In most states a certificate or memorandum of a trust agreement which conveys or entrusts an interest in real property may be recorded with the land records clerk of the appropriate county in lieu of the entire trust agreement. The certificate must be executed by the trustee and it must contain the following: (a) the name of the trust; (b) the street and mailing address of the office, and the name and street and mailing address of the trustee; (c) the name and street and mailing address of the trustor or grantor; (d) a legally sufficient description of all interests in real property owned by or conveyed to the trust; (e) the anticipated date of termination of the trust; and (f) the general powers granted to the trustee.

Idaho Certificate or Memorandum of Trust Agreement

Description

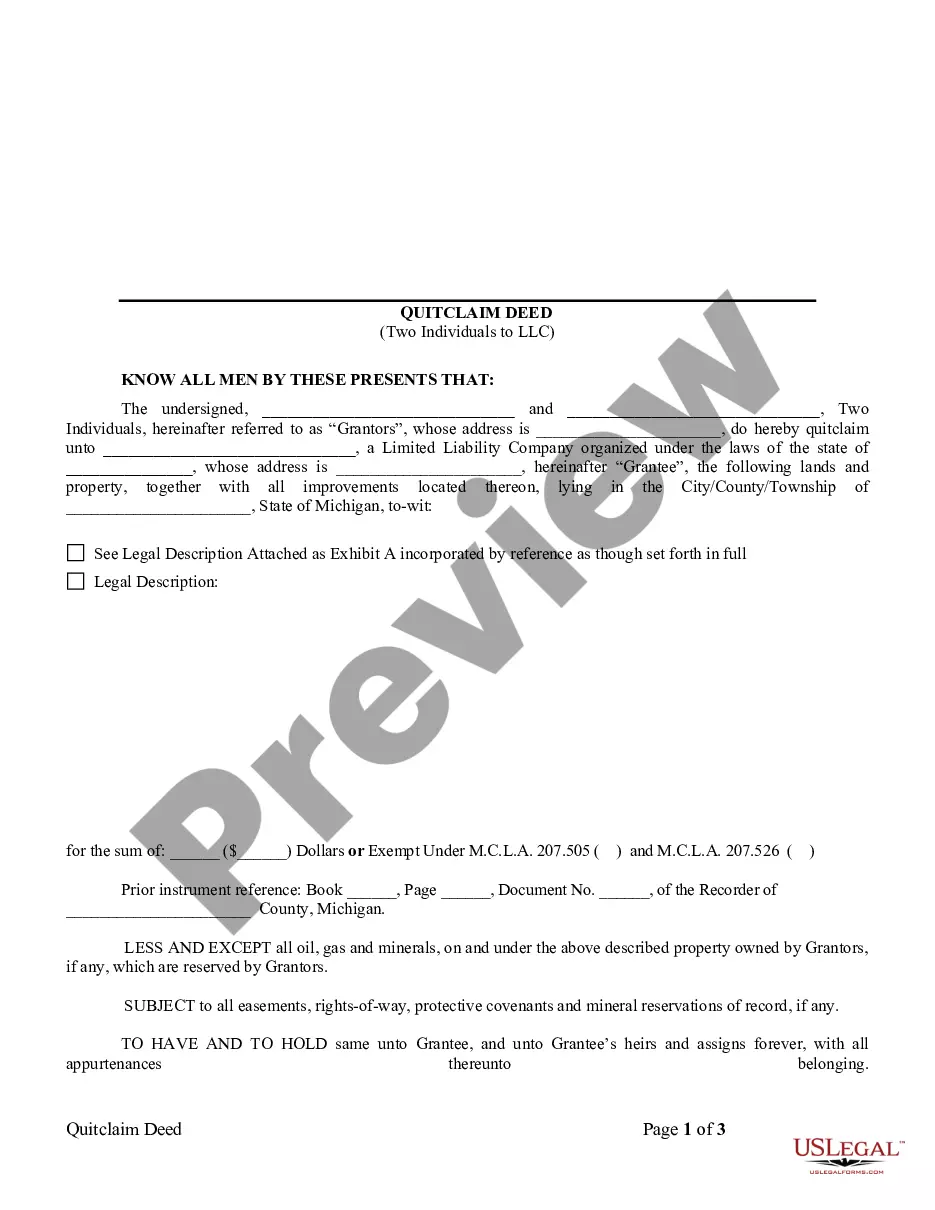

How to fill out Certificate Or Memorandum Of Trust Agreement?

If you wish to comprehensive, acquire, or print out authorized record themes, use US Legal Forms, the biggest collection of authorized forms, which can be found online. Utilize the site`s basic and hassle-free research to obtain the documents you require. Numerous themes for company and personal reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to obtain the Idaho Certificate or Memorandum of Trust Agreement in a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in for your profile and click on the Download key to obtain the Idaho Certificate or Memorandum of Trust Agreement. Also you can access forms you earlier downloaded from the My Forms tab of your profile.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the right metropolis/region.

- Step 2. Take advantage of the Review method to look through the form`s content. Do not forget about to learn the outline.

- Step 3. In case you are unsatisfied with all the type, utilize the Research field near the top of the display to find other variations in the authorized type template.

- Step 4. Once you have found the shape you require, click on the Buy now key. Opt for the costs strategy you like and add your accreditations to sign up to have an profile.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal profile to accomplish the transaction.

- Step 6. Select the formatting in the authorized type and acquire it in your device.

- Step 7. Full, change and print out or signal the Idaho Certificate or Memorandum of Trust Agreement.

Every single authorized record template you purchase is yours permanently. You possess acces to each type you downloaded in your acccount. Click the My Forms portion and select a type to print out or acquire once more.

Contend and acquire, and print out the Idaho Certificate or Memorandum of Trust Agreement with US Legal Forms. There are many skilled and status-distinct forms you can use for the company or personal demands.

Form popularity

FAQ

The cost of creating a will in Idaho can range from roughly $350 to $1,150. A Idaho trust typically costs anywhere between $1,150 and $3,950. At Snug, any member can create a Power of Attorney and Health Care Directive for free.

Duty to register trusts. The trustee of a trust having its principal place of administration in this state shall register the trust in the court of this state at the principal place of administration.

Four Reasons You Don't Need a (Revocable) Trust Probate avoidance is the only goal. While this is an admirable goal, a trust may not be the only way to avoid probate. ... You have straightforward wishes. ... You're motivated by tax savings or Medicaid eligibility. ... You're not great at follow-through.

All of your plans remain private. The trust also gives you total control of your assets during your life as well as after your death. While you are alive, you continue to manage and use your assets with no change. After your death, you can continue to control them through the terms of the trust.

To create a living trust in Idaho, you create and then sign a declaration of trust in front of a notary. You then transfer ownership of assets into the trust to fund it. At this point it becomes effective. A revocable living trust offers a variety of benefits that may appeal to you and fill your needs.

Most people don't have to worry about that. Because of this, most people under current law do not need a trust. However, even if you don't have a large estate, there may still be a need for a trust as part of your estate planning. You do need a trust if you have children who are under the age of 18.

Trusts Can Avoid Probate A trust is an effective tool to avoid probate in Idaho. A trust can hold virtually any asset, including real property, bank accounts, and vehicles. A valid trust will transfer ownership of your property to yourself as the trustee.

(1) A trustee may present a certification of trust to any person in lieu of a copy of any trust instrument to establish the existence or terms of the trust. The trustee may present the certification voluntarily or at the request of the person with whom he is dealing.