Idaho Agreement for Sale of Goods Evidenced by Payment

Description

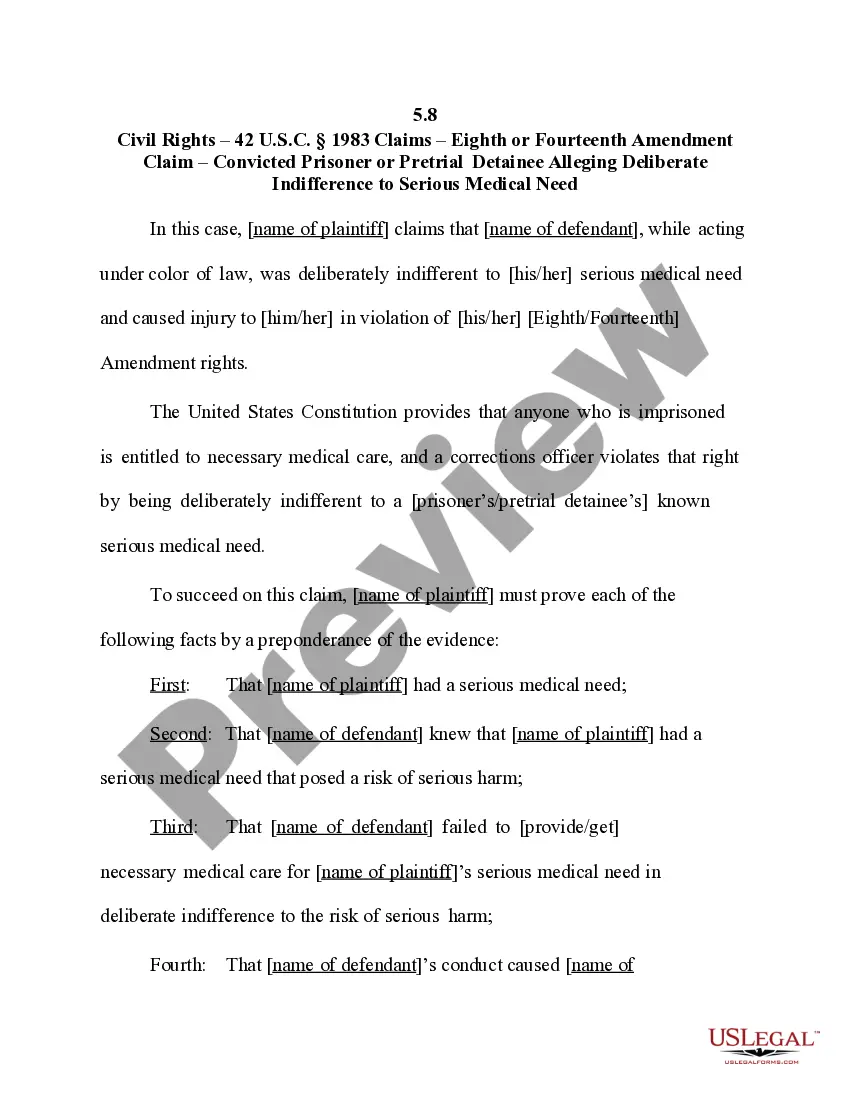

How to fill out Agreement For Sale Of Goods Evidenced By Payment?

Are you presently in the position where you need files for sometimes enterprise or specific purposes virtually every working day? There are plenty of legal file themes available on the net, but locating versions you can rely isn`t easy. US Legal Forms gives 1000s of type themes, like the Idaho Agreement for Sale of Goods Evidenced by Payment, which are composed to satisfy state and federal needs.

In case you are previously informed about US Legal Forms website and get a free account, just log in. After that, you may acquire the Idaho Agreement for Sale of Goods Evidenced by Payment format.

Unless you come with an accounts and want to start using US Legal Forms, adopt these measures:

- Obtain the type you will need and make sure it is for the correct area/region.

- Utilize the Review switch to examine the form.

- Look at the outline to actually have chosen the appropriate type.

- If the type isn`t what you are searching for, take advantage of the Lookup discipline to find the type that fits your needs and needs.

- When you find the correct type, click Get now.

- Choose the prices strategy you would like, fill in the specified info to generate your money, and pay for an order with your PayPal or Visa or Mastercard.

- Decide on a practical document format and acquire your duplicate.

Discover each of the file themes you possess purchased in the My Forms menu. You can get a more duplicate of Idaho Agreement for Sale of Goods Evidenced by Payment anytime, if needed. Just go through the required type to acquire or print out the file format.

Use US Legal Forms, the most substantial variety of legal kinds, to conserve time as well as stay away from faults. The services gives appropriately produced legal file themes that you can use for a variety of purposes. Generate a free account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

28-43-402. Buyer's right to cancel. (1) In addition to any right otherwise to revoke an offer, the buyer may cancel a home solicitation sale until midnight of the third business day after the day on which the buyer signs an agreement or offer to purchase which complies with this part 4.

Search Idaho Statutes (c) If so agreed, and in any event after default, a secured party may require the debtor to assemble the collateral and make it available to the secured party at a place to be designated by the secured party which is reasonably convenient to both parties.

Idaho's prompt payment laws only regulate payments from the public entity to the prime contractor. Once the prime has submitted a proper payment request, the public entity must accept, certify, and pay within 60 calendar days of receipt. However, this deadline may be modified by the contract between the parties.

(1) An action for breach of any contract for sale must be commenced within four (4) years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one (1) year but may not extend it.

(b) Any person required under this act to collect, account for and pay over any tax imposed by this act, who wilfully fails to collect or truthfully account for and pay over such tax, and any person who wilfully attempts in any manner to evade or defeat any tax imposed by this act or the payment thereof, shall, in ...

For collection of a debt on an account, where there is an agreement in writing, the statute of limitations is five years. (Refer to §5-216.) For collection of a debt on an account, where there is an oral agreement, the statute of limitations is four years. (Refer to §5-217.)

18-8201. Money laundering and illegal investment ? Penalty ? Restitution.

28-2-607. Effect of acceptance ? Notice of breach ? Burden of establishing breach after acceptance ? Notice of claim or litigation to person answerable over. (1) The buyer must pay at the contract rate for any goods accepted.