Idaho Pledge of Shares of Stock

Description

How to fill out Pledge Of Shares Of Stock?

Finding the appropriate legal document template can be challenging.

Certainly, there is an array of templates available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a multitude of templates, such as the Idaho Pledge of Shares of Stock, suitable for both business and personal requirements.

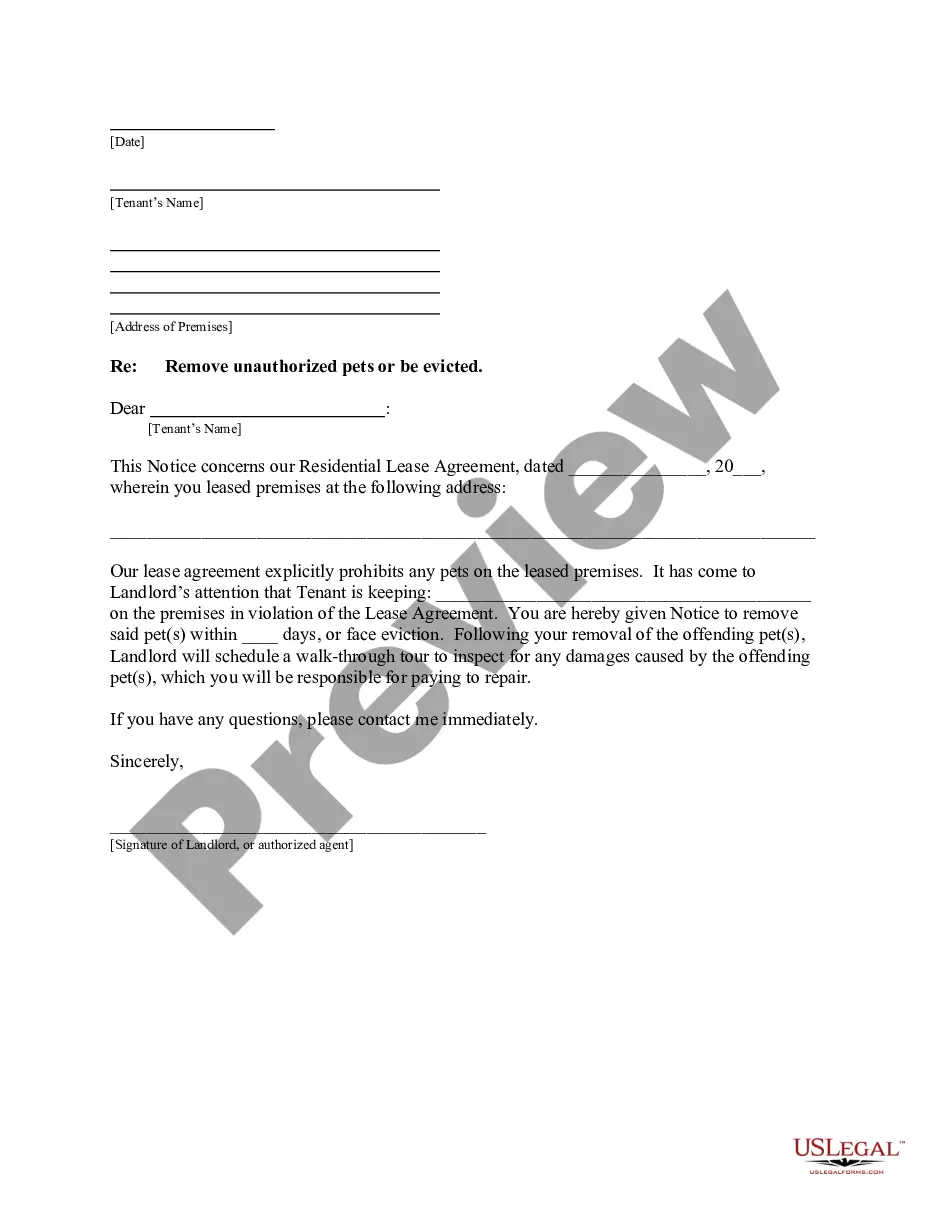

You can review the form using the Preview option and read the form summary to ensure it meets your needs.

- All forms are reviewed by experts and comply with federal and state standards.

- If you are already a member, Log In to your account and select the Download option to obtain the Idaho Pledge of Shares of Stock.

- Use your account to search through the legal forms you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, below are simple steps for you to follow.

- First, confirm that you have chosen the correct form for the specific city/county.

Form popularity

FAQ

Perfecting a lien on stock requires you to establish legal documentation that recognizes the lien's rights. This involves completing a stock pledge agreement and notifying the stock issuer, ensuring that they acknowledge the lien. Properly perfecting the lien secures your rights and protects your interests in any potential default situations.

To pledge your shares, start by drafting a stock pledge agreement that clearly outlines the terms of the pledge. After both parties sign this agreement, you may need to notify the company holding your shares. If you are unsure about the process, platforms like uslegalforms can provide templates and guidance to help you through the necessary steps.

