Idaho Affidavit of Domicile for Deceased

Description

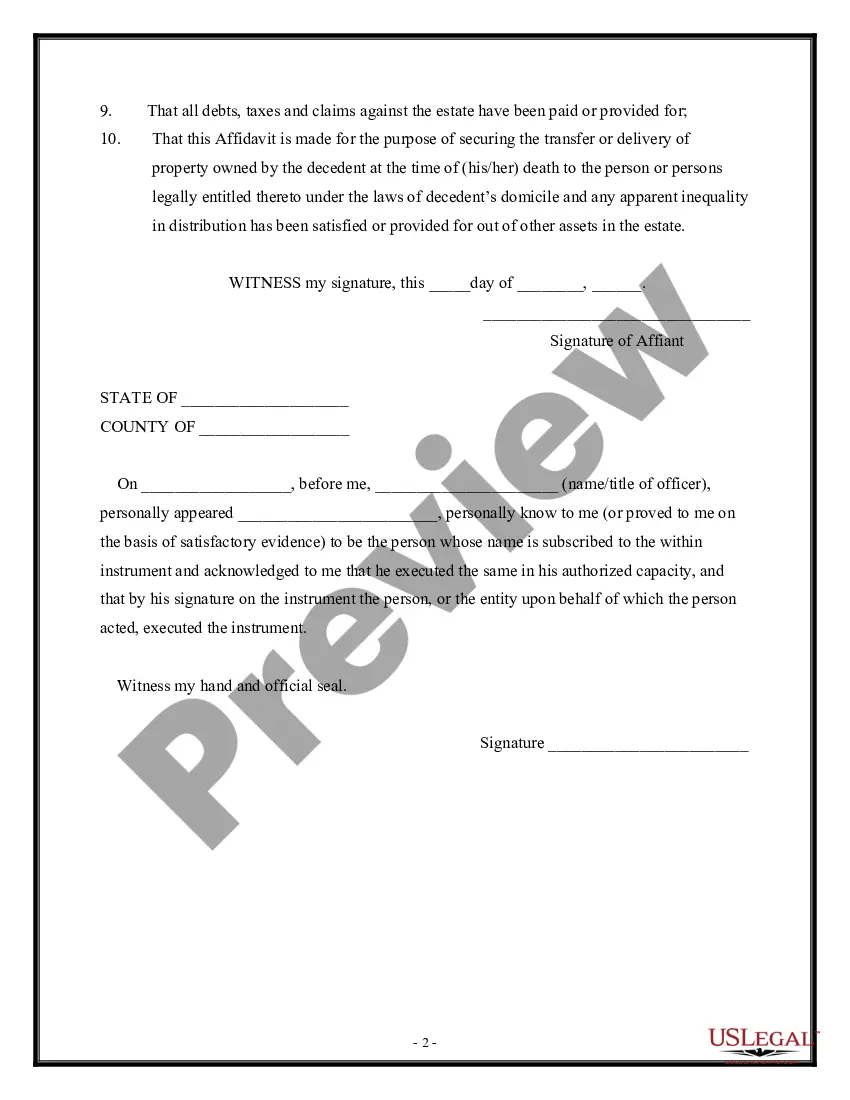

How to fill out Affidavit Of Domicile For Deceased?

It is possible to devote hrs on the web attempting to find the authorized record web template that fits the federal and state needs you want. US Legal Forms gives thousands of authorized types which can be examined by professionals. You can actually acquire or print the Idaho Affidavit of Domicile for Deceased from my support.

If you currently have a US Legal Forms profile, you can log in and click on the Download switch. Afterward, you can comprehensive, modify, print, or sign the Idaho Affidavit of Domicile for Deceased. Each and every authorized record web template you get is the one you have forever. To get another duplicate associated with a purchased type, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms internet site for the first time, keep to the basic directions listed below:

- Initial, make certain you have selected the correct record web template to the state/area of your liking. Read the type description to ensure you have chosen the proper type. If readily available, take advantage of the Preview switch to look through the record web template at the same time.

- If you wish to locate another model in the type, take advantage of the Lookup field to get the web template that suits you and needs.

- Upon having found the web template you want, simply click Purchase now to carry on.

- Choose the pricing prepare you want, type your references, and register for an account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal profile to pay for the authorized type.

- Choose the format in the record and acquire it for your product.

- Make adjustments for your record if possible. It is possible to comprehensive, modify and sign and print Idaho Affidavit of Domicile for Deceased.

Download and print thousands of record web templates using the US Legal Forms Internet site, which provides the greatest selection of authorized types. Use skilled and status-particular web templates to take on your organization or specific demands.

Form popularity

FAQ

In Idaho a surviving spouse can choose to do a simple Affidavit of Heirship as their Idaho probate when certain circumstances exist. An Idaho Affidavit of Heirship is a wonderful mechanism used to transfer personal property to the surviving spouse without the requirement of filing a probate with the Idaho courts.

An Idaho small estate affidavit, or 'Form CAO Pb 01', is a legal document that can be used by the heirs or beneficiaries of a person who died and left behind an estate not exceeding $100,000.

I.C. § 15-3-1205. Letters Testamentary: The instrument by which a probate court approves the appointment of an executor under a will and authorizes the executor to administer the estate.

As part of the probate process, letters testamentary are issued by your state's probate court. To obtain the document, you need a copy of the will and the death certificate, which are then filed with the probate court along with whatever letters testamentary forms the court requires as part of your application.

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more. Additionally, a probate is required in Idaho anytime your name is on the deed to any real estate, homes, or land regardless of its value.

The first and the best way is when a person has a written last will and testament where they nominate who they want to appoint as their executor. This person could be a spouse, or a child, or other family member, or it could be a close family friend.

Trusts Can Avoid Probate A trust is an effective tool to avoid probate in Idaho. A trust can hold virtually any asset, including real property, bank accounts, and vehicles. A valid trust will transfer ownership of your property to yourself as the trustee.

A Lack of Probate affidavit may be used when the deceased owned less than $100,000.00 in personal property and did not own real estate. With an affidavit, you do not go to court to direct the distribution of property. The successor or beneficiary can claim any of the belongings of the deceased.