Idaho Building Loan Agreement between Lender and Borrower

Description

How to fill out Idaho Building Loan Agreement Between Lender And Borrower?

US Legal Forms - one of the greatest libraries of legitimate forms in America - offers a wide array of legitimate file templates you are able to obtain or print. Making use of the web site, you may get a large number of forms for organization and specific purposes, sorted by classes, states, or key phrases.You can get the newest versions of forms such as the Idaho Building Loan Agreement between Lender and Borrower within minutes.

If you already have a subscription, log in and obtain Idaho Building Loan Agreement between Lender and Borrower through the US Legal Forms library. The Obtain option will show up on every type you look at. You have accessibility to all earlier delivered electronically forms within the My Forms tab of your own profile.

If you would like use US Legal Forms initially, allow me to share straightforward guidelines to obtain started off:

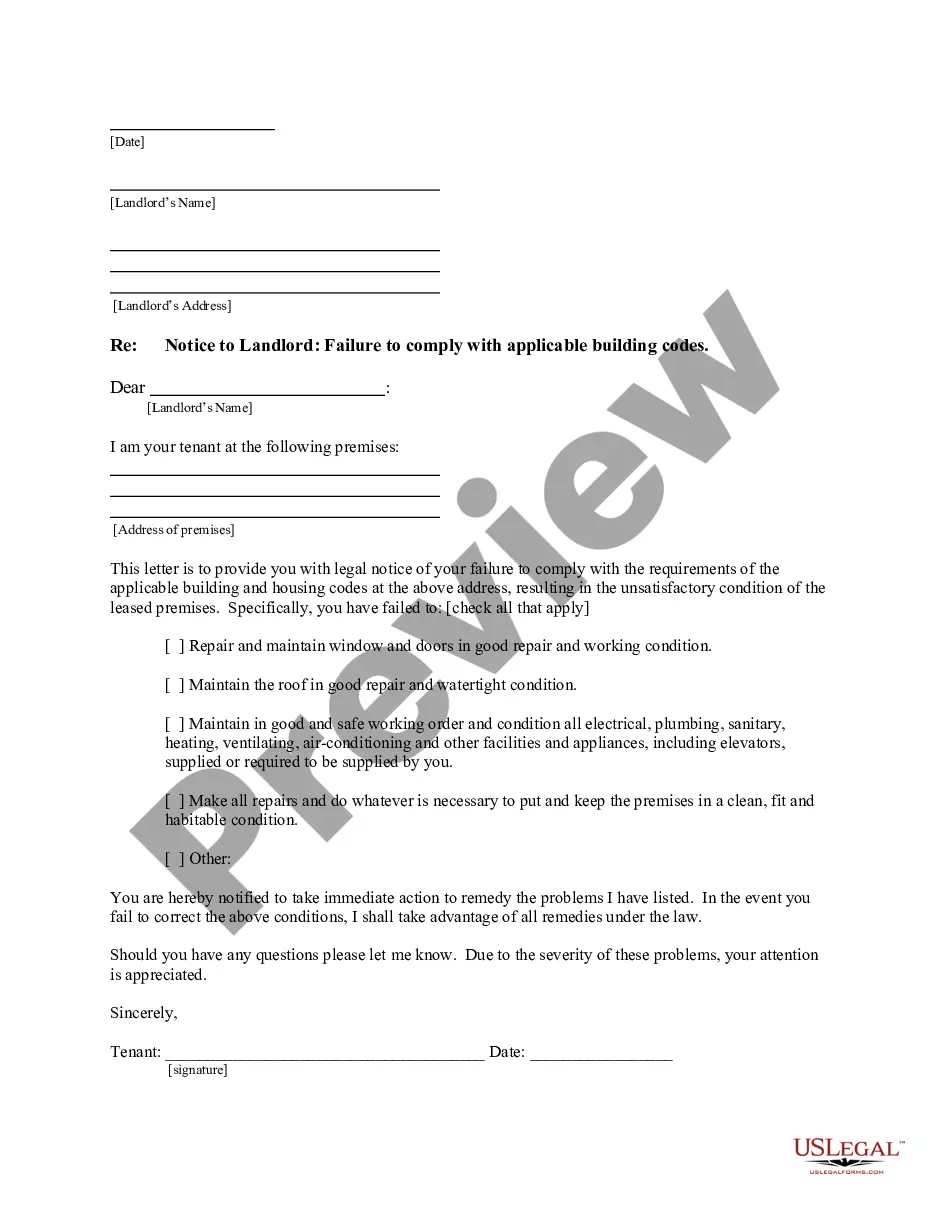

- Be sure to have picked out the proper type for your personal city/state. Select the Preview option to analyze the form`s articles. Look at the type outline to actually have selected the appropriate type.

- When the type does not satisfy your demands, take advantage of the Search discipline on top of the display screen to discover the one which does.

- When you are content with the form, confirm your option by clicking on the Acquire now option. Then, pick the pricing strategy you want and give your references to register on an profile.

- Process the transaction. Use your bank card or PayPal profile to finish the transaction.

