Idaho Withdrawal of Partner

Description

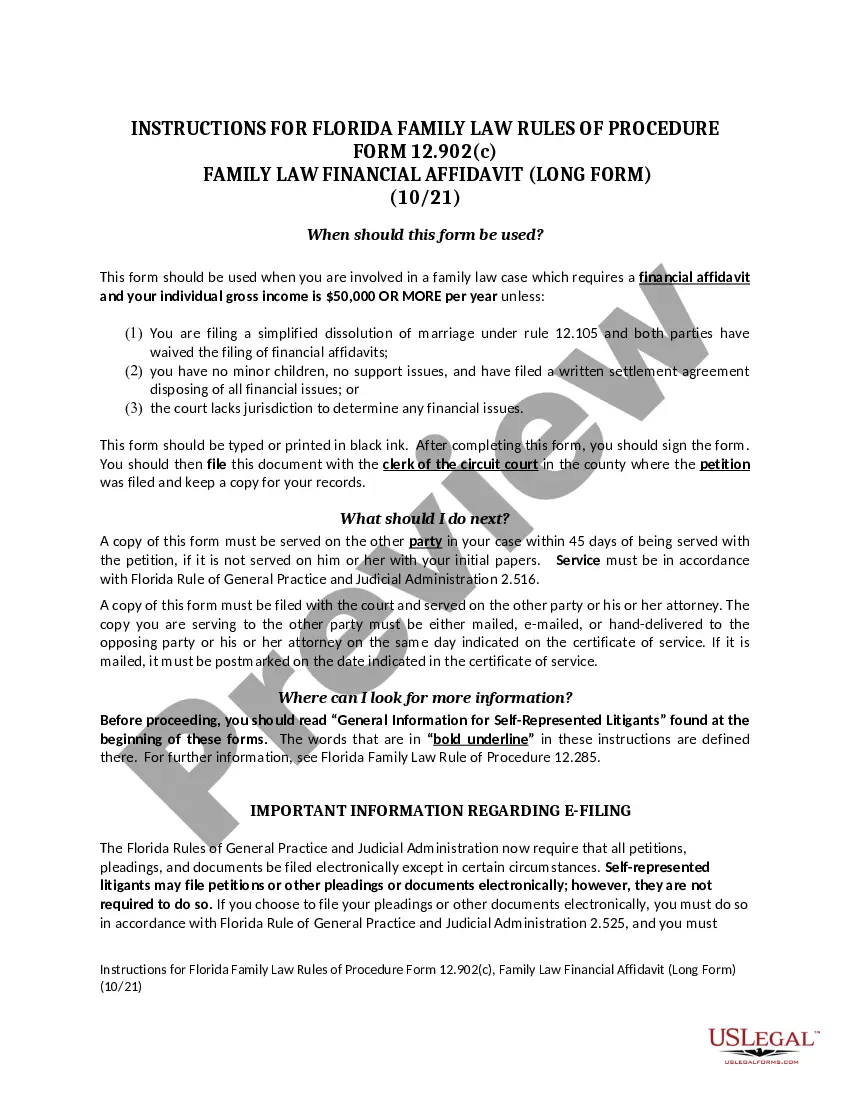

How to fill out Withdrawal Of Partner?

You can spend time online attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can download or print the Idaho Withdrawal of Partner document.

If available, use the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and hit the Obtain button.

- Then, you can complete, modify, print, or sign the Idaho Withdrawal of Partner.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

Married couples should consider filing separately when they have significant medical expenses or miscellaneous deductions. This approach can also be beneficial if one partner has substantial income and the other has none, especially during an Idaho Withdrawal of Partner. However, weigh this option carefully, as it may restrict access to certain tax benefits.

Yes, Idaho Public Employee Retirement System of Idaho (PERSI) benefits are subject to state income tax. If you’re going through an Idaho Withdrawal of Partner, it's important to account for these taxes in your financial planning. PERSI taxation can impact your overall income, which could affect decisions related to partnership dissolutions.

Yes, Idaho has an individual income tax that applies to residents and income earned in the state. This tax is relevant for individuals navigating an Idaho Withdrawal of Partner. Understanding how individual income tax works in Idaho helps ensure that you comply with state requirements during and after any partnership changes.

Filing separately as a married couple can lead to some penalties, mainly due to the loss of certain tax credits and deductions. When facing an Idaho Withdrawal of Partner, this decision becomes more significant, as it can limit benefits you might receive on shared resources. Always evaluate the pros and cons to ensure this method suits your situation.

1 form in Idaho refers to the Schedule K1, which reports income, deductions, and credits from partnerships and S corporations. If you're involved in a business partnership, understanding your K1 obligations is crucial for accurate reporting, especially during an Idaho Withdrawal of Partner. Your K1 information helps determine how much income you should report on your tax returns.

Yes, individuals can opt to file as married filing separately in Idaho. This choice may allow you to manage your tax responsibilities better, especially in cases involving an Idaho Withdrawal of Partner. Filing separately can also protect one spouse from the other’s tax liabilities. However, ensure you understand the implications it may have on tax benefits.

Yes, the registered agent can indeed be the owner of the business in Idaho. This arrangement can streamline communication and ensure timely handling of legal documents. Ensure that the owner remains available during business hours to fulfill the agent's responsibilities. For assistance with this and related issues, consider leveraging USLegalForms.

Yes, Idaho has a state withholding form that employers must file for employee wages. This form ensures that the appropriate amount of state tax is withheld from employees' paychecks. Properly completing this form is essential for compliance with state tax laws. To navigate the complexities of tax forms, including related aspects of Idaho Withdrawal of Partner, resources like USLegalForms may be beneficial.

Yes, a statutory agent can also be the owner of the business in Idaho. This can simplify the process as it centralizes legal responsibilities. However, consider the potential impacts on privacy and availability. For effective compliance and resources related to Idaho Withdrawal of Partner, explore what USLegalForms offers.

Yes, you can act as your own registered agent in Idaho. This gives you the flexibility to handle your own legal documents and correspondence. However, ensure that you are available during business hours to receive important papers. For additional resources regarding the Idaho Withdrawal of Partner process, USLegalForms can be a helpful tool.