A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

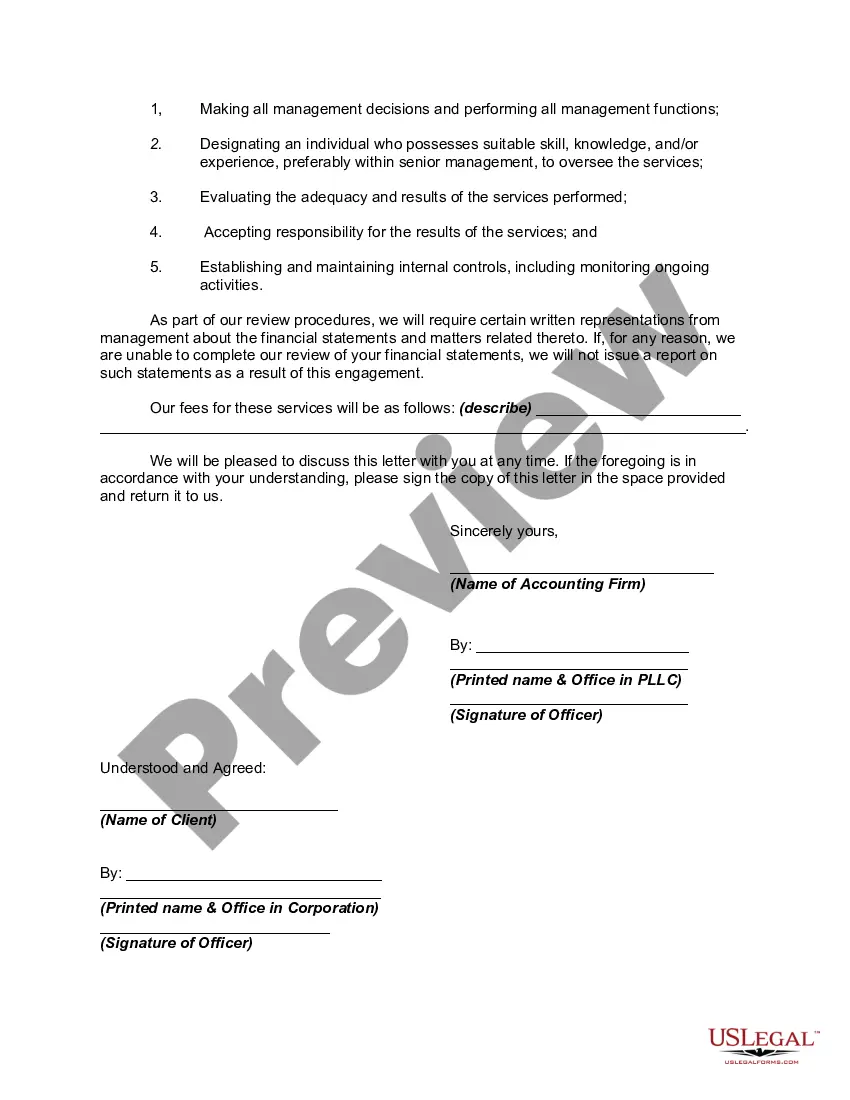

An Idaho engagement letter for the review of financial statements by an accounting firm is a crucial document that outlines the terms and conditions under which the firm will perform the review engagement for a client's financial statements. This letter serves as a legally binding agreement that ensures both parties understand their responsibilities and expectations throughout the review process. Here are some essential details often included in an Idaho engagement letter for the review of financial statements: 1. Introduction: The engagement letter begins with a formal introduction, stating the name and contact information of the accounting firm and the client. It also establishes the purpose of the letter, which is to define the terms of the review engagement. 2. Objectives and Scope: This section outlines the objectives of the review engagement, such as expressing limited assurance on the financial statements in accordance with applicable professional standards. It defines the scope of the engagement, specifying which periods will be covered and the level of detail required. 3. Responsibilities: The engagement letter outlines the responsibilities of both the accounting firm and the client. The firm's responsibilities typically include conducting the review in accordance with professional standards, assessing the appropriateness of accounting policies used, and forming conclusions based on the review procedures performed. The client's responsibilities may include providing accurate and complete financial records, giving access to all necessary information and personnel, and supplying any additional documentation required. 4. Independence: To ensure objectivity and independence, the engagement letter usually mentions that the accounting firm must be independent of the client and any conflicts of interest should be disclosed promptly. 5. Fees and Payment Terms: This section details the fees for the review engagement, whether they will be billed on an hourly basis or a fixed fee, and the payment terms and due dates. 6. Reporting: The engagement letter specifies the form of the accountant's report and to whom it will be addressed, such as the client's management or the board of directors. It states that the report will contain the accountant's conclusions based on the review procedures performed. Different types of engagement letters for the review of financial statements may vary depending on the specific circumstances or requirements. Some additional types might include: 1. Specific Industry Engagement Letter: This type of engagement letter may be tailored to fit the review engagement requirements for specific industries, such as healthcare, manufacturing, or nonprofit organizations. 2. Non-Assurance Review Engagement Letter: In some cases, clients may only need a non-assurance review, where the accountant performs review procedures but does not provide any assurance or express any conclusion on the financial statements. This engagement letter would reflect the limited scope of the engagement. Overall, an Idaho engagement letter for the review of financial statements by an accounting firm is a critical document that establishes the relationship and expectations between the firm and the client during the review engagement process. It aims to ensure transparency, professionalism, and the adherence to professional standards while providing valuable insights into the accuracy and