement differs from the balance sheet and income statement in that it excludes non-cash transactions required by accrual basis accounting, such as depreciation, deferred income taxes, write-offs on bad debts and sales on credit where receivables have not yet been collected.

A typical cash flow statement comprises three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

To construct an indirect cash flow statement, you first need to focus on operating activities. To do that, determine net income and remove non-cash expenses (e.g. depreciation and amortization) from that number. You can find the net income number on your profit and loss statement (also called the income statement).

The main components of the cash flow statement are:Cash flow from operating activities.Cash flow from investing activities.Cash flow from financing activities.Disclosure of non-cash activities, which is sometimes included when prepared under generally accepted accounting principles (GAAP).

The three main components of a cash flow statement are cash flow from operations, cash flow from investing, and cash flow from financing.

More info

What would you like to learn about today? If you don't know what you would like to learn, and you want to find out at the exact moment that you will be learning, then start reading the course description. All the courses in the course description can be selected freely. You can start whatever course you wish right at this moment with this very, very valuable course. The course content is very simple, and you don't need any special knowledge or experience to understand the courses. The course content is also divided into easy to understand sections for you. Do you already have the skills to do this kind of course? If you already have some skills, then this is the perfect course to learn about managing money. This can be a great way to learn the basics of Investing and Trading and also learn the most common problems you face today on the way. The course Content will teach you all of these topics with plenty of examples. What would You Like to See More of?