A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Idaho Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

You might spend countless hours online looking for the legal document outline that meets the federal and state requirements you seek.

US Legal Forms offers thousands of legal templates that are vetted by professionals.

You can download or print the Idaho Transmutation or Postnuptial Agreement to Transform Community Property into Separate Property from my service.

If available, use the Preview option to review the document template as well.

- If you have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can fill out, modify, print, or sign the Idaho Transmutation or Postnuptial Agreement to Transform Community Property into Separate Property.

- Every legal document template you receive is yours permanently.

- To obtain another copy of any form you have acquired, visit the My documents section and select the respective option.

- If you are accessing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the right document template for the county/city of your choice.

- Review the form description to confirm that you have selected the correct one.

Form popularity

FAQ

Code 32-906 in Idaho outlines the rules related to property distribution during divorce proceedings. This statute emphasizes the division of community property and the ability to convert it into separate property through legal agreements. Utilizing an Idaho Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is an essential strategy for individuals who want to protect their assets in alignment with this code.

Idaho does not recognize common law marriage. Instead, couples need to establish legal recognition through a formal marriage ceremony. If you are considering how to manage property ownership, an Idaho Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property provides a solid framework to maintain individual rights, regardless of the marriage status.

Joint family property refers to assets acquired by both spouses during their marriage, which are considered shared ownership. In contrast, separate property includes assets that one spouse owns individually, often acquired before the marriage or through inheritance. Understanding the distinction is essential for those considering an Idaho Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, as it can help clarify ownership and rights.

A transmutation agreement serves to clarify and define the ownership of property between spouses, ensuring transparency and reducing potential future disputes. By formally converting community property into separate property, couples can protect their assets. Utilizing a postnuptial agreement is an effective strategy to solidify these intentions legally.

The transmutation rule in Idaho allows couples to change the classification of their property from community to separate. This process can help manage assets more effectively, especially if spouses desire clarity on ownership. A well-drafted Idaho Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can facilitate this transition.

Separate property in Idaho refers to assets owned by one spouse prior to marriage or received as a gift or inheritance. This designation helps define which assets are not subject to division upon divorce. Understanding the difference between community property and separate property can significantly impact financial decisions and estate planning.

A postnuptial agreement in Idaho cannot include provisions regarding child custody or child support. Additionally, it should not promote illegal activities or terms that violate public policy. Importantly, both spouses must enter into the agreement willingly and without undue pressure, ensuring equity in the arrangement.

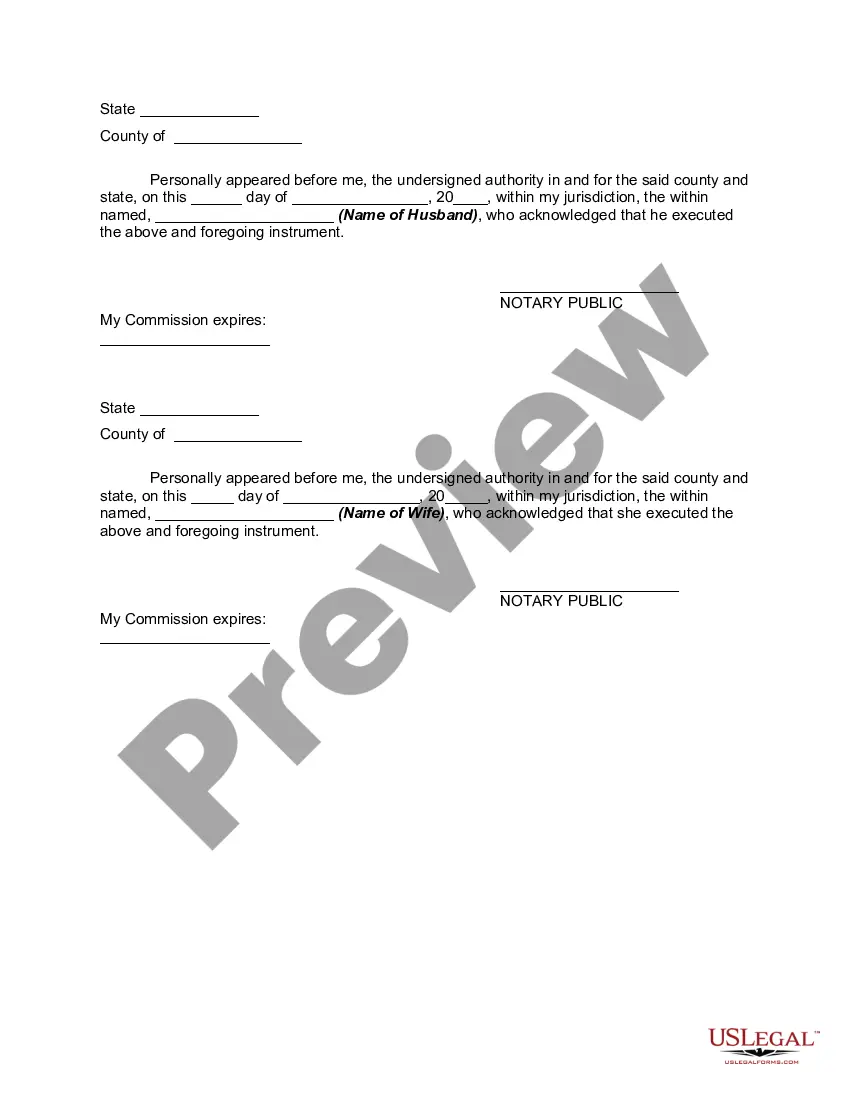

To create a postnuptial agreement in Idaho, both spouses must agree on the terms they want to include. Start by outlining how you want to convert community property into separate property. It’s essential to draft the agreement in writing and have it reviewed by an attorney to ensure it meets Idaho state laws. Finally, sign the agreement in front of a notary public for validation.

In Idaho, a spouse may not take their partner's house unless it is classified as community property. However, if the property is sole and separate, you cannot claim it without an agreement. It's wise to seek legal options like an Idaho Transmutation or Postnuptial Agreement to clearly define property rights and avoid disputes during divorce proceedings.

'As her sole and separate property' indicates that an asset is owned exclusively by one spouse and is not subject to division in the event of a divorce. This designation is crucial in protecting individual assets. By utilizing an Idaho Transmutation or Postnuptial Agreement, you can formalize arrangements about how property is categorized, reinforcing its status as separate.