- Select the structure and obtain the form on your own product.

- Make alterations. Complete, change and print and indication the delivered electronically Idaho Building Loan Agreement between Lender and Borrower.

Each web template you put into your money does not have an expiration particular date which is your own permanently. So, if you would like obtain or print another copy, just proceed to the My Forms section and then click in the type you need.

Get access to the Idaho Building Loan Agreement between Lender and Borrower with US Legal Forms, one of the most extensive library of legitimate file templates. Use a large number of expert and status-certain templates that meet your small business or specific requirements and demands.

Form popularity

FAQ

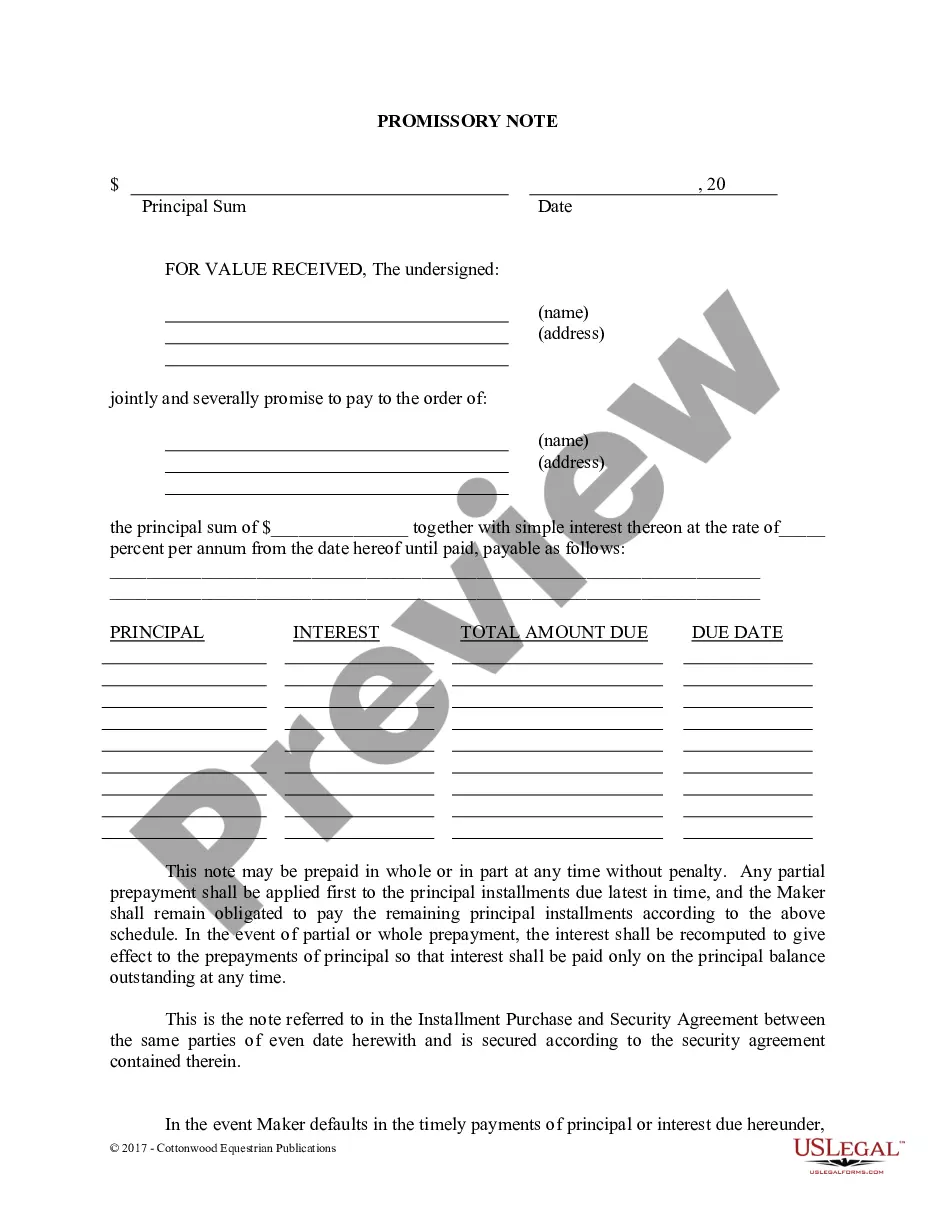

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

A promissory note is essential in any transaction where money is being lent by a person, bank, company, or other organization to another entity. This document is a contract that protects the lender from the risk of the borrower not paying the full amount agreed to by both parties.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lenderat a later date. It allows you to buy now with the promise of paying later. By understanding how each type of credit works, you will learn to manage credit successfully.

A loan agreement is a legally binding contract between the borrower(s) and the lender that states the terms of borrowing the loan, including the amount to be repaid, the interest rate, and any other conditions.

Loan agreement - Typically refers to a written agreement between a lender and borrower stipulating the terms and conditions associated with a financing transaction and in addition to those included to accompanying note, security agreement and other loan documents.

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.