Idaho Summary of Account for Inventory of Business is a detailed document that provides comprehensive information about the inventory of a business located in Idaho. This summary serves as an essential tool for monitoring and managing the stock of goods or products that a business holds. Keywords: Idaho, Summary of Account, Inventory of Business. The Idaho Summary of Account for Inventory of Business includes the following essential details: 1. Business Information: This section includes the name, address, and contact information of the business. It provides a clear identification of the company to which the inventory belongs. 2. Inventory Description: A detailed description of the inventory items is provided. This includes information such as product names, item numbers, SKU (Stock Keeping Unit) codes, and any other unique identifiers that help in identifying the items accurately. 3. Quantity: The summary lists the quantity of each item present in the inventory. This is crucial for determining the availability and stock levels of each product. 4. Unit Cost: The unit cost of each item is mentioned. This value represents the cost at which a single unit of an item was acquired or produced. 5. Total Value: The summary calculates the total value of each inventory item by multiplying the quantity with the unit cost. This gives an overall value of the inventory, providing an idea of the financial worth of the stock. 6. Categorization: If there are different types of inventory in the business, the summary may categorize items based on their nature, such as raw materials, finished goods, work-in-progress, or spare parts. This categorization can help businesses understand their inventory composition and make informed decisions accordingly. 7. Valuation Method: The summary may also mention the valuation method used to calculate the inventory value, such as FIFO (first-in, first-out), LIFO (last-in, first-out), or weighted average method. This valuation method impacts the calculation of the inventory's cost and value. Different types of Idaho Summary of Account for Inventory of Business may exist, depending on the specific requirements of the businesses. Some variations could include: 1. Annual Idaho Summary of Account: This type of summary provides a comprehensive overview of the inventory's status at the end of the fiscal year. It is helpful for accounting and financial purposes, including tax filings. 2. Monthly Idaho Summary of Account: A monthly summary provides more frequent updates on the inventory, enabling businesses to closely monitor their stock levels, identify trends, and make necessary adjustments in their operations. 3. Perpetual Idaho Summary of Account: A perpetual summary offers real-time tracking of inventory, continuously updating the stock quantities and values. It requires advanced inventory management systems and helps in efficient inventory control and reordering. In conclusion, the Idaho Summary of Account for Inventory of Business is a crucial document that provides detailed information about a business's inventory in Idaho. It includes various key elements such as inventory description, quantity, unit cost, total value, categorization, and valuation method. It serves as a valuable tool for businesses to manage their inventory effectively and make informed decisions regarding purchasing, stocking, and sales strategies.

