Idaho Subcontractor Agreement for Insurance

Description

How to fill out Subcontractor Agreement For Insurance?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal templates that you can obtain or print.

By utilizing the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the latest templates like the Idaho Subcontractor Agreement for Insurance in moments.

If you already have a monthly membership, Log In and retrieve the Idaho Subcontractor Agreement for Insurance from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously acquired documents in the My documents section of your account.

Select the format and download the form to your device.

Edit. Fill out, modify, print, and sign the acquired Idaho Subcontractor Agreement for Insurance. Each template added to your account does not expire and is yours indefinitely. Therefore, if you need to obtain or print another copy, simply navigate to the My documents section and click on the document you require.

- Ensure you have selected the appropriate form for your locality/region. Click the Review button to examine the content of the form.

- Review the details of the form to make sure you have chosen the correct one.

- If the form does not meet your requirements, use the Search box located at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and enter your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

Setting up an independent contractor agreement involves a few key steps. First, define the scope of work clearly and outline payment terms. Next, include any relevant clauses related to confidentiality or liability, ideally using an Idaho Subcontractor Agreement for Insurance as a template. Utilizing platforms like USLegalForms can simplify this process, ensuring you create an agreement that meets legal standards and protects your interests.

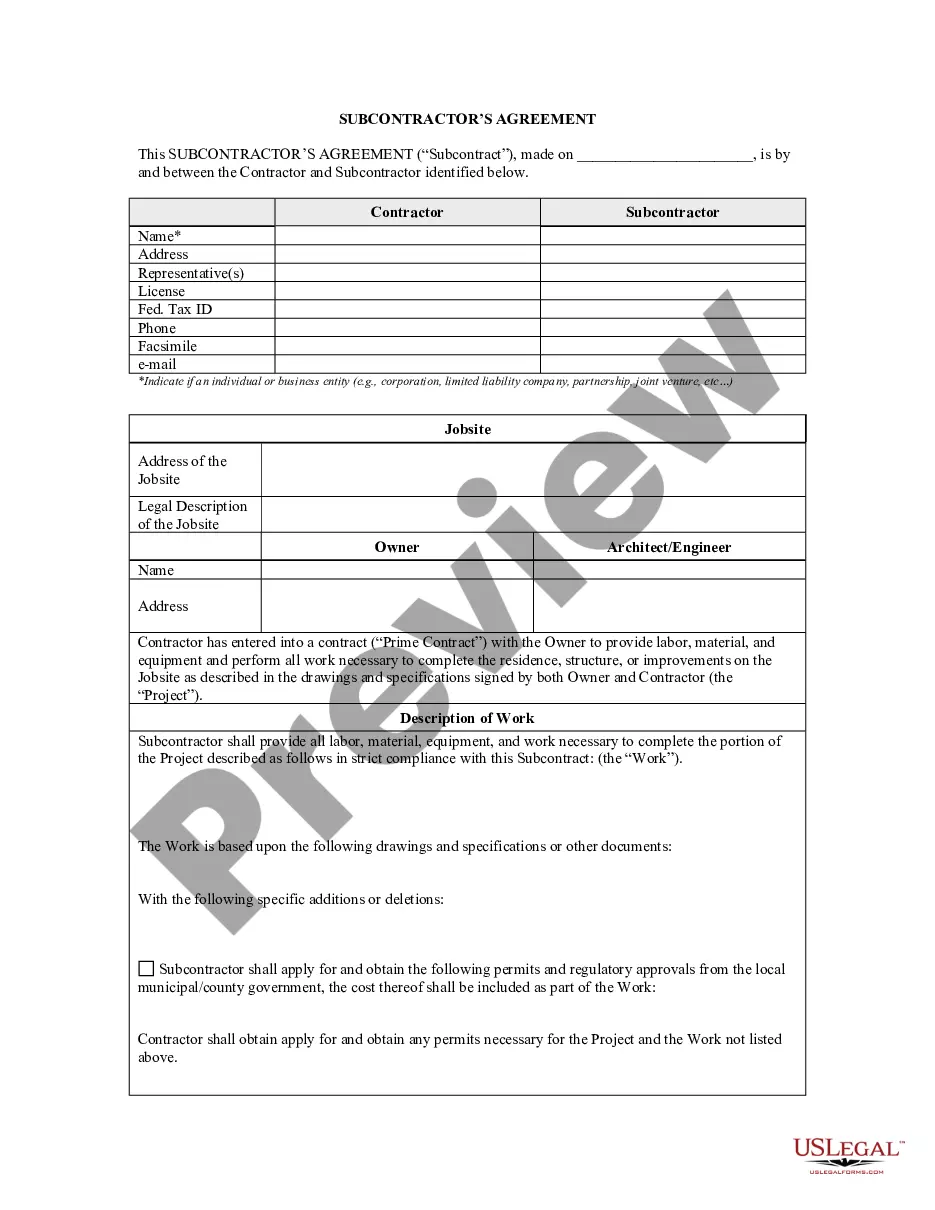

A subcontractor agreement is a formal document that outlines the terms of the working relationship between a contractor and a subcontractor. This agreement typically specifies the scope of work, payment terms, and responsibilities of each party. Having a well-drafted Idaho Subcontractor Agreement for Insurance can protect both parties by delineating expectations and safeguarding interests. It serves as a foundation for successful collaboration and project execution.

In Idaho, subcontractors generally must have a license if the work they perform exceeds a certain monetary threshold. Understanding the requirements of the Idaho Subcontractor Agreement for Insurance is essential for compliance. Always check local regulations to ensure you meet all necessary licensing obligations. This proactive step helps you avoid potential legal issues and secures your business operations.

Subcontractor default insurance acts as a safety net when a subcontractor fails to meet its obligations. If a subcontractor defaults, this insurance helps cover the costs of finding a replacement and completing the work. Understanding how this works can be crucial when drafting your Idaho Subcontractor Agreement for Insurance, as it provides clarity on liabilities and protections involved.

Generally, the general contractor purchases subcontractor default insurance to mitigate risks associated with subcontractor performance. This coverage can be beneficial for managing liability and ensuring project completion. However, the specifics should be discussed and documented in the Idaho Subcontractor Agreement for Insurance to establish clear responsibilities.

In most cases, subcontractors are required to carry their own insurance as part of their contracts. This includes general liability and workers' compensation coverage. Your Idaho Subcontractor Agreement for Insurance should clearly stipulate these requirements to protect both parties and ensure compliance. This safeguards your project against potential liabilities.

Typically, the contractor pays for subcontractor default insurance as part of the project budget. This coverage protects against potential defaults by subcontractors. However, in some cases, the responsibility may be negotiated into the Idaho Subcontractor Agreement for Insurance. Always clarify these terms in your agreement to avoid any misunderstandings.

Creating an Idaho Subcontractor Agreement for Insurance involves several key steps. First, outline the scope of work, payment terms, and timelines for the project. Then, include clauses that specify insurance requirements and liability limitations. Utilizing platforms like UsLegalForms can simplify the process, offering customizable templates tailored to meet your specific needs.

While legal requirements for subcontractor insurance vary by state, it is generally advisable for them to carry insurance. This requirement helps protect both the subcontractor and the hiring party from unforeseen incidents. Implementing an Idaho Subcontractor Agreement for Insurance helps outline these insurance obligations clearly.

An uninsured subcontractor is a contractor who does not possess liability insurance to cover potential accidents or damages. This lack of coverage poses risks not only for them but also for homeowners and businesses hiring them. Using an Idaho Subcontractor Agreement for Insurance can help ensure that the subcontractor provides necessary coverage.