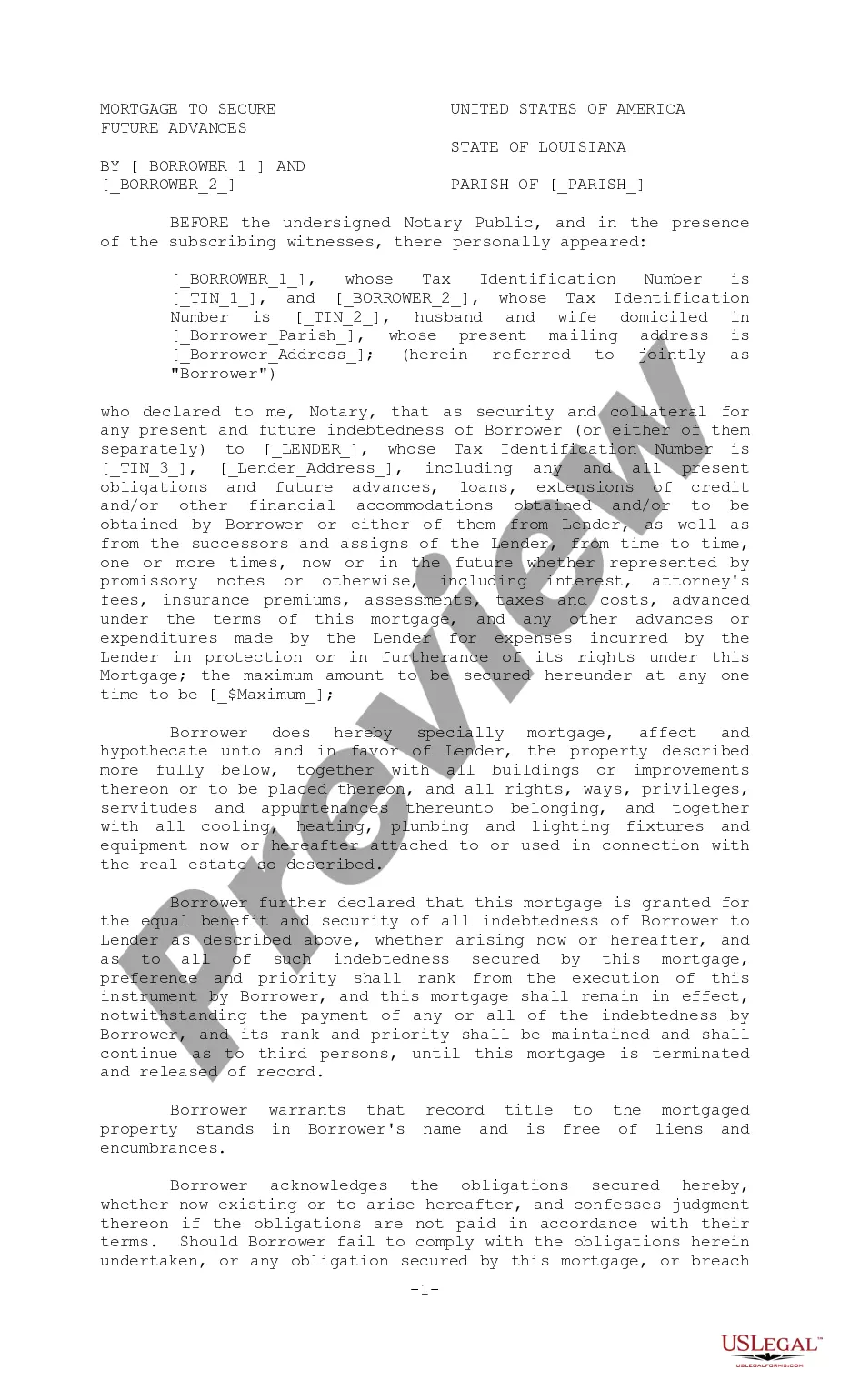

Perfecting a stock pledge involves a few key steps. First, you need to create a legally sound pledge agreement detailing the shares involved and the obligations tied to them. Next, you should consider notifying the issuer of the shares and filing any necessary documentation to establish legal rights in the event of default.

To perfect a stock pledge, you must follow legal steps to establish the lender's claim to the pledged shares. This usually involves transferring rights to the lender, which can often include notifying the company that issues the shares. It's essential to properly execute the stock pledge agreement to ensure it's enforceable.

If you decide not to pledge your shares, you retain full control and ownership without encumbrance. However, not pledging can limit your ability to secure financing or fulfill certain financial obligations. Consider using the Idaho Pledge of Shares of Stock if you need to leverage your assets for better financial opportunities.

Yes, you typically receive dividends on your pledged shares unless your stock pledge agreement states otherwise. The dividends continue to belong to you since you maintain ownership of the shares. However, be sure to review your specific agreement to understand any unique conditions related to dividends.

In Idaho, felony theft occurs when an individual steals property valued at $1,000 or more. This means that if the stolen goods fall within this value range, it triggers serious legal consequences. Such matters can also intersect with financial assets, such as the Idaho Pledge of Shares of Stock, highlighting the importance of legal diligence. To protect your rights and assets, consider using resources available on the US Legal Forms platform to stay informed and prepared.

Spousal abandonment in Idaho typically refers to one partner leaving the marital home without just cause and without the consent of the other spouse. Such abandonment can affect legal matters, including division of assets such as stock pledges, like the Idaho Pledge of Shares of Stock. If you find yourself in this situation, it is advisable to seek legal guidance to understand your rights and options. The US Legal Forms platform offers valuable resources to help you manage your legal journey effectively.

Idaho Code 30 30 505 relates to the procedures for issuing stock certificates and making stock transfers in Idaho. It serves as a crucial reference for investors looking to understand their rights and responsibilities when engaging in the Idaho Pledge of Shares of Stock. Having clarity on this code helps streamline transactions and minimizes disputes. For assistance, explore US Legal Forms to find relevant templates and forms that simplify your stock-related needs.

Idaho Code 30 30 508 pertains to the rules governing the transfer of shares of stock within a corporation. This code outlines the legal framework for how stock can be pledged as collateral, ensuring that the Idaho Pledge of Shares of Stock serves properly in financial transactions. Understanding this code can help you navigate legal obligations and protect your financial interests in Idaho. For comprehensive support, consider using the US Legal Forms platform to access detailed documents related to this code.