Idaho Summary of Account for Inventory of Business

Description

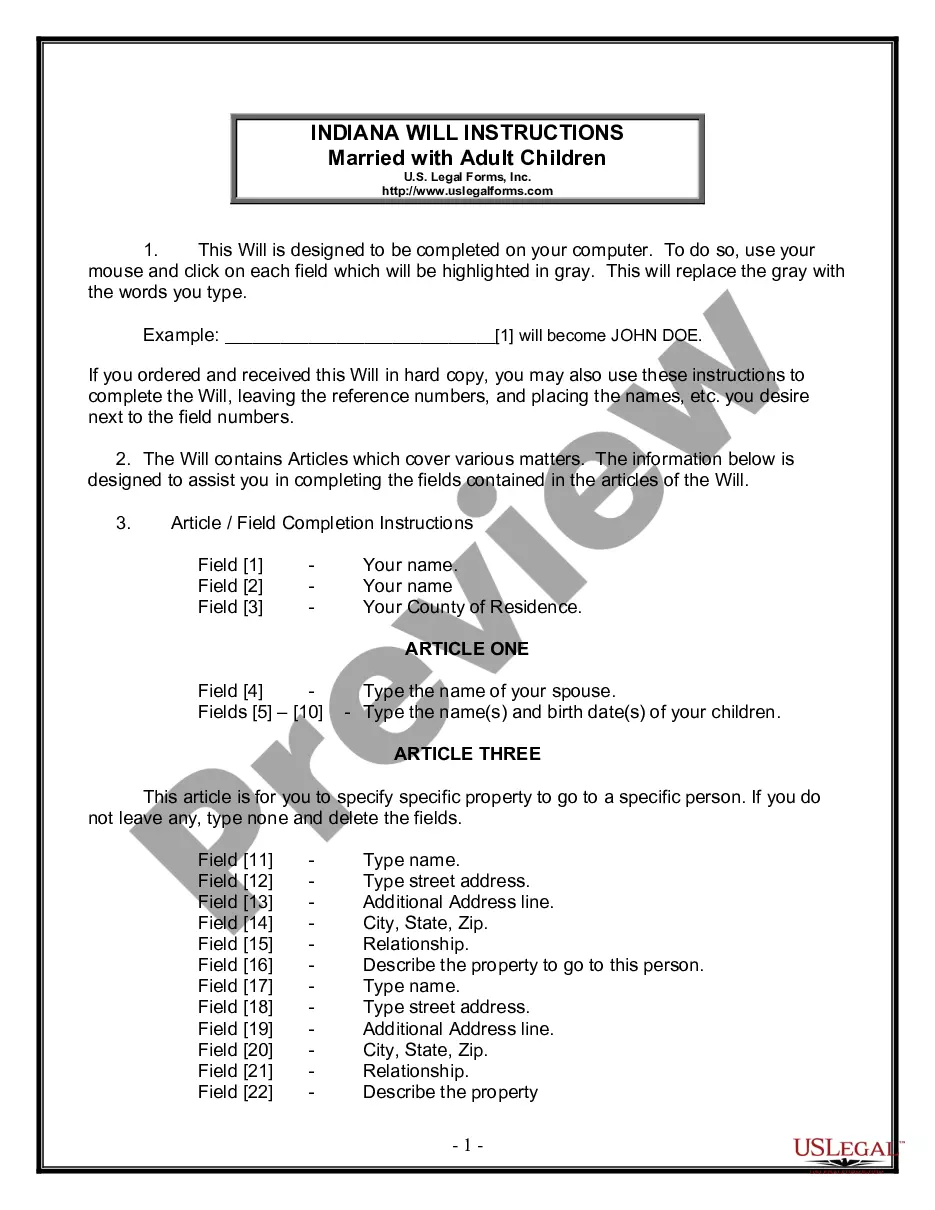

How to fill out Idaho Summary Of Account For Inventory Of Business?

US Legal Forms - one of several greatest libraries of legal types in the USA - gives a wide array of legal record web templates it is possible to acquire or print out. Utilizing the site, you will get a large number of types for enterprise and person reasons, categorized by categories, states, or search phrases.You will discover the most up-to-date types of types much like the Idaho Summary of Account for Inventory of Business in seconds.

If you already have a subscription, log in and acquire Idaho Summary of Account for Inventory of Business through the US Legal Forms catalogue. The Obtain key can look on each kind you see. You get access to all previously downloaded types from the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed here are simple instructions to help you get began:

- Make sure you have picked the right kind for your city/county. Click on the Preview key to check the form`s content. Browse the kind information to actually have selected the correct kind.

- In the event the kind does not fit your demands, take advantage of the Look for industry near the top of the display to get the the one that does.

- Should you be happy with the shape, verify your selection by visiting the Acquire now key. Then, pick the costs plan you want and give your credentials to sign up for the bank account.

- Process the transaction. Make use of your bank card or PayPal bank account to complete the transaction.

- Pick the structure and acquire the shape on your product.

- Make changes. Complete, change and print out and signal the downloaded Idaho Summary of Account for Inventory of Business.

Every single template you added to your money lacks an expiry particular date and is your own property for a long time. So, if you wish to acquire or print out an additional version, just visit the My Forms portion and click on in the kind you need.

Gain access to the Idaho Summary of Account for Inventory of Business with US Legal Forms, one of the most considerable catalogue of legal record web templates. Use a large number of skilled and condition-certain web templates that satisfy your company or person needs and demands.

Form popularity

FAQ

An LLC can also elect S Corporation status. Many businesses do this for tax purposes. Usually, LLCs and sole proprietorships will pay self-employment taxes on net earnings. However, with an S Corporation, you may be able to avoid self-employment taxes if you pay yourself a reasonable salary.

With an LLC, anyone can be a member, or owner, of the business. State PLLC laws often provide that only licensed professionals can be members, or that a certain number of members must be licensed professionals. A PLLC cannot be used to shield the members from claims for malpractice.

The Limited Liability Company (LLC) has some of the characteristics of a sole proprietorship, some of a partnership, and some of a corporation. An LLC may, for tax purposes, be disregarded, be taxed like a partnership or taxed like a corporation (Idaho Code 63-3006A). The LLC has members rather than shareholders.

Legal Requirements: All businesses, including home-based ones, need to register their name and entity type with the Idaho Secretary of State's office. The exception is sole proprietorships that use the owner's full name in the business name.

Why Create an Idaho LLC? Create, manage, regulate, administer and stay in compliance easily. Easily file your taxes and discover potential advantages for tax treatment. Protect your personal assets from your business liability and debts. Low cost to file ($100)

Use Form 41S to amend your Idaho income tax return. Make sure you check the Amended Return box and enter the reason for amending. If you amend your federal return, you also must file an amended Idaho income tax return.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Idaho LLC net income must be paid just as you would with any self-employment business.

An LLC has pros such as flow-through taxation and limited liability protection. However, there are also disadvantages such as the legal process of ?piercing the corporate veil? and being forced to dissolve the LLC if a member leaves.