reliability of the reviewed financial statements.An Idaho engagement letter for the review of financial statements by an accounting firm is a crucial document that outlines the terms and conditions under which the firm will perform the review engagement for a client's financial statements. This letter serves as a legally binding agreement that ensures both parties understand their responsibilities and expectations throughout the review process. Here are some essential details often included in an Idaho engagement letter for the review of financial statements: 1. Introduction: The engagement letter begins with a formal introduction, stating the name and contact information of the accounting firm and the client. It also establishes the purpose of the letter, which is to define the terms of the review engagement. 2. Objectives and Scope: This section outlines the objectives of the review engagement, such as expressing limited assurance on the financial statements in accordance with applicable professional standards. It defines the scope of the engagement, specifying which periods will be covered and the level of detail required. 3. Responsibilities: The engagement letter outlines the responsibilities of both the accounting firm and the client. The firm's responsibilities typically include conducting the review in accordance with professional standards, assessing the appropriateness of accounting policies used, and forming conclusions based on the review procedures performed. The client's responsibilities may include providing accurate and complete financial records, giving access to all necessary information and personnel, and supplying any additional documentation required. 4. Independence: To ensure objectivity and independence, the engagement letter usually mentions that the accounting firm must be independent of the client and any conflicts of interest should be disclosed promptly. 5. Fees and Payment Terms: This section details the fees for the review engagement, whether they will be billed on an hourly basis or a fixed fee, and the payment terms and due dates. 6. Reporting: The engagement letter specifies the form of the accountant's report and to whom it will be addressed, such as the client's management or the board of directors. It states that the report will contain the accountant's conclusions based on the review procedures performed. Different types of engagement letters for the review of financial statements may vary depending on the specific circumstances or requirements. Some additional types might include: 1. Specific Industry Engagement Letter: This type of engagement letter may be tailored to fit the review engagement requirements for specific industries, such as healthcare, manufacturing, or nonprofit organizations. 2. Non-Assurance Review Engagement Letter: In some cases, clients may only need a non-assurance review, where the accountant performs review procedures but does not provide any assurance or express any conclusion on the financial statements. This engagement letter would reflect the limited scope of the engagement. Overall, an Idaho engagement letter for the review of financial statements by an accounting firm is a critical document that establishes the relationship and expectations between the firm and the client during the review engagement process. It aims to ensure transparency, professionalism, and the adherence to professional standards while providing valuable insights into the accuracy and reliability of the reviewed financial statements.