Idaho Finders Fee Agreement

Description

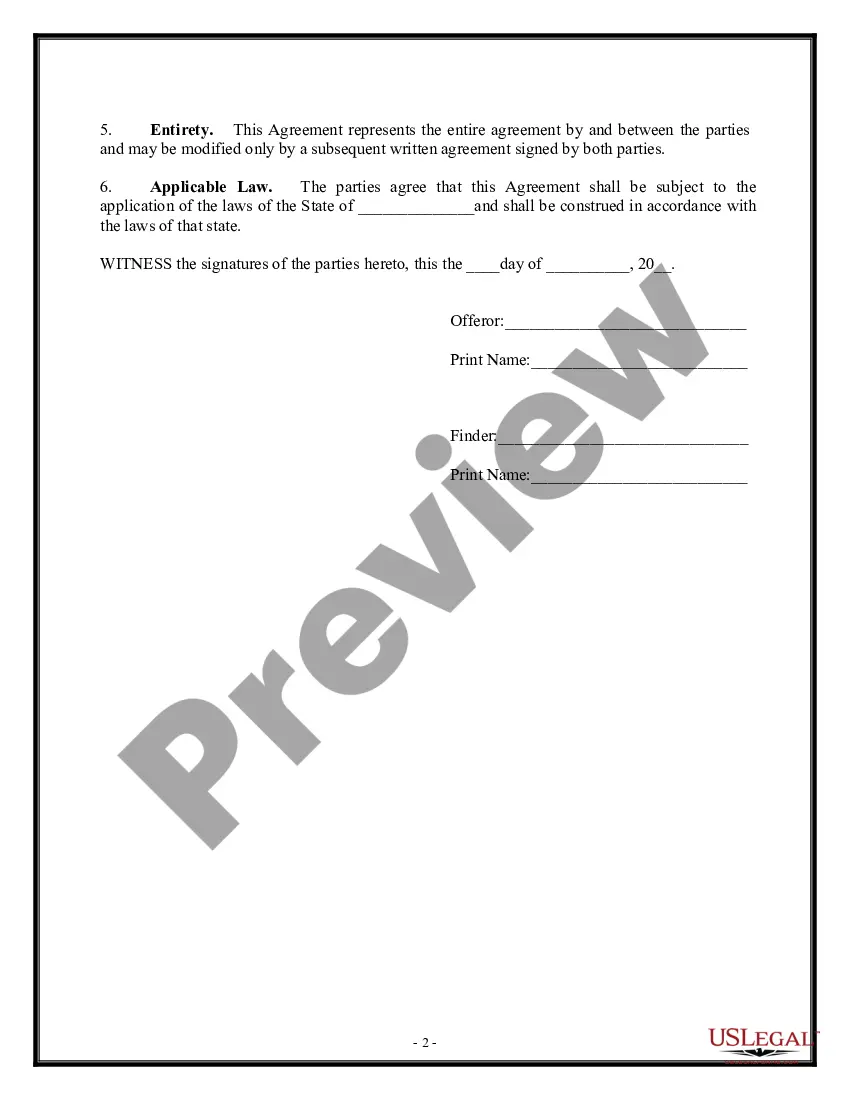

How to fill out Finders Fee Agreement?

US Legal Forms - one of the most prominent collections of legal templates in the USA - provides a range of legal document formats that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest templates like the Idaho Finders Fee Agreement in moments.

If you have a subscription, Log In and obtain the Idaho Finders Fee Agreement from the US Legal Forms library. The Download button will appear on every template you view. You can access all previously downloaded forms in the My documents section of your account.

Make modifications. Complete, edit, print, and sign the downloaded Idaho Finders Fee Agreement.

Every document you save in your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply return to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/county. Click the Review button to evaluate the form’s details. Check the form description to make sure you have chosen the appropriate document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the document, confirm your choice by clicking the Download now button. Then, choose the payment plan you prefer and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the payment.

- Select the file format and download the document to your device.

Form popularity

FAQ

The Real Estate License Law prohibits Idaho licensees from splitting fees with unlicensed persons. This prohibition means that a licensee may not pay any part of his commission, fee or other compensation to any individual or entity that does not have an active real estate license. Paying Finder's Fees.

A finder's fee isn't legally binding, so it is often simply a gift from one party to another. This is commonly seen in real estate deals. If someone is selling their home and their friend connects them with a potential buyer, the seller might give their friend a small portion of the sale when the deal is finalized.

A finder's fee is a type of cash commission paid to the coordinator or intermediary in a transaction between two other parties (a business and a potential customer). The fee rewards the finder for bringing the interested parties together and facilitating the deal.

Finder's fees are usually determined by how much money the finder's efforts bring in for the company. But a legal issue arises when the finder is not properly licensed as a broker-dealer. In that case, the finder's fee agreement "is an illegal contract and is likely unenforceable," Johnson writes for Inside Counsel.

If you paid finder's fees, you can deduct them as a business expense. Note them on line 8521 of Form T2125, Statement of Business and Professional Activities, with the rest of your advertising costs.

Payment type: While finder's fees can be money or gifts, referral fees are always monetary. Payment source: Brokers pay finders directly. For referral fees, the lead broker receives the payment first, then passes it on to the seller who pays the referrer.

Kickbacks and referral fees are essentially a hidden markup on the product or service. If they are not disclosed, they have the great potential of violating trust between the referrer and the individual being referred.

The terms of finder's fees can vary greatly, with some citing 5% to 35% of the total value of the deal being used as a benchmark. It's a staple of Fundera's business model. In many cases, the finder's fee may simply be a gift from one party to another, as no legal obligation to pay a commission exists.

A Finder's Fee Agreement outlines the relationship and the compensation to be expected in a relationship where an incentive is being offered in exchange for new leads or clients. Documenting your arrangement on paper helps ensure that the interests of both parties are laid out in certain terms.

The terms of finder's fees can vary greatly, with some citing 5% to 35% of the total value of the deal being used as a benchmark. It's a staple of Fundera's business model. In many cases, the finder's fee may simply be a gift from one party to another, as no legal obligation to pay a commission exists.